The artificial intelligence, or “AI,” revolution is upon us. The financial media and headlines are abuzz with stories of generative “AI” and the subsequent “industrial revolution.”

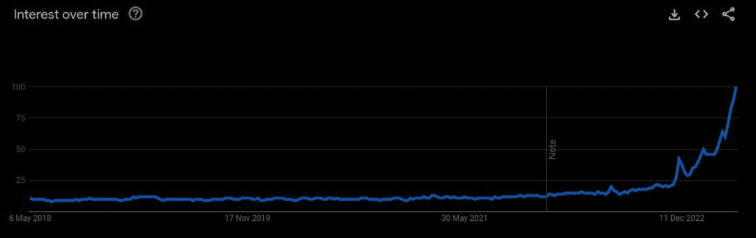

Not surprisingly, attention has turned to AI with the launch of ChatGPT. The benefits are already apparent with the incorporation of AI into search engines. Even TikTok videos on "making a million" using AI suggest why stocks associated with AI surged in recent months.

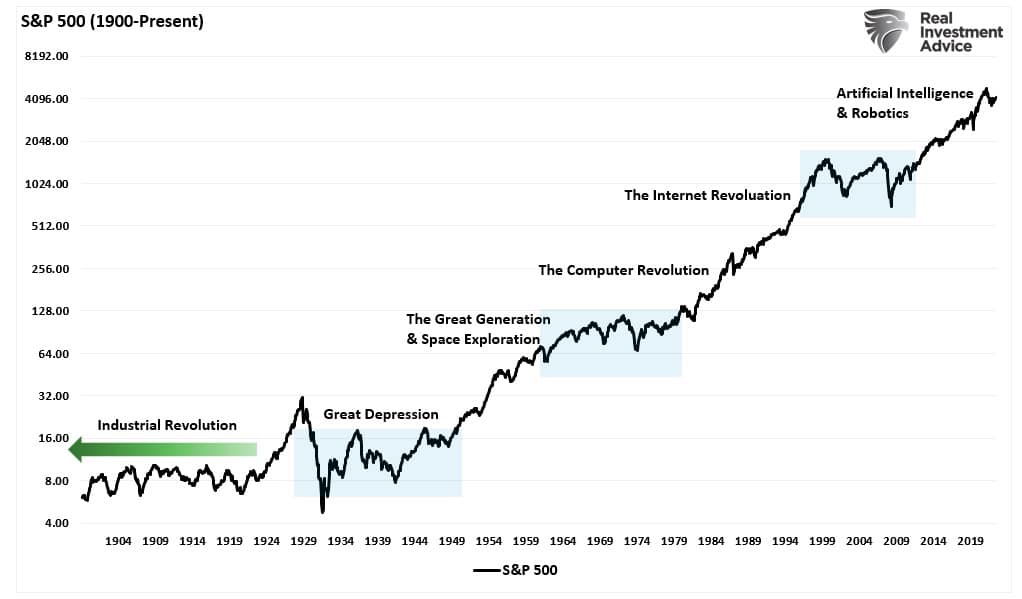

The Industrial Revolution is often considered a continuous event from the 1800s to the present. However, it is better understood as a series of paradigm shifts. The first, which began in the late 18th century, was propelled by mechanization and steam power. Mass production, electricity, and the assembly line fostered the second, which ran through the early 20th century. The third, which began post-WWII, introduced giant leaps in space exploration, computers, automation, and information technologies.

The fourth paradigm shift is occurring now. That revolution encompasses the advent of exponential technologies, from artificial intelligence and intelligent machines to robotics, blockchain, and virtual reality. Those technologies have already impacted how we live for over a decade.

These booms provided great opportunities as the innovations offered great investment opportunities to capitalize on the advances. Each phase led to stellar market returns that lasted a decade or more as investors chased emerging opportunities. (We will come back to those blue-shaded areas momentarily.)

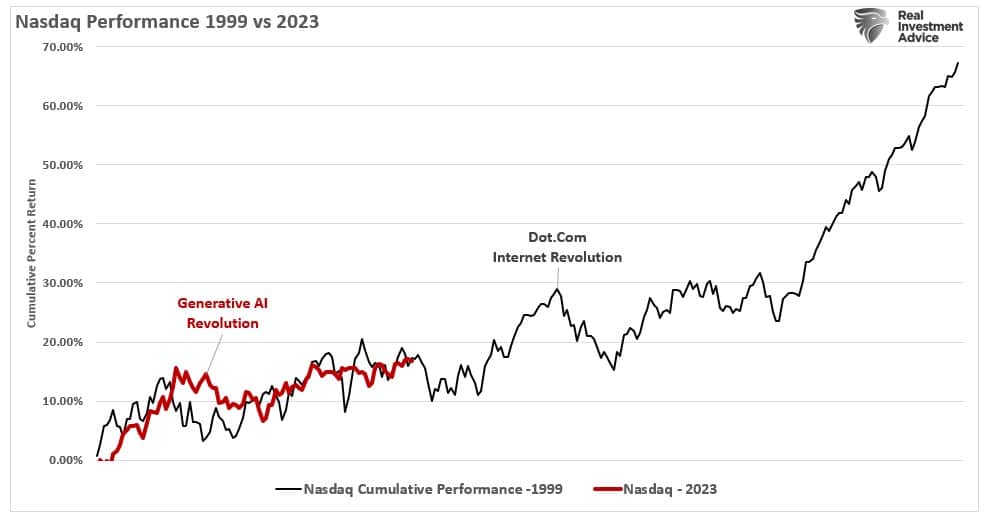

We are experiencing another of these speculative “booms” as “Generative AI” grips investors’ imaginations. The chart below compares the 1999 “Dot.com/Internet Revolution” in the Nasdaq Composite versus the 2023 “Generative AI” revolution.

If that analogy holds, it suggests the opportunity to capitalize on the impact of “AI” from an investment perspective remains.

But what about those blue-shaded boxes?

Those Blue Shaded Boxes

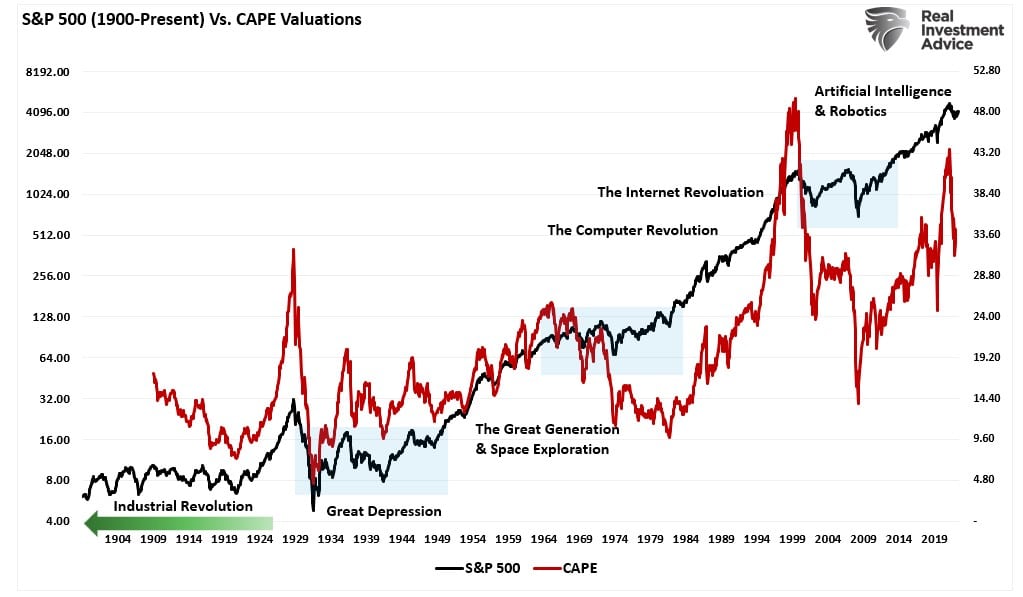

While the allure of “AI” certainly has investors salivating at the potential return profile, the valuation problem remains. As shown, despite the technological advances made from space exploration, the internet, or even “AI,” over-valuation can lead to long periods of stagnation.

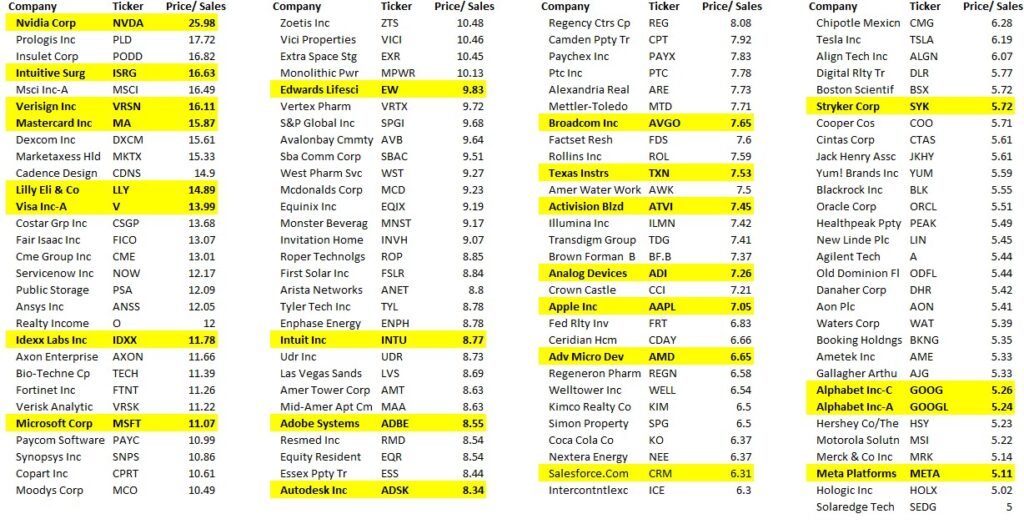

Throughout history, low valuations preceded the best investment return periods. Such is because low valuations allowed for multiple expansions as investors could “pay up” for expected earnings growth. For example, in 1994, investors could buy Microsoft (NASDAQ:MSFT) shares at a price-to-sales ratio of roughly three. As the internet boomed and more computers were needed to attach to the internet, sales for Microsoft accelerated. Today, shares of Microsoft are trading at more than 11 times price-to-sales. The expectations are that AI will fuel another massive boom in revenue.

However, therein lies the problem with valuations. At 11x price-to-sales, there is little margin for error. A good reminder of the importance of valuations was the comment made by Scott McNeely. Scott was the CEO of Sun Microsystems at the peak of the Dot.com revolution in 1999.

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. It assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are?”

This is an important point. At a price-to-sales ratio of two, a company needs to grow sales by roughly 20% annually. That growth rate will only maintain a normalized price appreciation required to maintain that ratio. At 11 times, the sales growth rate needed to maintain that valuation is astronomical.

But it isn’t just Microsoft. The table below lists the S&P 500 companies trading at five times sales or higher. I have highlighted a few of the more visible companies discussed in the mainstream media.

Yes, many of these companies will benefit from adopting “AI.” However, it is hard to justify, even under optimistic assumptions, that revenue growth will support the multiples paid today.

Even ChatGPT suggested the same.

“Paying more than five times the price to sales for an investment may pose several potential problems for investors, including overvaluation risk, unstable earnings, market saturation, competitive pressure, and industry-specific factors. As such, investors must conduct thorough due diligence and consider various financial and non-financial factors before making any investment decisions.”

Or, as Warren Buffett once quipped:

“Price is what you pay. Value is what you get.”

Been Here Before

“Maybe this time is different. Those words, supposedly the most dangerous to utter in the investing realm, came to mind amid the frenzied pops in the highly anticipated initial public offerings recently.” – Randall Forsyth, “Shades of 1999.”

For anyone who has lived through two “real” bear markets, the imagery of people trying to “trade” their way to riches is familiar. The recent surge in anything “AI” related is not new.

The companies that advanced regardless of actual revenue, earnings, or valuations were on the cutting edge of the internet revolution. As such, many thought “trees could grow to the sky.” Endless possibilities existed of how the internet would change our lives, the workplace, and futures. While the internet did indeed change our world, the reality of valuations and earnings growth eventually “mean reverted.”

It is crucial to remember that while valuations are essential to the eventual outcome of speculative market phases, it is a terrible market timing indicator. Price measures the current “psychology” of the “herd” and is the most precise representation of the behavioral dynamics of the living organism we call “the market.”

We are currently in a speculative phase regarding “AI” and its impact on the world as we know it. Unsurprisingly, searches for “AI” have exploded as retail investors chase performance.

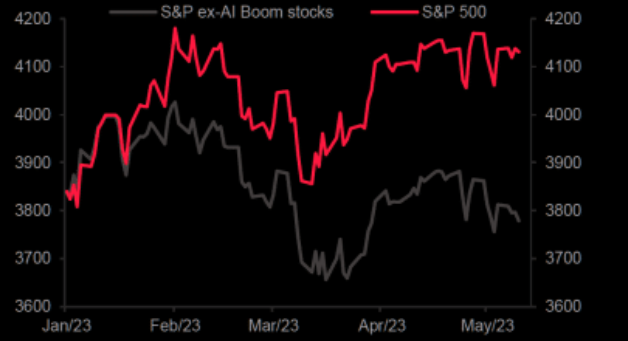

And the breadth of the winners versus the losers in the market is extremely weak.

“The AI boom and hype is strong. So strong that without the AI-popular stocks, S&P500 would be down 2% this year. Not +8%.” – Societe Generale

The difference this time is that we are not starting from a place of low valuations. As noted above, current valuations are expensive across the entire market and astronomical in stocks like Microsoft, Nvidia (NASDAQ:NVDA), Adobe (NASDAQ:ADBE), and Apple (NASDAQ:AAPL).

While we are in the boom phase of the “AI” market, valuations suggest that the ride will eventually end. Chasing markets is the purest form of speculation. It is simply a bet on prices going higher rather than determining if the price being paid for those assets is selling at a discount to fair value.

A lot of money will be made in “AI” before this phase ends. But as with all market phases in the past, the end of the era was simply a function of the realization that “valuations matter.”