While interest rates continue to be high and cost of living pressures keep biting, older Australians living in large houses they no longer need could benefit hugely from selling their property and moving somewhere more affordable.

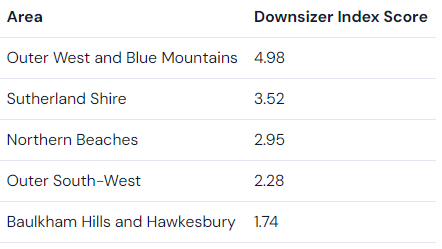

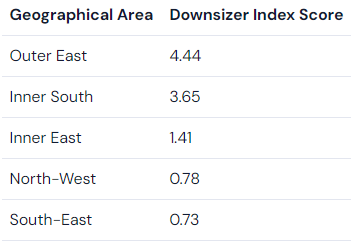

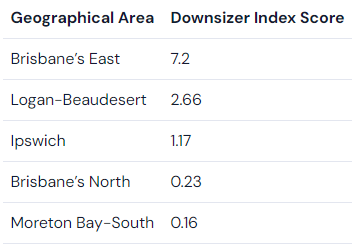

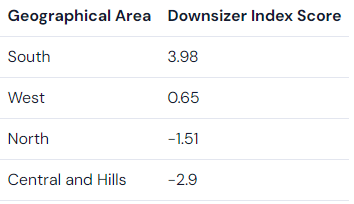

- Research shows the top spots for older Aussies to downsize to from each capital city.

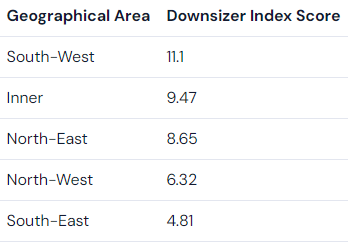

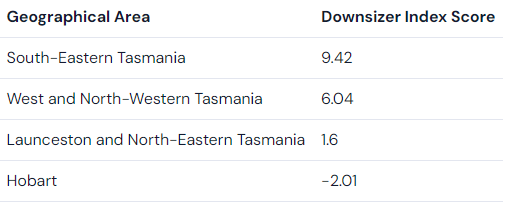

- Downsizing Index is based on demographics, dwelling suitability, health indicators, financial indicators and mobility.

- At the same time, a PropTrack report has revealed the Australian suburbs where residents hold on to property the longest.

The Downsizing Index, from startup Downsizer.com, shows the top spots where residents of each of Australia's capitals are downsizing to.

Michael Blythe, former chief economist at CommBank, compiled the index, and believes downsizing is important for both the older Aussies involved and the broader housing market.

"Downsizers can free up equity and can boost their incomes, assisted by government incentives to place some of the funds into superannuation," Mr Blythe said.

"Downsizing also frees up housing stock for younger families."

The index is based on demographics, dwelling suitability, health indicators, financial indicators and mobility.

Mr Blythe said the index captured the differences in categories between the region and the capital city itself, to give an idea of the likelihood of downsizing activity.

A positive score on the index means the area scored higher than its respective capital city across the categories, while a negative one means it is below.

He believes it's information in which households, governments and developers should take note.

"This kind of data is valuable...to identify where the downsizing focus should be as we battle with the current nation-wide housing crisis and the longer-run pressures from the ageing population," he says.

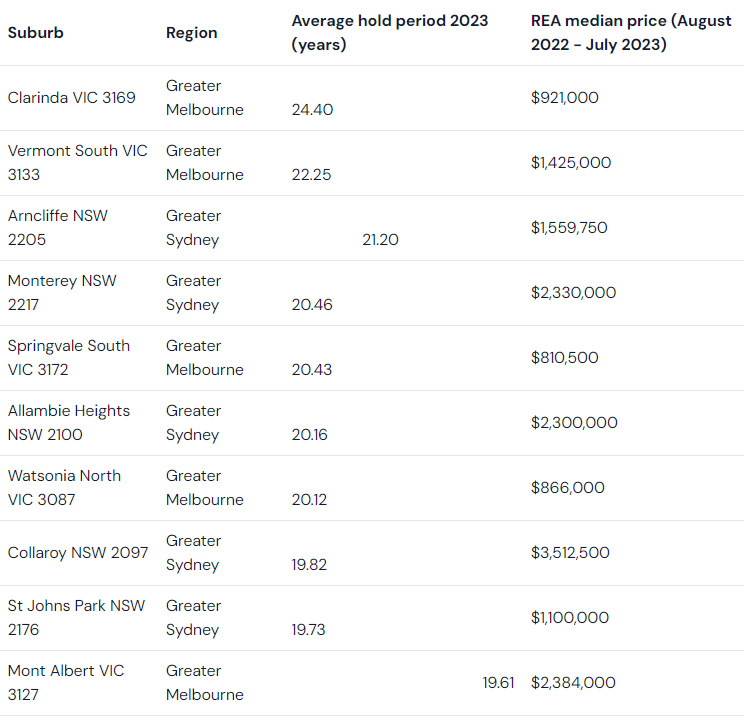

The suburbs where Aussies just won't let go

While the reasoning behind downsizing might be tough to argue with, it can be equally hard to move on from the home you've lived in for decades.

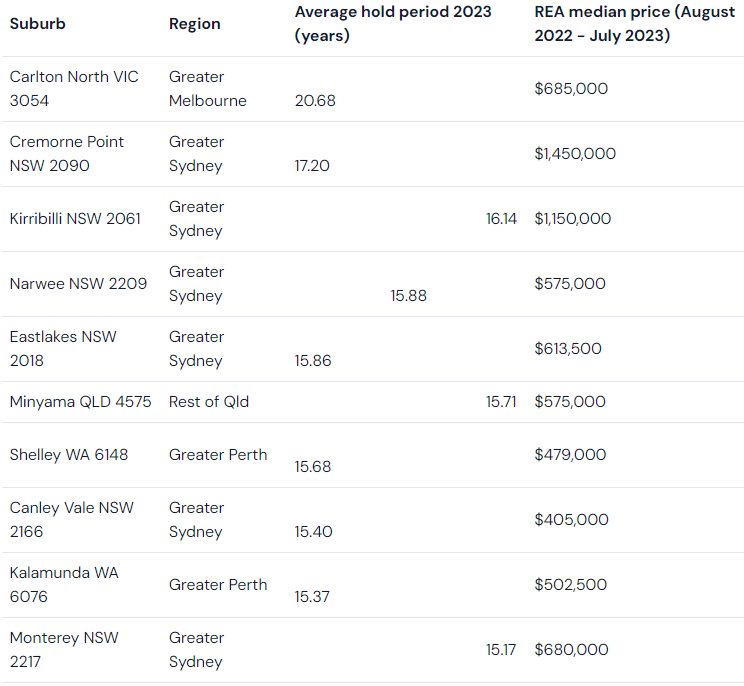

New data from PropTrack has revealed the Australian suburbs that seem to be grabbing residents' hearts the most, where the average homeowner holds on to their property the longest.

The list for houses consists exclusively of suburbs in Greater Sydney and Melbourne, and tended to be more prestige areas with only two of the ten having a median price under $1 million (based on recent sales data).

Units tend to be more prominent in regional areas.

"The suburbs best suited for downsizing...and the suburbs where residents just can't let go" was originally published on Savings.com.au and was republished with permission.