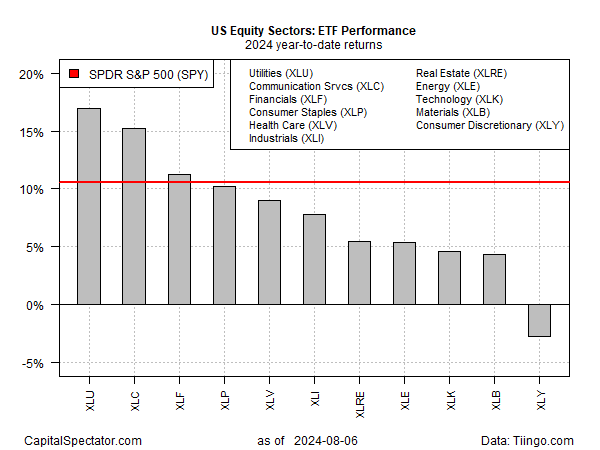

Utility stocks have taken the lead in 2024 among US equity sectors following the market sell-off in recent days, based on a set of ETFs through Tuesday’s close (Aug. 6).

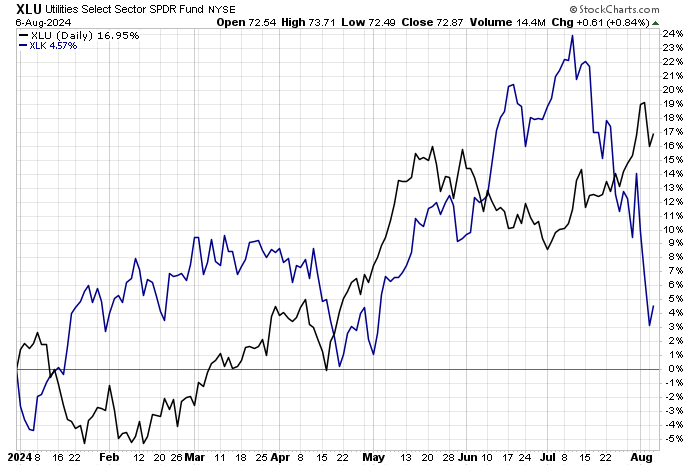

The spike in market volatility reshuffled the year-to-date performance horse race for sectors. The combination of a sharp decline in technology shares (XLK) and the safe-haven demand lately for shares of utilities (XLU) marks a dramatic shift in market leadership.

A month ago, tech shares (XLK) were outperforming by utilities by a nearly two-to-one ratio for year-to-date gains. Today, the leadership has reversed. Thanks to a rally in utilities in recent days, combined with a dramatic slide in tech stocks, has lifted XLU to a 17.0% rise in 2024, far above XLK’s newly diminished 4.6% advance this year.

There has also been a performance reshuffling in other sectors in recent days. Notably, the formerly lagging real estate sector (XLRE) has revived, shifting from a months-long run of year-to-date loss to a 5.5% gain for the year.

One high-flying sector that has only been modestly bruised is the so-called communication services sector (XLC). Despite holding such large-cap, tech-related winners in recent years, such as Meta (NASDAQ:META) and Alphabet (NASDAQ:GOOGL), XLC’s correction has, so far, been comparatively light. As a result, XLC’s year-to-date gain of 15.2% is second only to utilities (XLU) in 2024.

A key part of the renewed allure of utilities is the sector’s relatively high payout yield, which looks even more attractive by comparison next to the sharp slide in the US 10-year Treasury yield, which is currently 3.90% (Aug. 6).

As the payout spread between utilities and Treasuries ebbs and flow, one or the other enjoys a competitive edge for yield-seeking investors. XLU’s trailing 12-month yield is currently 3.01%, according to Morningstar.com. The 10-year yield is still higher, but by a diminished 90 basis points following the benchmark rate’s sharp decline in recent days.

The competitive yield narrative for utilities is on track to resonate in the weeks ahead amid expectations that the Federal Reserve will cut interest rates at its Sep. 18 policy meeting.

“The start of Fed rate cutting cycles are typically characterized by defensive sector outperformance, similar to the rotation that has occurred during the past week,” advise Goldman strategists in a note published on Monday.