November's monetary policy decision has been called the most 'live' for several months, and will depend on data like yesterday's unemployment figures, and Q3 CPI inflation which will be released next week.

There were no dramatic rate changes this week, but it's interesting to see the different approaches banks are taking, with rates moved both up and down.

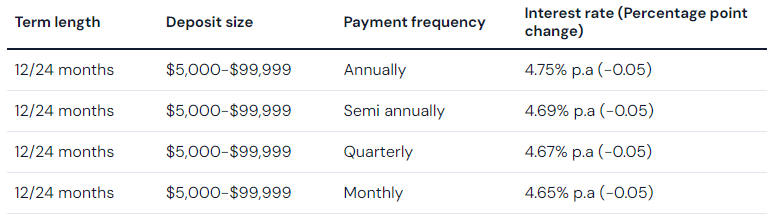

ANZ was the biggest bank to move this week, cutting back rates slightly on its one to two year Advance Notice term deposits.

Advance Notice accounts have higher rates, but customers need to give 31 days notice if they intend to withdraw early, with prepayment adjustment penalties still applying.

This cut means the highest rate available at ANZ is behind both CommBank (4.80% p.a on its special offer one to two year terms) and Westpac (4.85% p.a available with its special online offer, again for 12-23 months).

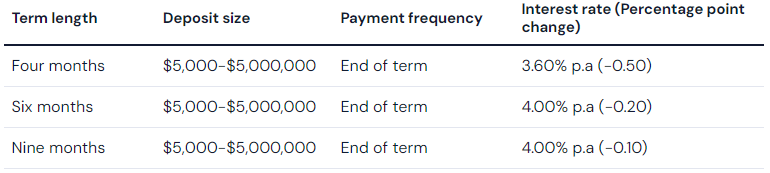

Bendigo was one of the other large banks to move this week, and it was also the biggest slasher of rates with cuts up to 50 basis points.

If you keep up to date with term deposit returns you'll know rates elsewhere are significantly above 4.00% p.a, so Bendigo are clearly content to not compete with the market leaders for term deposits.

Bendigo's maximum rate available on savings accounts is 5.25% p.a on its Reward Saver account, so it's there customers can look to for stronger returns.

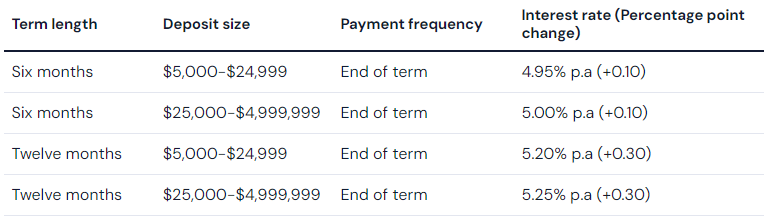

While most of the movement this week was downward, AMP bucked the trend, making big moves.

Twelve month term deposits at AMP now return 5.25% p.a, level with Bank of Sydney as the highest rate available in Australia for one year terms, per Savings.com.au's market research, although to get this rate your deposit will need to be $25,000 or greater.

AMP's products are available with the following discounts in exchange for more frequent interest payments.

Other movers

- Community First cut rates by 10 basis points

- Northern Inland Credit Union cut rates by 10 basis points

- The Mutual Bank cut rates up to 15 basis points

"Which banks moved term deposit rates this week?" was originally published on Savings.com.au and was republished with permission.