By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Even as U.S. rates tumbled on Tuesday, USD/JPY refuses to fall. It broke above 112, hit a high of 112.30 and spent nearly all of the NY session trading above the round number. We know that U.S. data is weak and USD's vulnerability can be seen against European currencies and the New Zealand dollar, which means this is a selective dollar rally with only USD/JPY and USD/CAD marching higher. There’s very little explanation for the dollar’s strength outside of the consistent increase in the odds for a rate hike in June and Treasury Secretary Mnuchin’s talk of issuing extra-long maturity bonds. With that in mind, the latest political landscape has not been completely supportive of the dollar. Some people attributed USD/JPY’s rally to the government avoiding shutdown and the hope that the healthcare bill will be based quickly. However President Trump said Tuesday that the “U.S. needs a good government shutdown in September to fix the mess,” which suggests that he endorses one later this year. Reuters reported that Republicans are still short a few votes on the healthcare bill.

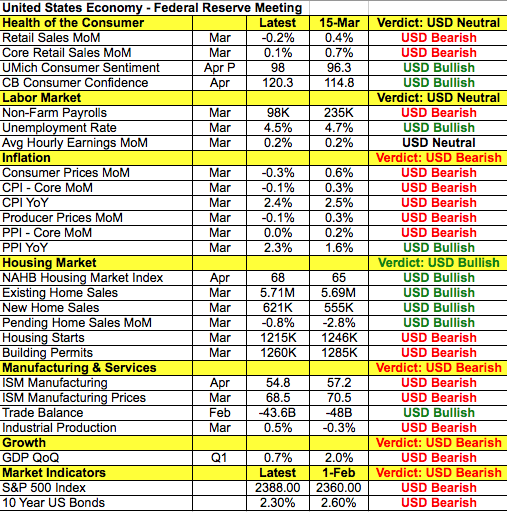

Yet for the next 24 hours, the only thing that matters to the dollar will be whether the FOMC statement supports or diminishes the case for a rate hike in June. About 5 weeks have passed since the last monetary policy meeting and based on the table below, there’s been more deterioration than improvement in U.S. data. Consumer spending turned negative, wage growth is muted, inflation is lower and manufacturing activity slowed. The only improvements were in the housing market and consumer confidence, so there’s a weaker — not stronger case for June tightening. The Federal Reserve raised interest rates at its last meeting and instead of rallying the dollar tanked because there was one dissent (by Kashkari) and Fed Chair Janet Yellen was not hawkish enough. While she talked positively about the labor market and business sentiment at the time, Yellen also felt that not much had changed since December. She did not offer anything more than to say that 3 rate hikes in 2017 qualifies as 'gradual' and the Fed expects policy to remain accommodative. Since then, Yellen has provided no new optimism. In early April she expressed confidence in the housing market, the domestic and global economies but she also described productivity and GDP growth as disappointing — the dollar sold off in reaction. Which makes it difficult to understand why Fed fund traders are so optimistic. Wednesday’s FOMC meeting is a major risk for USD/JPY as it will determine whether 112 holds or breaks. ADP and non-manufacturing ISM is due before the Fed meeting and given ADP’s inaccuracy last month and the weakness of manufacturing ISM, the risk is to the downside for both reports.

Tuesday's commodity currencies were on the move with USD/CAD, climbing to a fresh 1-year high. The current uptrend has lasted for 9 straight trading days, which is the longest stretch for the pair since January 2016 when USD/CAD rose for 12 days before there was a retracement. This sell-off coincided with the drop in oil prices, which fell to a fresh 1-month low Tuesday. Crude prices have fallen more than 10% over the past 3 weeks. In contrast, the New Zealand dollar rose strongly on the back of rising dairy prices. The GDT index rose 3.6% this week, marking the fourth consecutive increase for the country’s most important commodity. New Zealand’s economy has turned a corner but Tuesday night's labor-market report, which reflects data for the first 3 months of the year, could still be soft as the Manpower index reported weaker job growth at the start of the year. The Australian dollar also ended the day higher but only marginally, as investors were disappointed by the Reserve Bank of Australia's failure to acknowledge improvements in the economy saying instead its forecasts for Australia’s economy has not changed much since the last monetary policy meeting. Australia’s service sector PMI report was scheduled for release Tuesday evening.

European currencies performed well Tuesday with the euro, British pound and Swiss franc all trading higher versus the greenback. The euro had at one point sold off on reports that the ECB bought more bonds last week than the week prior but managed to recover its losses by the end of the North American trading session. Sterling, on the other hand, traded strongly thanks to an unexpectedly large rise in the manufacturing PMI index. Manufacturing activity grew at its fastest pace in 3 years thanks to the weakness in the pound in March and April and a post-Brexit recovery. German labor data is scheduled for release Wednesday along with the Eurozone’s first-quarter GDP report. Job creation was strong in April according to the PMIs, so further job losses in Germany are expected. We expect EUR/USD to take another aim at 1.0950 and break this level if the Fed disappoints.