This article was written exclusively for investing.com

Markets have risen uninterruptedly since the March lows. The bull narrative has morphed over the months from Fed liquidity to low-interest rates, vaccine hopes, and stimulus. No matter the narrative, it seems stocks always found a reason to rally.

The big problem the market faces as it waits for the potential vaccines to be distributed is a slowing economy. The latest retail sales and jobless claims would suggest that the pace of the recovery is slowing, potentially halting the market rally. With a second stimulus deal unlikely any time soon, the Fed's balance sheet is no longer expanding. The market may feel forgotten about, resulting in a tantrum to get what it needs to rise further.

A Meltdown

A tantrum is likely to result in a sharp drawdown in equity prices, helping to motivate a policy response to a slowing economy or rising fears of a double-dip recession. To this point, Congress has not been able to agree on a second stimulus deal. Meanwhile, the Fed isn't set to meet until the middle of December.

It seems a tantrum is the method of choice for the market to get its way. Sharp and unexpected drawdowns always get the attention of policymakers, who quickly try to soothe the market's emotions. The sell-off in the fall of 2018 resulted from the market feeling nervous about the Fed tightening rates too much. Meanwhile, the coronavirus meltdown in the spring of 2020 easied once the Fed agreed to supply ample liquidity to the market and Congress issuing a historic fiscal policy response.

Market Is Already Over Extended

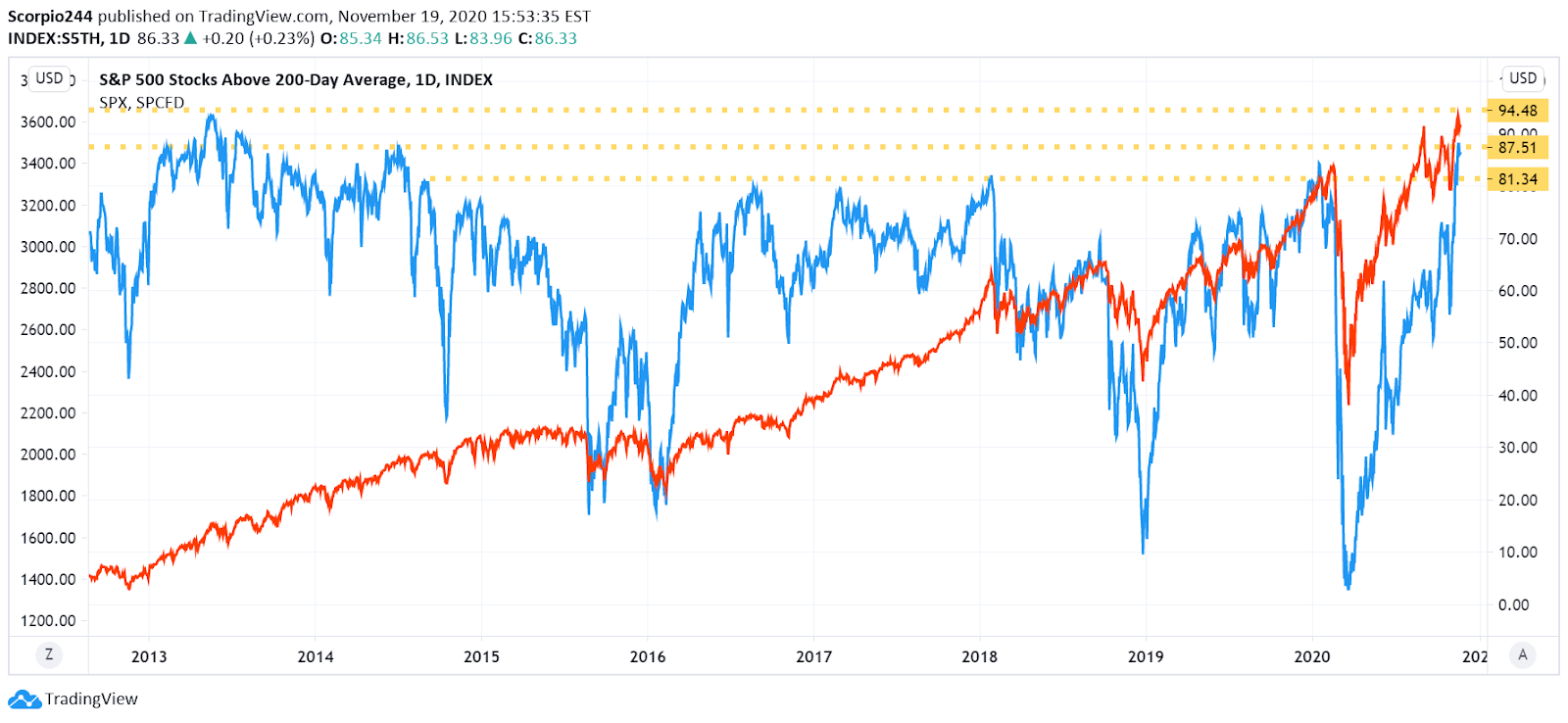

While it is nearly impossible to predict when such a tantrum may come, there may already be signs that suggest the market is overheated and ready for a new narrative. The S&P 500 has traded relatively flat since the beginning of September, while the NASDAQ is down. Still, the number of stocks above their 200-day moving average in the S&P 500 was as high as 88% on Nov.18, a level not seen since the middle of 2014. It is a level associated with a pullback in the equity index.

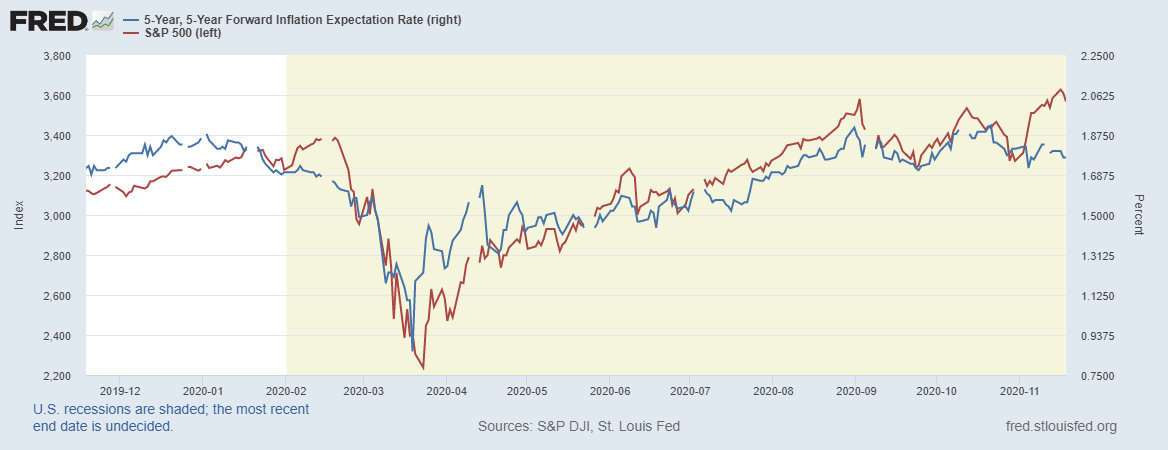

Additionally, inflation expectations have begun to diverge from the equity market over the last few weeks. The 5-year forward expectations have fallen, while the S&P 500 has continued to rise. The lower inflation expectations could be suggesting the bond market is picking up this slowing economic recovery.

A Catalyst

The Fed will meet on Dec.15, which could serve as a catalyst event for the broader equity market. If the Fed suggests it will not pick up the pace of asset purchase should the economy weaken further, the market may be displeased.

Standing on its own, the S&P 500 will struggle because the index valuations are already very high. Without the support of a stimulus or further easing, the PE ratio could begin to contract, resulting in the value of the S&P 500 falling.

While it is entirely possible for the equity market to just continue the rally, it will likely need a narrative to drive itself higher from here. The only narrative that may be left at the moment is the hope for a global economic recovery. But that is likely to be slow, given it will take time for a vaccine to be distributed worldwide.

Once that happens, investors may turn their attention to an improving global economy, allowing stocks to trade on fundamentals instead of hopes and dreams. Until that happens, this bull market will need a narrative, and soon, to avoid seeing another one of its typical tantrums we have all grown to know and love.