Firstmac and MOVE increased rates, while there were cuts from Suncorp and Macquarie, with Judo and NAB making both upward and downward movements.

This was a more mixed week, after a period of many providers hiking rates back up, with several products now once again returning well over the coveted 5% p.a threshold.

It's another great opportunity for Australians looking to save to lock in a term deposit, with uncertainty about how rates will fare for the rest of the year.

If November was to bring a further increase to the cash rate, term deposit rates would likely see another boost, but most economists think it would take a shock in the CPI inflation numbers for the September quarter for this to happen.

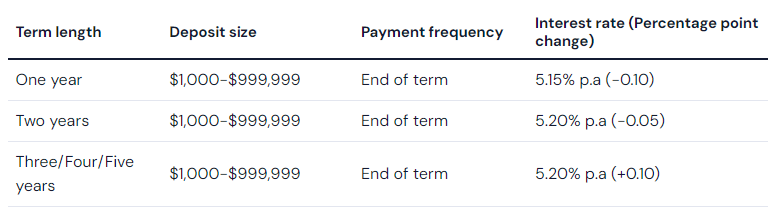

After Judo's cut to its one year term deposit product, Bank of Sydney now stands alone with the strongest one year term deposit return (5.25% p.a) available in Australia, per Savings.com.au's market research.

It also cut back its two year term slightly, leaving G&C Mutual Bank to take the crown for two year terms, again at 5.25% p.a.

However, for term lengths of three years or more, a 10 basis point increase to 5.20% p.a is enough to make Judo the market leader in that space.

The above products are available at discounted rates with interest paid annually or monthly.

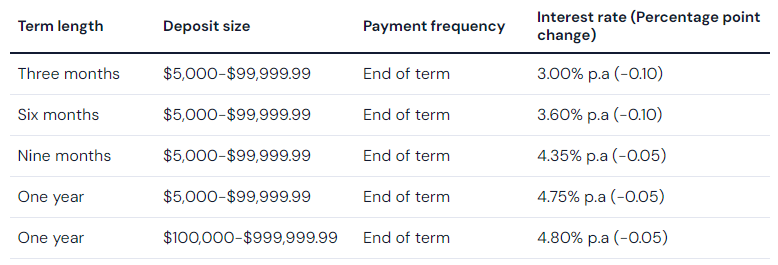

One of the larger banks to alter TD rates this week was Suncorp, slightly cutting back its term deposit returns by up to 10 basis points.

Suncorp has a wide range of products available, with deposits starting at $5,000 and going all the way to $2,000,000.

Deposits sized between $100,000 and $999,999 have a rate 5 basis points above those $5,000-$99,999, while customers who deposit more than $1,000,000 can benefit from a further 5 basis point boost.

These products are also available with semi annual, quarterly and monthly interest payments, at discounted rates.

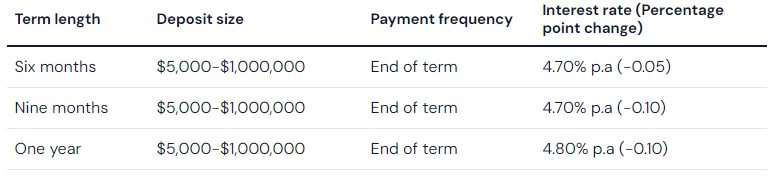

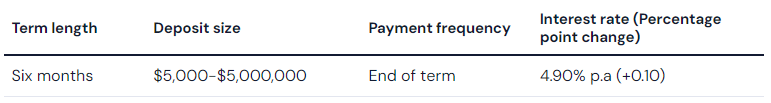

Firstmac's only move this week was boosting its six month term deposit, to now sit just 10 basis points below the 5% p.a mark.

The six month product now has a higher return than the one year, which pays 4.80% p.a.

NAB is the only one of Australia's big four banks in which its economists are predicting further increases to the cash rate this year.

NAB economist Taylor Nugent correctly predicted CPI inflation would be 5.2% for August, and believes high service price inflation could see the RBA make one final hike, taking rates to 4.35%, in November.

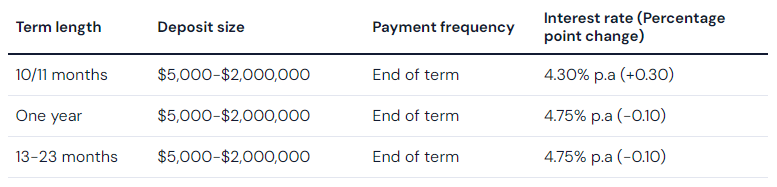

As far as term deposits go, NAB cut back returns on products lasting more than a year, while hiking up rates on 10 or 11 month terms.

Other movers

- MOVE increased rates up to 25 basis points, including a 5% p.a return on nine month terms.

- People's Choice cut rates by 10 basis points

- UniBank varied rates up to 335 basis points

- Teachers Mutual Bank varied rates up to 335 basis points

- Heritage Bank cut rates by 10 basis points

- The Mutual varied rates up to 50 basis points

"Which banks moved term deposit rates this week, October 13th?" was originally published on Savings.com.au and was republished with permission.