As most people anticipated, the RBA decided to hold the cash rate steady at 4.10% earlier this week.

In her first monetary policy board meeting, new RBA Governor Michele Bullock maintained further tightening of monetary policy might be necessary to ensure inflation returns to target levels, and it looks increasingly unlikely rates will be cut until well into 2024.

Pre-empting Tuesday's decision, last week saw several prominent term deposit providers including Bank of Sydney, Judo and Macquarie increase rates.

This week, AMP, Bank of Sydney and Firstmac followed suit, with substantial rate hikes.

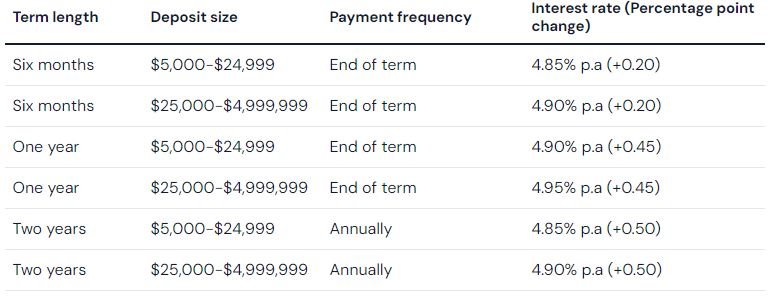

AMP increases rates by up to 50 basis points

AMP hiked up rates across its range of term deposit products, with increases of up to 50 basis points pushing rates back up towards the coveted 5% p.a mark.

Previously among the market leaders, AMP made big cuts at the start of September, with its one year term deposit rate dropping to 4.50% p.a, but this week's raise reverses the trend once again.

Shane Oliver, AMP Chief economist, is concerned the RBA has tightened rates more than necessary, and does not believe we will see any further rate hikes.

"The RBA has already done more than enough to slow the economy in order to rebalance demand and supply and bring inflation back to target," he said.

He expects rate cuts to begin in the first half of 2024.

For now though, with a 4.10% cash rate confirmed for at least another month, AMP seemingly is looking to rebuild market share in term deposits.

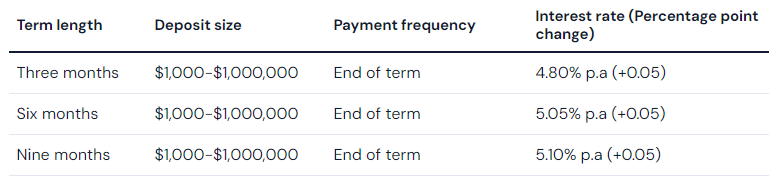

Bank of Sydney increase rates by 5 basis points

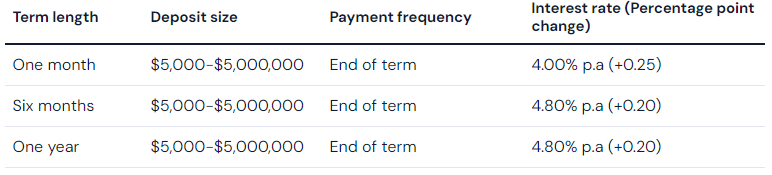

Firstmac (Goldfields Money) increases rates by up to 25 basis points

It's a similar story at Firstmac, which has also done a 180, hiking up rates once again after several cuts.

At one stage, Firstmac offered 5.40% p.a returns for both six month and one year terms, but cut rates dramatically in August and September, dropping to 4.60% p.a.

Even after this week's increase, returns are still well behind what they were, but it remains to be seen whether the white labelled product will fire again, taking rates back up towards 5% p.a.

Other movers

- Australian Military Bank cut rates by up to 115 basis points

"Which banks increased term deposit rates this week?" was originally published on Savings.com.au and was republished with permission.