Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Daily FX Market Roundup Sept 24, 2019

The US dollar traded lower against all of the major currencies today on the back of lower rates and weaker data. Treasury yields have fallen for seven straight days – one more and it would be the longest stretch of weakness for 10-year rates this year. This decline reflects the market’s concerns about weakness in the Eurozone, the UK’s political troubles, ongoing US-China trade tensions and softer US data. House prices rose less than expected while consumer confidence dropped the most in 9 months. Consumers share many of the same concerns as bond traders as they worry about how the domestic and global slowdown will impact the labor market and economy in the months ahead.

Meanwhile the greenback experienced a brief recovery after President Trump authorized the “complete, fully declassified and unredacted transcript” of his call with the Ukraine president. Over the past few weeks, there’s been growing calls to impeach President Trump over reports that he asked or pressured Ukraine’s resident to investigate his political rival Joe Biden. The release of the transcript will go a long way toward exonerating President Trump but the recovery in the dollar was short-lived following reports that House Speaker Pelosi will officially announce a formal impeachment inquiry.

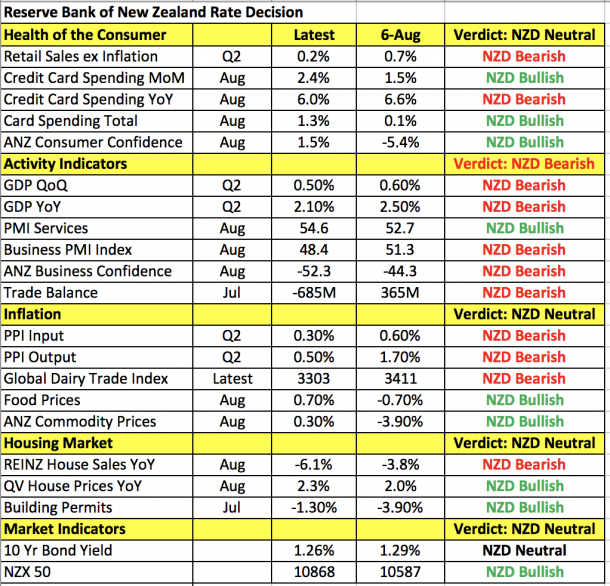

The currency that benefitted the most from US dollar strength was NZD, which rallied for the second day in a row ahead of tonight’s Reserve Bank rate decision. After surprising the market with a 50bps rate cut in August over the forecasted 25bps, the RBNZ won’t be in a rush to ease again. While the central bank suggested that further easing may be in store as the neutral interest rate declined, back-to-back rate reductions is not necessary. For the RBNZ, their greatest concerns are lower GDP growth, rising headwinds and easing demand for New Zealand’s goods and services. Since August we’ve seen mixed spending numbers, weaker manufacturing, softer GDP growth, a surprisingly large trade deficit and lower inflation. Yet housing data improved along with consumer confidence. For NZD, the question won’t be whether the central bank eases but the tone of the monetary policy statement. If it is unquestionably dovish, NZD/USD will extend to 10-year lows, but any hint of optimism and the deeply oversold currency could reverse sharply higher. Trade numbers will be released before the rate decision and significantly weaker numbers are expected.

The euro received a boost from a slightly better-than-expected IFO report. The business climate index climbed to 94.6 from 93.3. Although German businesses grew less optimistic about the economy’s outlook, they felt current conditions improved from the previous month. The pair is itching for a short squeeze after hitting multi-month lows. Meanwhile, sterling shrugged off fresh political troubles for Prime Minister Boris Johnson. As reported by our colleague Boris Schlossberg, “The UK Supreme court in a unanimous decision voided PM Johnson’s right to prorogue Parliament stating in no uncertain terms that the move was unconstitutional.” He explained that sterling recovered because while today’s unambiguous ruling was yet another stunning defeat for PM Johnson, it makes the prospect of no-deal Brexit less of a possibility, which is ultimately positive for the pound.

The Australian dollar was supported by comments from RBA Governor Lowe. He described household spending as the main domestic uncertainty and said an extended period of low rates is likely needed, but also said he felt that Australia’s economy has reached a gentle turning point. They expect further modest GDP pickup in the quarters ahead but the strength and durability of the pickup remains to be seen. They’ll take stock of everything in October and decide if further easing is necessary. The mention of further monetary easing and QE undermines his optimism and leads us to believe that the path of least resistance for the Australian dollar is lower, especially after the People’s Bank of China ruled out aggressive stimulus.