Macquarie, Bank of Sydney and ME were among the banks that altered rates.

Whereas recent weeks have seen nearly uniform increases, there was more diverse activity this week.

Bank of Sydney announced a new market leading rate, while Judo and Macquarie both elected to slightly decrease returns on term deposits.

Many analysts continue to expect further increases to the cash rate in the coming months, although Adam Boyton, head of Australian Economics at ANZ, now expects the RBA to hold a 4.10% cash rate for an extended period.

He said strong anecdotal evidence about rate hikes influencing consumer behaviour and positive inflation trends could mean rates won't go as high as many expect.

For mortgage holders, this would be cause for celebration, but it could also spell the beginning of the end of a golden period for savers, with term deposit rates the highest in almost a decade.

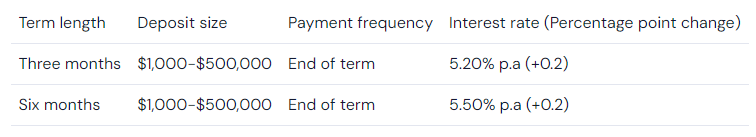

Bank of Sydney revealed this week it would be the first provider to offer returns of 5.50% p.a on a term deposit.

For one year terms, Bank of Sydney continues to offer 5% p.a, which means it offers substantially higher rates on three and six month products.

When it increased rates, Bank of Sydney was initially just five points ahead of Judo, the previous market leaders for six month terms, but, as we'll get to, activity later in the week means it now enjoys a 10 basis point advantage.

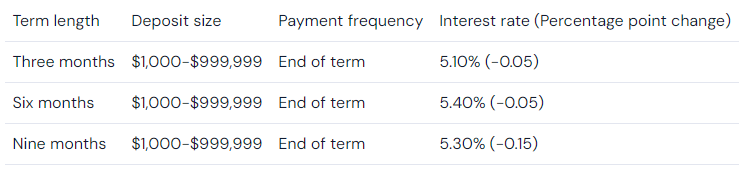

Judo has been consistently among the market leaders during the high rate period, regularly announcing term deposit rate increases.

However, this week the neobank instead chose to slightly decrease rates for some of its shorter term products in a decision that many savers are likely to be dismayed at.

Judo continues to offer a 5.45% p.a return on one year term deposits, the highest available rate in Australia per Savings.com.au's market research.

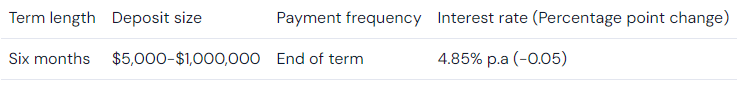

The largest bank to change term deposit rates this week was Macquarie, decreasing six month terms by 5 basis points.

Rates going down could be an indication economists at the bank expect the RBA to bring the cash rate down sooner than expected, or at least that there aren't likely to be more increases.

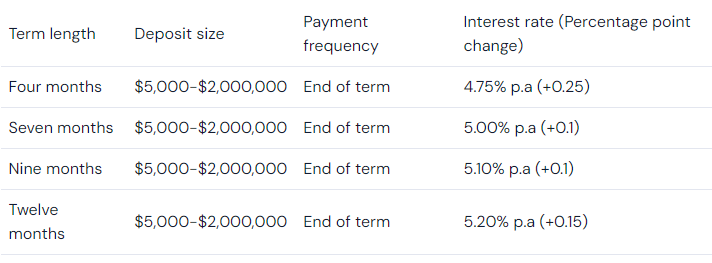

ME, the first bank to offer rates exceeding 5%, increased rates on several products this week.

A 15 basis point increase to one year terms means ME is now 25 basis points behind Judo, which remains the market leader.

Other movers

- Bank First increased rates by up to 20 basis points

- Summerland Credit Union increased rates by up to 65 basis points

- Rabobank increased rates by up to 20 basis points

- Australian Unity increased rates by up to 50 basis points

- Regional Australia Bank increased rates by up to 55 basis points

- Northern Inland Credit Union increased rates by up to 25 basis points

"Which banks moved term deposit rates this week, 14 July?" was originally published on Savings.com.au and was republished with permission.