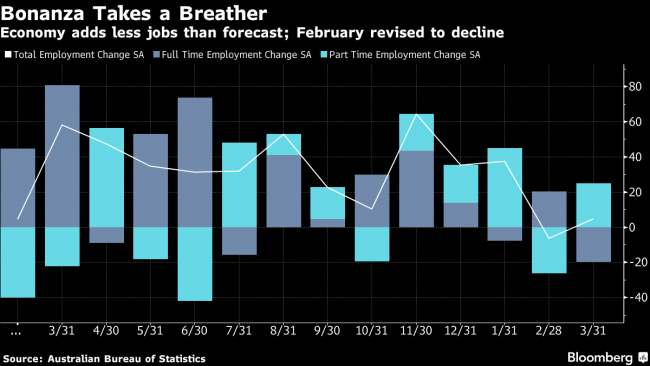

(Bloomberg) -- Australian employment rose less than forecast in March and the previous month’s gain was revised to a decline, suggesting the central bank will keep interest rates on hold.

Key Details

- Jobs rose 4,900 from February, when they dropped by a revised 6,300; economists forecast 20,000 gain for March

- Unemployment rate was 5.5%; estimate 5.5%

- Full-time jobs fell 19,900; part-time employment climbed 24,800

- Participation rate fell to 65.5% from revised 65.6%; economists predicted 65.7%

- Aussie dollar fell to 77.67 U.S. cents at 11:50 a.m. in Sydney from 77.96 cents pre-data

Big Picture

The Reserve Bank of Australia predicts hiring at an “above-average pace” in the months ahead after a blockbuster 2017 when more than 400,000 jobs were added. Yet the impact of those gains on the jobless rate has been blunted by rising female participation and high immigration. Governor Philip Lowe says there’s no strong near-term case to raise interest rates from a record-low 1.5 percent, in contrast to his global counterparts.