Stocks ended the day mostly mixed. The technology sector was down, while small caps and financials were higher, leading to the S&P 500 finishing near flat.

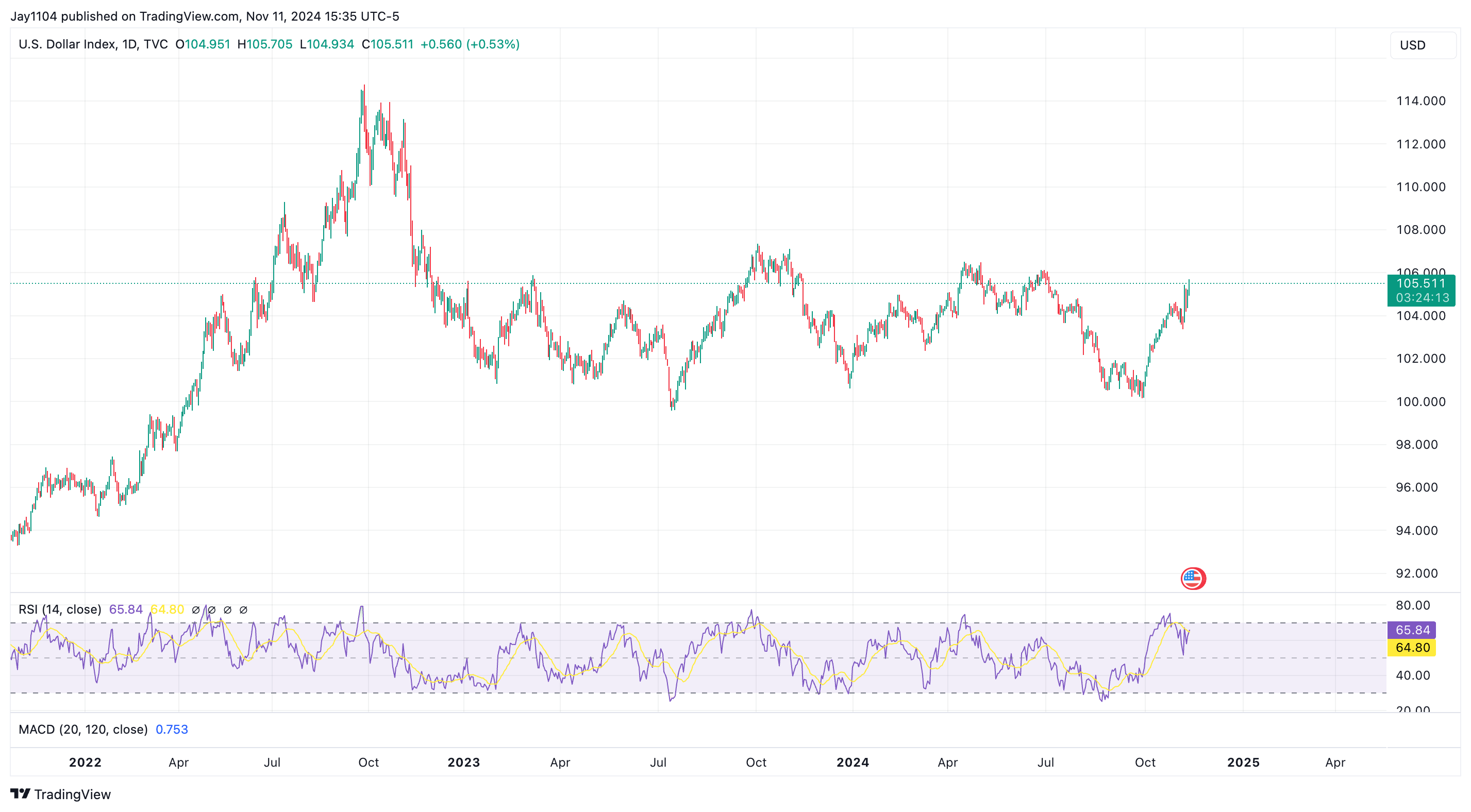

Dollar

The bond market was closed yesterday, but the dollar was stronger, rising by more than 50 bps on the dollar index. The DXY is nearing a very important level, and a significant move higher if the dollar index can clear resistance around 107 would have substantial global impacts.

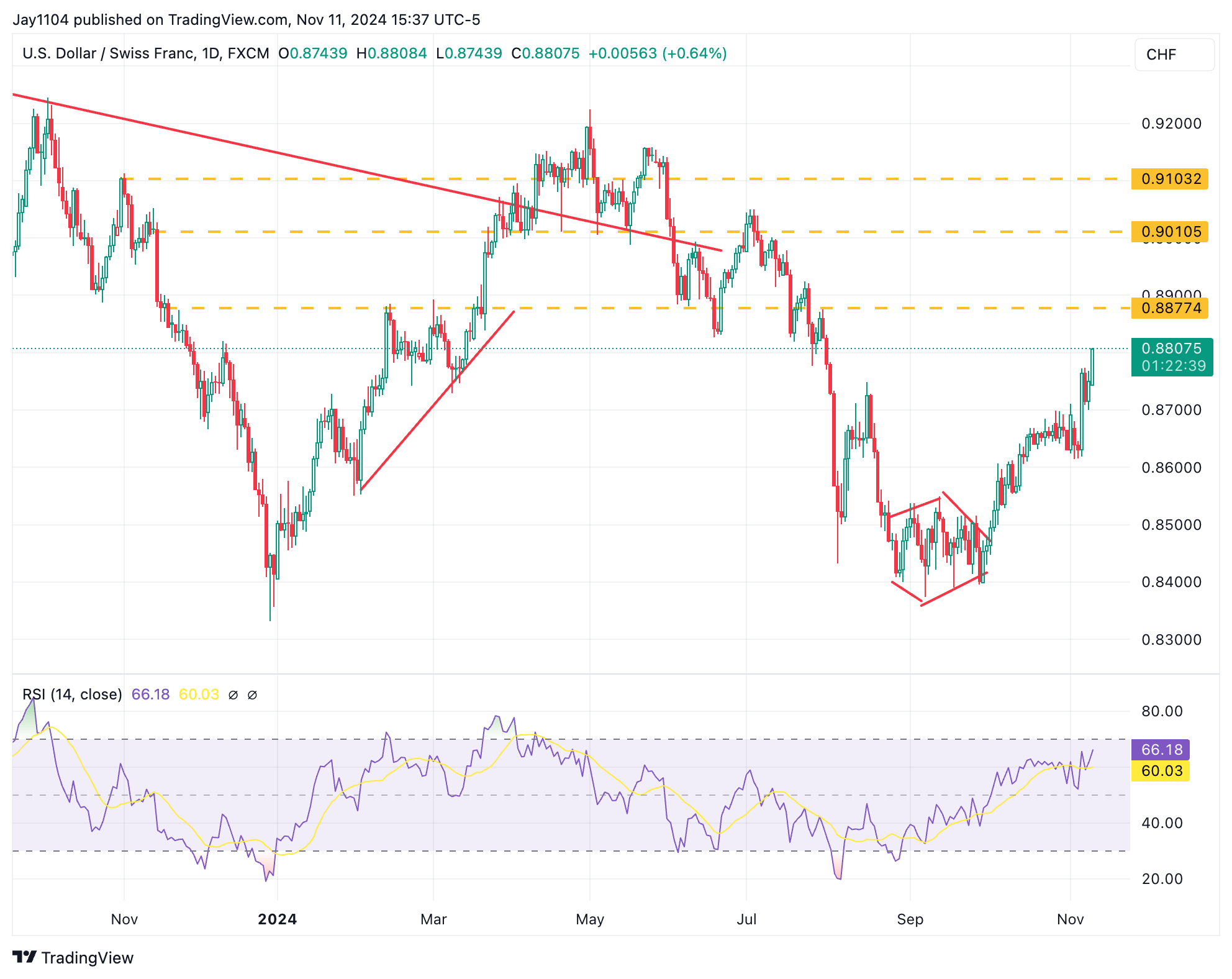

The USD/CHF also made another big move higher today, and it appears to be heading toward a level around 0.89, indicating a weaker Swiss franc.

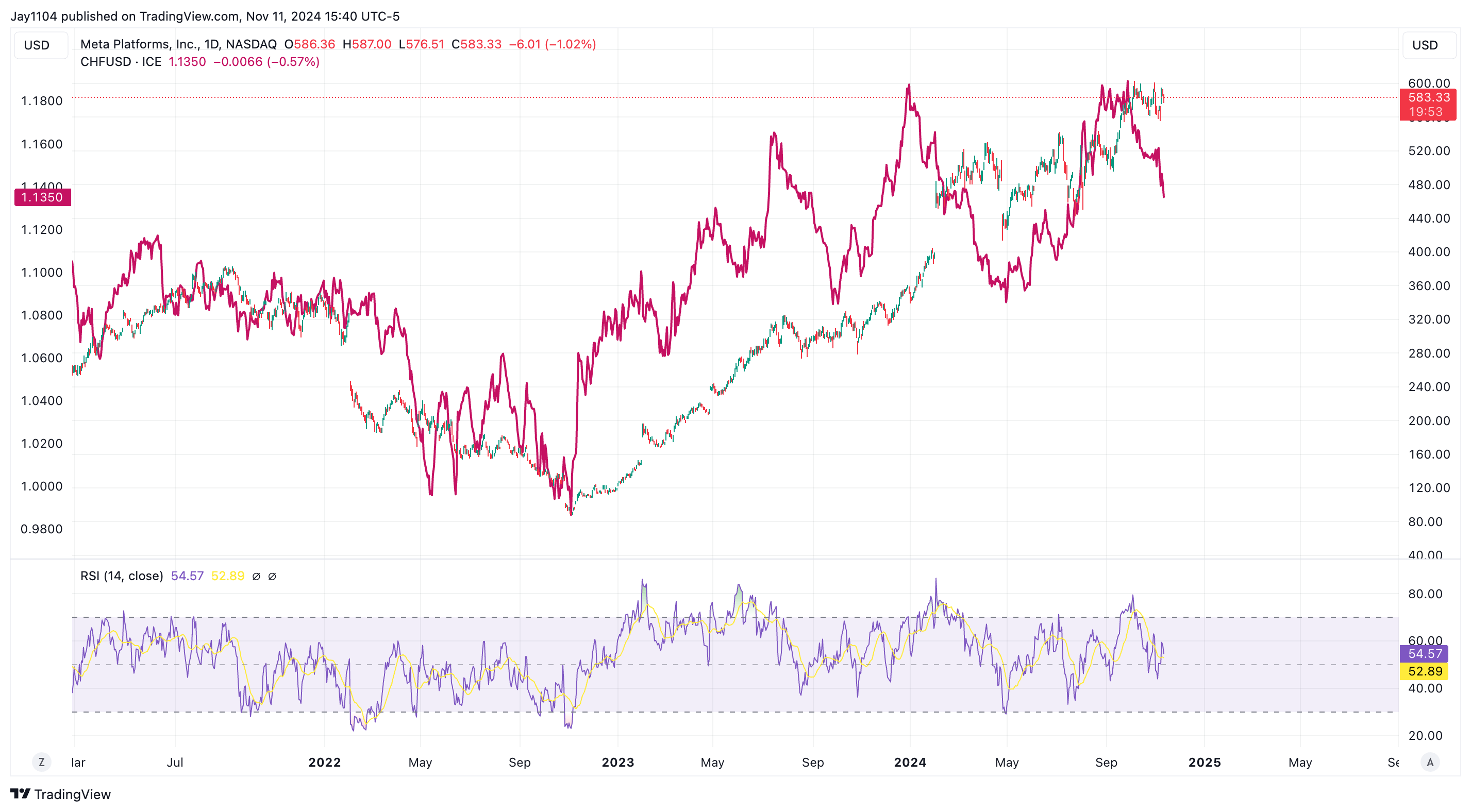

The Swiss franc tends to significantly impact technology stocks. Meta (NASDAQ:META) is one such stock that appears to ebb and flow at times with the CHF/USD. It’s something to keep an eye on.

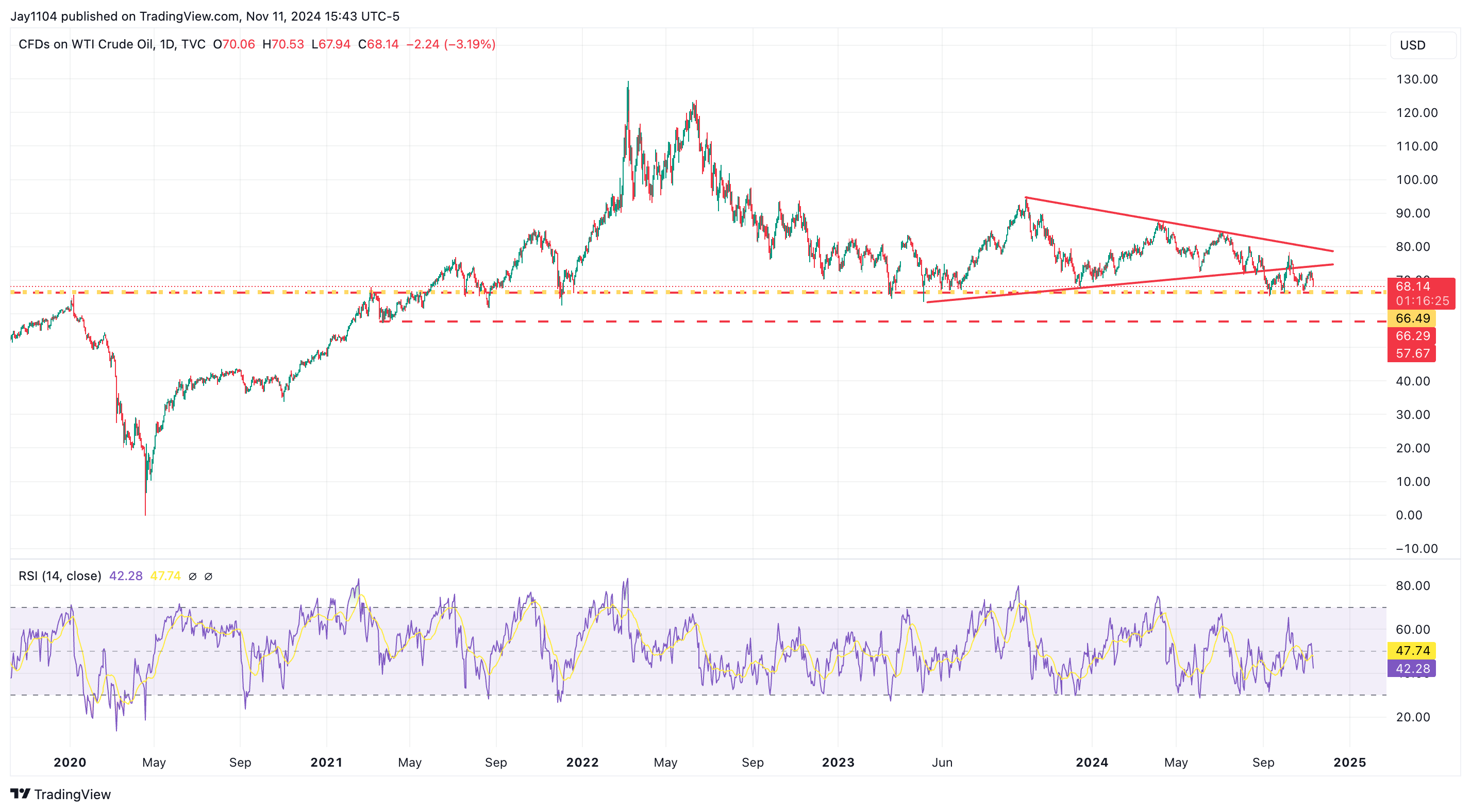

The dollar has also been presenting issues for oil more recently, and the old relationship has been a stronger dollar/weaker oil. So we wait again to see if oil breaks below that $66 level of support that has been a focus for what feels like forever. If oil breaks $66, it can drop well into the mid-$50s.

Tesla/Nvidia

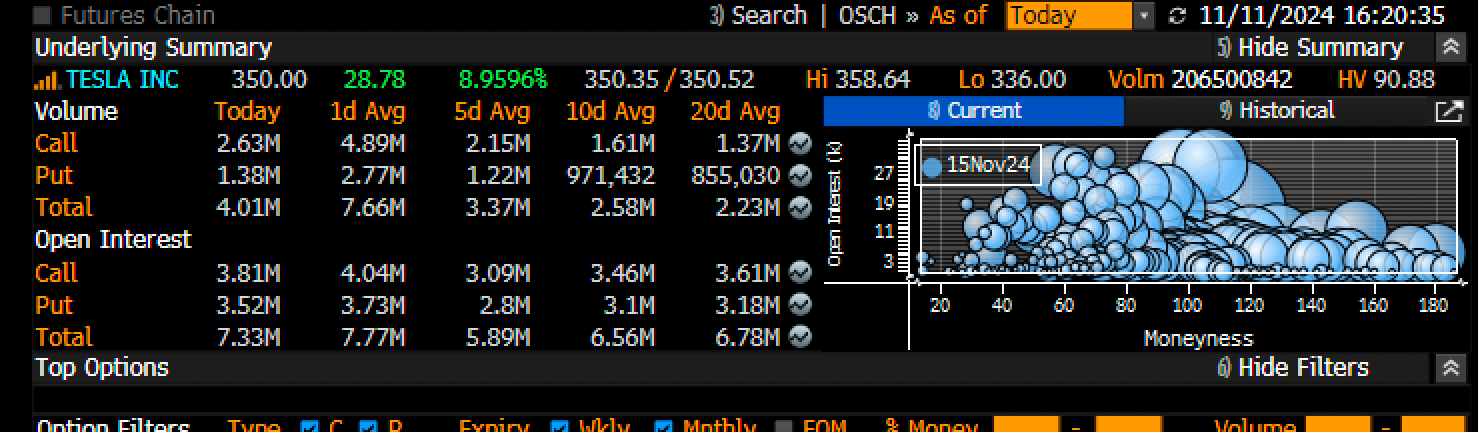

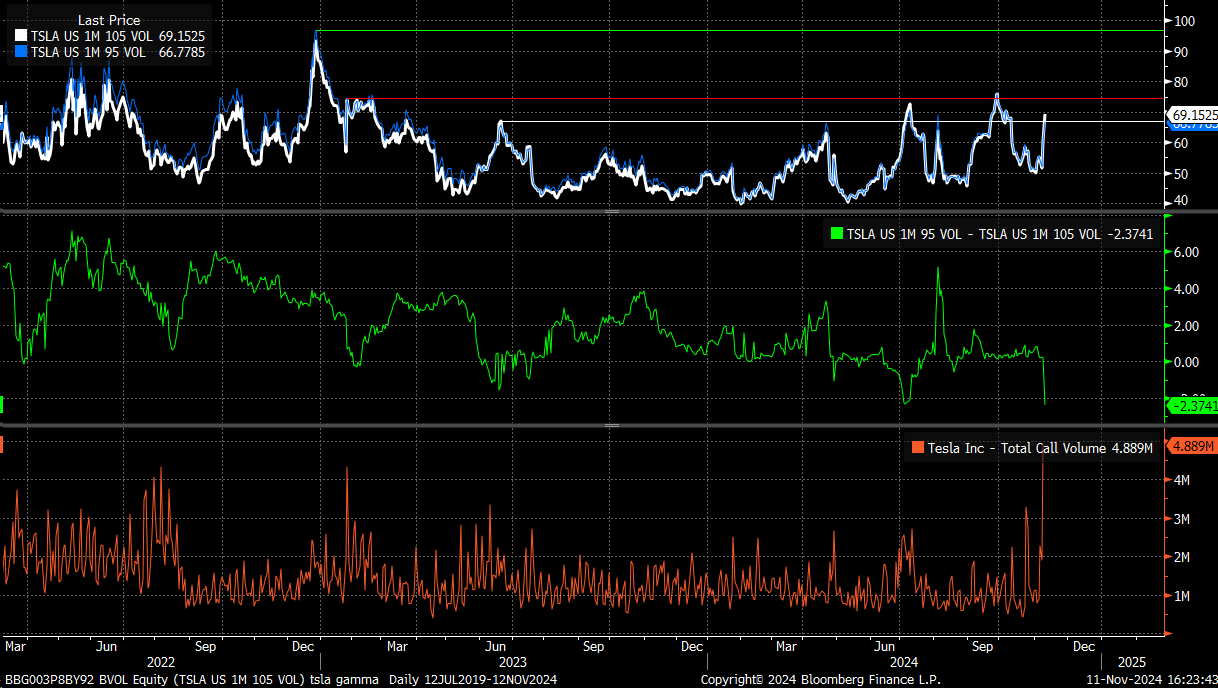

Tesla (NASDAQ:TSLA) rose another 8ish% on the day, but that looks to be a gamma-like squeeze. Call volume has surged in recent days, peaking at almost 5 million contracts on Friday and today trading another 2.6 million, which is about double its 20-day average.

Meanwhile, we have seen the 1-month 105% moneyness IV climb almost 2.5 points above the 95% moneyness IV.

We have seen this countless times in Nvidia (NASDAQ:NVDA) in the past, and typically we are nearing a point where this will just burn itself out, and the stock will come back to earth.

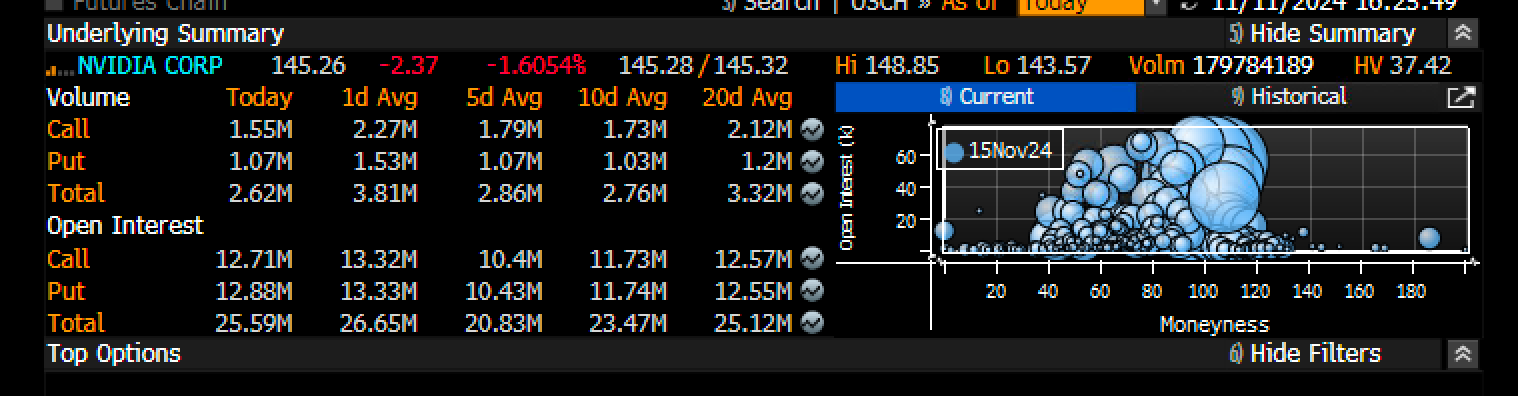

With Tesla up, Nvidia was down, no surprise there. Call volume and put volume were both lighter than usual today. I guess Tesla just occupied too much of the day traders’ time today.

The financial sector showed strength today. While potential tailwinds have been discussed previously, it’s unclear if the sector still offers bargains.

The S&P 500 Financials sector is now trading at a price-to-tangible book value of 3.5, higher than in the years leading up to the Great Financials Crisis, with only the bubble years being more expensive.

This doesn’t mean there are no bargains, but it indicates that one should be cautious and understand what they’re pursuing at this stage.