By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Tuesday was a lively session in the foreign-exchange market despite the lack of market-moving data as the moves in FX were led by losses in the British pound. Sterling crashed hard on the back of Bank of England Governor Mark Carney’s comments and extended its slide throughout the North American trading session. GBP/USD dropped as low as 1.26 while EUR/GBP hit a high of 0.8835. Unlike the 3 members of the monetary policy committee who voted for an immediate rate hike, Carney feels that it will take several months to see if wages and, in turn, consumption recovers. He remains concerned about the consequences of Brexit and while he didn’t say so explicitly, political uncertainty. So while 3 members of the central bank want an immediate hike, the BoE’s leadership does not support tightening, making a 2017 hike unlikely. 10-year gilt yields fell sharply in response, driving GBP/USD down with it. A deal between the Conservative and DUP party is expected to be announced on Thursday. Unless it is accompanied by Theresa May’s resignation (and we don’t think that will be the case), we could see a relief rally on the back of a coalition deal. Fundamentally and technically, GBP/USD should be trading lower but it could be a rocky ride on BoE division and political uncertainty.

The U.S. dollar traded higher against all of the major currencies except for the Japanese yen and New Zealand dollar. Fed President Evans said Monday night that it remains to be seen if there’ll be 2 or 3 rate hikes in 2017 because while he expects inflation to rise, he’s nervous. Nothing groundbreaking was said by Kaplan who expressed his less-hawkish views last week and as a nonvoting member of the FOMC this year, Rosengren’s bias carries less significance. With that in mind, we believe that most U.S. policymakers share Evans’ view that “we could go until December and then make a decision on rates as we watch the data.” No one is in a rush to change policy as most prefer to wait for evidence of stronger labor-market recovery before tightening the noose again. Technically, the rally in USD/JPY stopped right under the 100-day SMA. With U.S. rates falling, we believe USD/JPY will pullback to 110.70 as buyers swoop in near the 200-day SMA.

The euro dropped to its lowest level in 3 weeks on the back of softer data. German producer prices fell -0.2% in May, taking the year-over-year rate down to 2.8% from 3.4%. The Eurozone’s current account surplus also shrank to 22.2B from 35.7B on the back of weaker activity in Germany and France. Although technically, EUR/USD looks like it could dip below 1.11, the fall in U.S. yields and the prospect of stronger Eurozone PMIs should limit further losses. Let's not forget that at the last monetary policy meeting, the ECB upgraded its GDP forecasts, altered its risk assessment and dropped the word “lower rates” from its forward guidance. Buyers will be attracted by this brighter outlook and political stability.

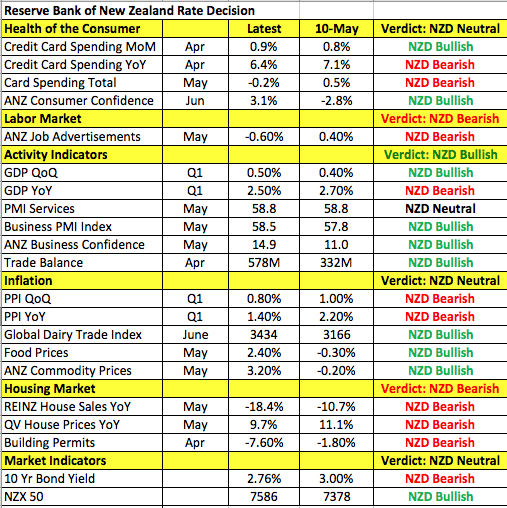

Meanwhile, Tuesday's best-performing currency was the New Zealand dollar. Despite the first decline in dairy prices since March, the New Zealand dollar is holding up well against all of the major currencies, thanks in part to stronger consumer confidence. Investors are clearly banking on hawkishness from the Reserve Bank but we think the recent rise in the currency will make it more cautious than optimistic. Since the March meeting, NZD is up 1.7% vs. AUD, 2.5% vs. EUR, 3.8% vs. CNY and 5% vs. the USD. A strong currency is problematic for an export-dependent economy, especially one whose central bank is worried about the low level of core inflation. Back in May, they specifically cited the exchange rate as a positive development. It had fallen 5% between February and May but unfortunately it is up 4% since the last meeting, making it difficult for the central bank to remain optimistic about the tradeable sector. Although the following table shows that business activity is up, consumer spending is mixed, house prices are slowing and inflation is moving in the wrong direction. For all of these reasons, we believe that the tone of the RBNZ statement will be cautious and the outcome of the RBNZ will be negative for the New Zealand dollar. The Australian and Canadian dollars on the other hand lost value versus the greenback. The RBA minutes provided nothing insightful but the persistent decline in oil prices pushed the loonie lower. The price of crude fell 2% even though OPEC and non-OPEC compliance with oil cuts were at their highest level since May.