-

Choosing undervalued and overlooked markets over popular tech stocks could offer better returns.

-

Consistent undervaluation in certain countries presents promising growth opportunities compared to the saturated US market.

-

Diversify by exploring overlooked regions through low-cost ETFs or hand-picking stocks with InvestingPro+.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

When faced with a choice between two sets of assets - one performing well and popular, while the other is declining with bleak prospects - opt for the latter.

Why? Because with careful analysis, investors are likely to find more opportunities with big returns.

The first group includes U.S. tech stocks (like those on the Nasdaq 100) and artificial intelligence stocks that have been soaring since October last year.

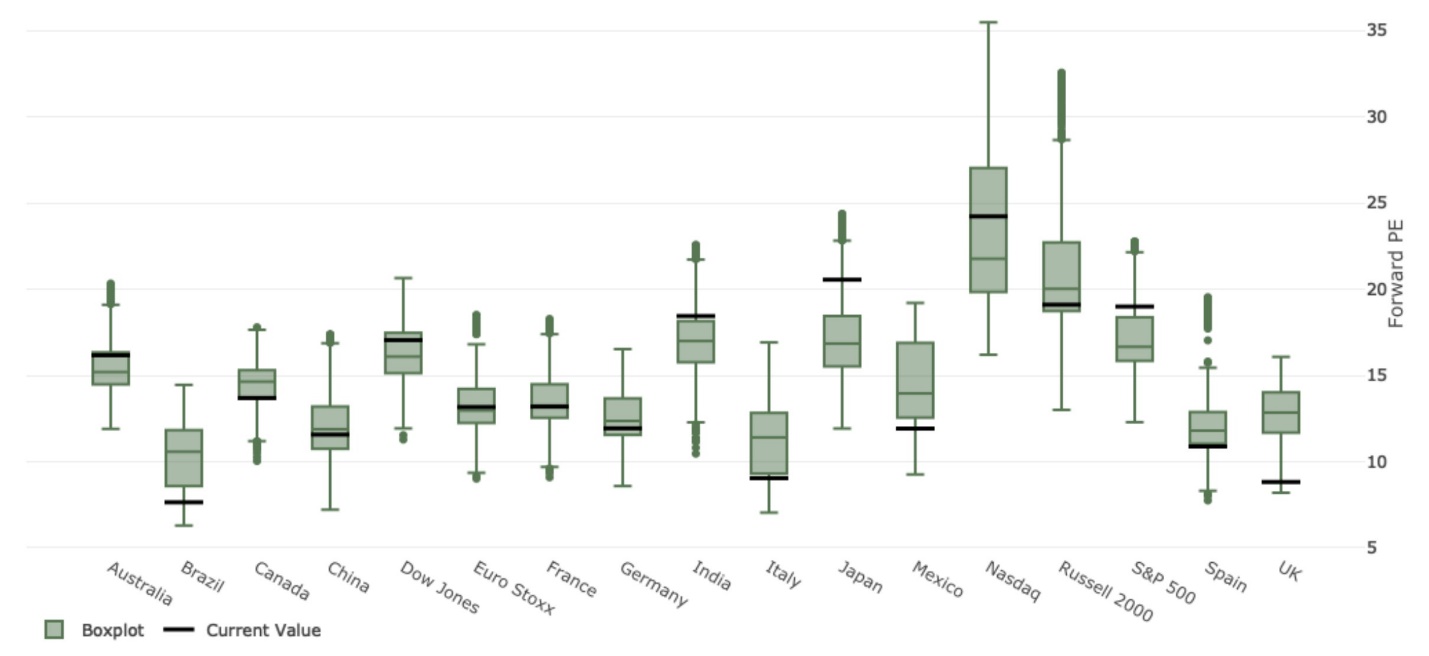

Meanwhile, the second group includes overlooked markets like China (Shanghai Composite), the United Kingdom (FTSE 100), Italy FTSE MIB, Spain IBEX 35, and Brazil iBovespa.

Source: Mike Zaccardi

These five countries have consistently had undervalued stocks so far.

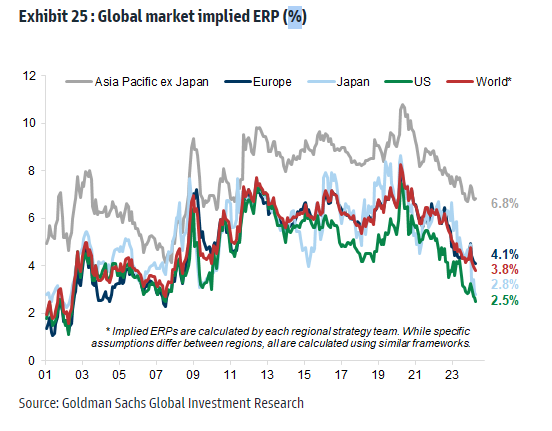

When we look at the equity risk premium (ERP) across different regions, we notice that the American market offers lower expected future returns compared to the Asian market, which is significantly discounted.

Europe as a whole, investible via STOXX 600, falls somewhere in between (see image below).

Source: Goldman Sachs (NYSE:GS)

Instead of just selling off safer investments altogether, a smarter move today might involve shifting your focus to different countries and regions.

This means favoring markets where there's still good value, without straying too far from your overall investment strategy.

You've got two main options:

- Dive straight into investing in those markets using low-cost ETFs.

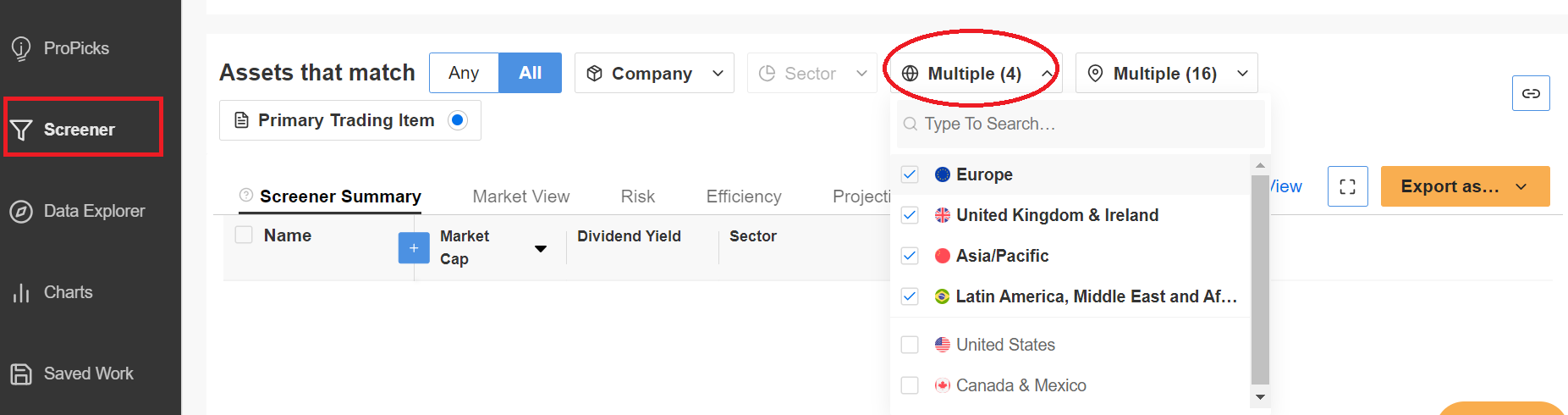

- Take a more hands-on approach by picking individual stocks from those countries. You can do this using the full version of InvestingPro+.

With InvestingPro+, you can use advanced filters to narrow down stocks by geographic area.

Then, you can set criteria for quality and value, helping you find the right stocks (out of over 160,000) from a specific country like China that match what you're looking for.

Source: InvestingPro

Always remember that speculation drives market movements in the short term. However, over the medium and long term, value takes precedence.

'High valuations today = low expected future returns tomorrow' consistently holds true. That's why buying during periods like 2022 is certainly wiser than purchasing at peaks or during periods of overexuberance.

***

Remember to take advantage of the InvestingPro+ discount on the annual plan (click HERE), where you can uncover undervalued and overvalued stocks using exclusive tools: ProPicks, AI-managed stock portfolios, and expert analysis.

Utilize ProTips for simplified information and data, Fair Value and Financial Health indicators for quick insights into stock potential and risk, stock screeners, Historical Financial Data on thousands of stocks, and more!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.