Economists from all four of Australia's biggest banks expect the RBA to once again hold the cash rate target at 4.10%.

- More and more banks are cutting 6-month and 12-month rates below 5.00% p.a. making the 4.85% p.a. rates on offer from ANZ, NAB, and Westpac more attractive.

CPI inflation for July came in softer than expected, while unemployment is also on the way up, hitting 3.7%.

Term deposit rates have been steadily dropping for the past few weeks as providers try to stay ahead of the curve, having previously seen returns increase heavily when the signs were pointing towards further cash rate increases.

This week saw three major term deposit providers cut rates.

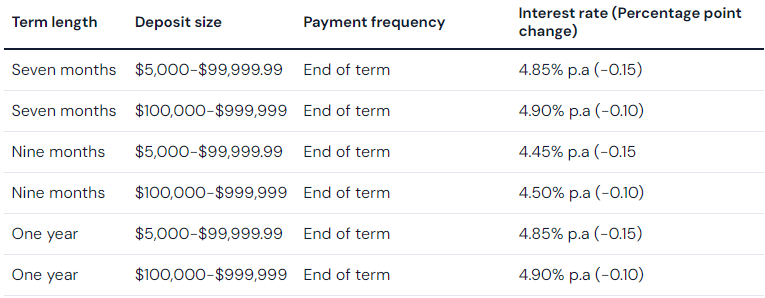

Firstmac is the latest term deposit provider to drop all rates below 5% p.a.

The non bank lender peaked at 5.40% p.a on both six month and one year term deposit products, but along with the likes of AMP and Bank of Sydney, has slashed rates dramatically in recent weeks.

Firstmac term deposits are white-labelled products from BNK Bank's subsidiary Goldfields Money.

There are still a few banks offering rates above the 5% threshold, including ING, Judo, Bank Australia and Great Southern Bank.

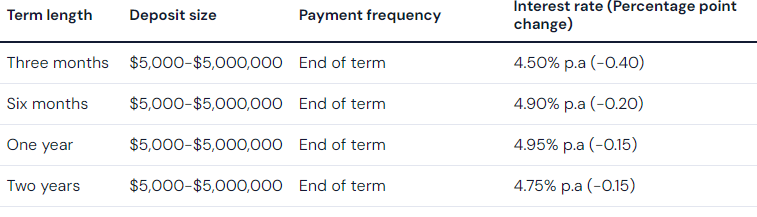

Like Firstmac, ME also cut rates that previously sat above 5% p.a.

It's a sad day for the more sentimental among term deposit enthusiasts, considering ME was the first bank to break the 5% threshold earlier in the year.

These products are also available with five basis point discounts when interest payments are made monthly.

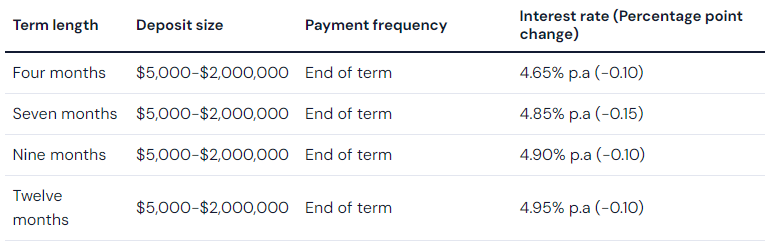

The biggest bank to make term deposit movements this week was Suncorp, with decreases of up to 15 percentage points.

The bank has slightly higher rates available for deposits between one and two million dollars, if you happen to have that kind of money lying around.

ANZ, NAB and Westpac all offer a top rate of 4.85% p.a on one year term deposits, so Suncorp is still offering slightly better returns than Australia's very largest banks.

"The banks that moved term deposit rates this week" was originally published on Savings.com.au and was republished with permission.