By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

After hitting a high of 114.73 overnight, USD/JPY dropped 100 points to end the day in negative territory. The dollar’s reversal impacted all of the major currencies by driving EUR/USD back above 1.16, GBP/USD well above 1.31 and USD/CHF below parity. With no U.S. economic reports released Monday and relatively benign comments from Fed Presidents Williams and Dudley, yields are the only explanation for the dollar’s moves. Ten-year treasury rates started the day in negative territory, turned positive briefly only to reverse course and settle the NY session near its intraday lows. Although the Federal Reserve has every intention of raising interest rates next month, the move has been fully discounted as 10-year yields retreat from 2.4%. President Trump is in Asia this week so investors are also nervous about potential comments on North Korea, which is rarely positive for the currency. The biggest news on Monday was Fed President Dudley’s plans to retire in mid 2018 – this leaves the U.S. with a very different central bank in 2018 that may have a less hawkish approach to policy. There are no U.S. economic reports scheduled for release on Tuesday but we’ll get the opportunity to hear from the Fed’s newest member, Quarles, who joined the board on October 13. As Trump’s first Fed appointment, Quarles has yet to share his views on policy but he voted with the majority at last week’s meeting. On the basis of North Korean risks, profit taking and technicals, USD/JPY appears poised for a move down to 113.25/113.00.

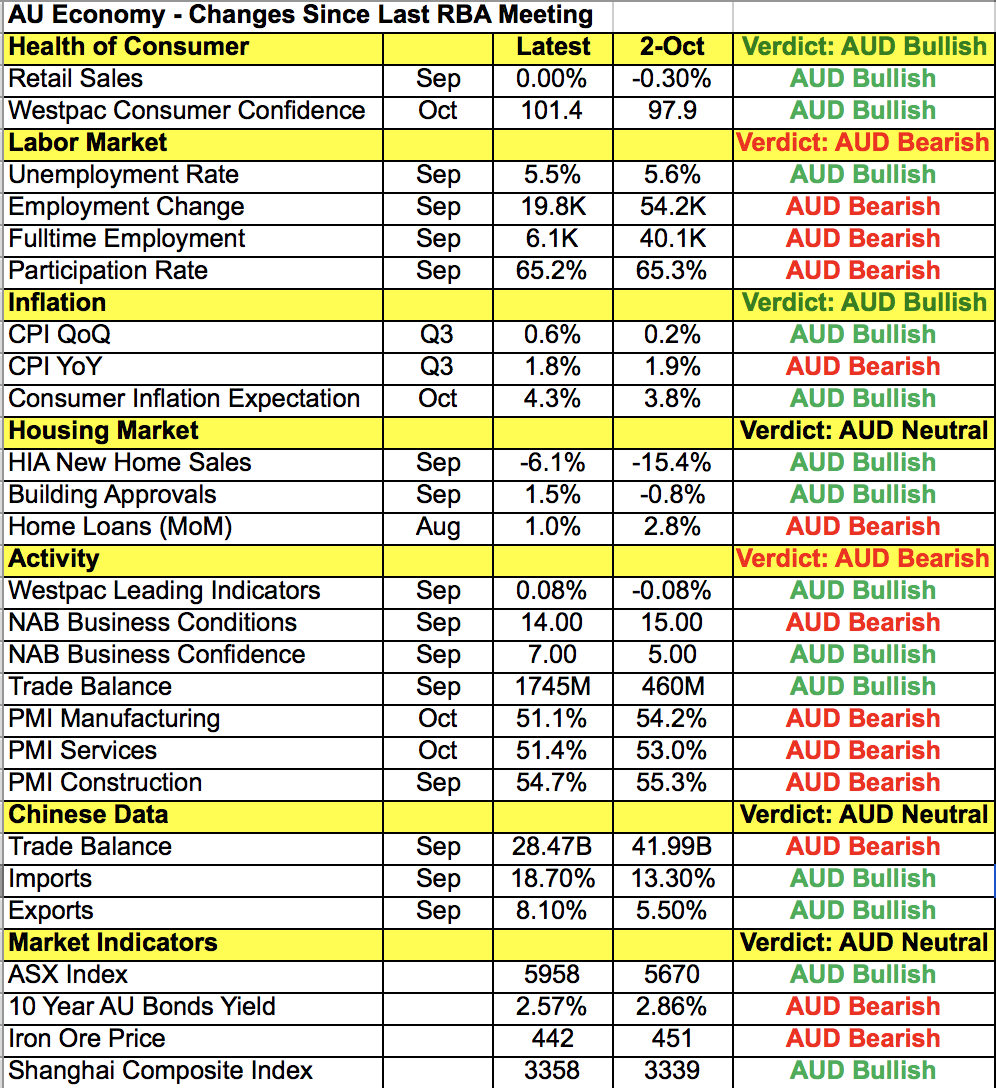

While there may not be much on the U.S. calendar, the Australian and New Zealand dollars will be in play this week with dual monetary policy announcements on the calendar. Between the two, the RBA rate decision should be less market moving than the RBNZ because the Australians have maintained a neutral policy stance for many months and the RBA is expected to continue to do so. Having traded in a relatively tight range over the past week, AUD/USD is prime for a breakout and according to the table below, the central bank has more reason to be cautious than optimistic. Although retail sales stabilized after falling in September, zero growth in demand means spending is weak. Labor-market activity and the annualized pace of inflation have also deteriorated on the back of softer manufacturing, service and construction activity, giving the RBA very little reason to alter its bias. The good news is that consumer and business confidence are up and the currency is down. But In the context of rising U.S. rates, the RBA doesn’t need to be all that cautious for AUD/USD to fall given how much it has declined over the past 2 months (nearly 5 cents), a tinge of optimism would send AUD/USD toward 0.7750 quickly.

All 3 of the commodity currencies traded higher Monday and while AUD led the gains, the New Zealand and Canadian dollars saw equally strong moves with 7USD/CAD ending the NY trading session at its lows, right above 1.2700. According to the IVEY PMI report, which was released Monday morning, Canadian manufacturing activity expanded at its fastest pace since January 2016. This strength should not be much of a surprise after last week’s strong employment report. Bank of Canada Governor Poloz speaks Tuesday and Canadian dollar traders will be watching closely to see if his views have been affected by recent reports. If Poloz fails to acknowledge these improvements or focuses on the need to be cautious, USD/CAD will rebound back to 1.28. However if he is optimistic, the next stop will be 1.26. The New Zealand dollar will be taking its cue from Tuesday’s dairy auction and if prices fall, the currency will give back its latest gains.

Although the euro ended the day slightly firmer than the U.S. dollar, it was dollar weakness and not euro strength that contributed to the move. The single currency actually shrugged off all of Monday morning’s better-than-expected economic reports to trade down to 1.1580. There was an unexpected rise in German factory orders, an upward revision to the Eurozone service and composite PMIs and a stronger producer price report. However investors are paying very little attention to these releases because the European Central Bank made it clear after its last meeting that it has no plans to raise interest rates until October 2018. Despite Monday’s rally, we are still looking for the single currency to drop to 1.15, but that won’t happen off of Tuesday’s German industrial production and Eurozone retail sales reports as both are expected to be stronger.

Monday's best-performing currency was sterling. Although there were no U.K. economic reports on the calendar and 10-year Gilt yields moved lower, investors are starting to think that even though the BoE did not say that another hike is on the way after last week’s meeting, there’s no doubt that additional rate hikes are on their minds. After Thursday’s meeting, Governor Carney said CPI will still be above target in 2020 with 2 rate rises. And on Friday, BoE member Broadbent said they may need a couple more rate increases as spare capacity diminishes. Brexit is a risk but everything points to a soft exit that will limit the damage to the U.K. economy. For this reason, we are looking for additional losses in EUR/GBP.