By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The Bank of England's monetary policy announcement hasn't been released and we've already seen a U-turn in sterling. After trading as high as 1.3338, GBP/USD dropped more than 200 pips as sellers returned. The reversal in GBP on Tuesday was driven by misplaced expectations -- economists are looking for a 25bp rate cut, investors felt they were wrong and bid up sterling on the hope that GBP will spike if the BoE leaves rates unchanged. On Wednesday, they resumed selling because they realized that regardless of whether its July or August, rates are coming down. And even if the BoE passes on a move Thursday, it'll prepare everyone for easing later this year. Unless Prime Minister Theresa May decides not to invoke Article 50, the outlook for the U.K. economy and sterling is grim. As for the Bank of England, it has plenty to worry about.

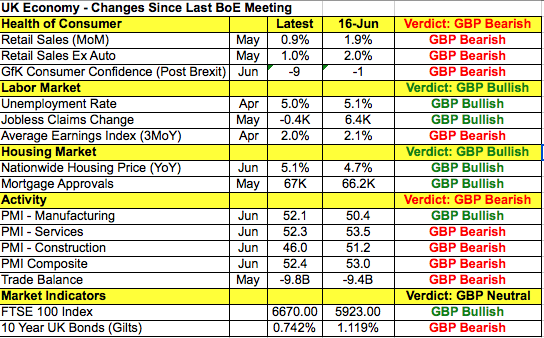

According to the following table, the U.K. economy was struggling before Brexit, with retail sales, wage growth and economic activity slowing. The case for a rate hike then was weak and now the case for a rate cut is strong. Economic data is expected to worsen in the coming months with business and consumer investment expected to freeze up. The Bank of England is trying to preempt the slowdown and avoid recession by being proactive, but it still needs more information before pulling the trigger. So far stocks have held up well and the decline in sterling along with the drop in Gilt yields is positive for the economy, which means they can wait until their economic forecasts are updated. Major policy changes tend to coincide with the release of the BoE Quarterly Inflation Report, which is generally used to telegraph changes. The next report will be released in less than a month. If sterling rises because the Bank of England left interest rates unchanged disappointing some part of the market, the rally should be sold. If it falls because of Carney's dovishness, traders may find it fruitful to join the move quickly.

The Bank of Canada left interest rates unchanged Wednesday morning sending the Canadian dollar higher. We did not expect the Canadians to cut rates but the run up in USD/CAD to 1.3080 in the early North American trading session suggests that some traders had hoped for easing or at least dovish comments. The BoC statement itself was relatively benign. The central bank cut its GDP forecast for 2016 and 2017 but shared its view that the contraction in oil-sector investment should end in 2016. Policymakers waited for the press conference to express their optimism -- Poloz felt the economy is adjusting well to lower oil prices and believes it will benefit from fiscal measures. Energy-sector cutbacks are expected to conclude this year with the output gap poised to close toward the end of next year. Poloz and Wilkins also shared their concern about the strong housing market, which explains why they are not actively considering rate cuts. Also, the economic data table that we showed on Tuesay highlighted the areas of strength in the economy. Overall, the Bank of Canada believes that underlying fundamentals remain strong and U.S. economic momentum will boost Canada. The only problem for the loonie is that oil prices have fallen sharply after a smaller-than-expected decline in oil inventories and the fact that oil has a greater day-to-day influence on the loonie.

The Federal Reserve's Beige Book failed to help USD/JPY, a currency pair that was under pressure for most of the North American trading session. The stall in stocks, lower U.S. yields and a smaller-than-expected increase in import prices set the tone for trading well before the Beige Book. According to the Fed Districts, the economy grew at a "modest pace" with improvements seen in the labor market and wage growth. They said the outlook was generally positive across broad areas of the economy -- a view that is consistent with our bullish dollar bias. Thursday's jobless claims and producer prices report isn't expected to have a significant impact on the dollar but Friday's retail sales release should be very market moving.

The euro was one of the day's strongest currencies. Weaker-than-expected Eurozone industrial production failed to hold the currency back on a day dominated by EUR/GBP flows. It will be much of the same Thursday with the BoE rate decision on tap.

Finally, both the Australian and New Zealand dollars ended the day slightly lower. The lack of movement in the two currencies mirrors the mixed data from China. Chinese exports reported an surprising upside coming in at -4.8% instead of the expected -5.0%. Imports, however, fell sharply by -8.4% for the month of June versus -6.2% expected. Both figures were weaker than the previous month, representing deterioration in China's trade balance. In total, the country's surplus dropped to $48.11B last month from $49.98B in May. While better than expected, this was not enough to extend gains for AUD and NZD. Investors are clearly in "wait-and-see" mode as the Australian dollar awaits the release of the country's employment report. Given the rise in the employment component of all 3 PMIs, we have strong reasons to believe that labor-market conditions improved last month.