The unemployment rate is likely to trend upwards over the coming months, according to Indeed senior economist Callam Pickering.

- Indeed senior economist Callam Pickering told the Savings Tip Jar podcast that, despite expectations the unemployment rate could finish 2023 at around 4%, we're still in a job seeker's market

- Unemployment rose to 3.7% in July

- Big four bank economists are predicting the August read to come in slightly lower

Mr Pickering is expecting unemployment to come in at around 4% by the end of 2023, in line with the Reserve Bank of Australia’s (RBA) expectations.

The former RBA economist turned Indeed senior figure told the Savings Tip Jar podcast that despite the likelihood that employment may tumble, it’s still a job seeker's market.

“Almost every labour market metric we have is doing things we haven't seen before or haven't seen in a long time,” Mr Pickering said.

“We've seen extraordinary employment growth over the past couple of years, we've seen amazing job creation, and certainly there's a lot more jobs out there today unfilled than there was before the pandemic began or at any point in Australia's recent economic history.

“But the dynamic has certainly shifted compared to where it was last year or the year before that.

“The imbalance between demand and supply in the labour market has begun to converge a little bit.”

The unemployment rate climbed to 3.7% on a seasonally adjusted basis in July.

It came as employment dropped by around 15,000 people and the number of unemployed people rose by 36,000.

That was largely due to the seasonal impact of the school holiday period, the Australian Bureau of Statistics (ABS) noted.

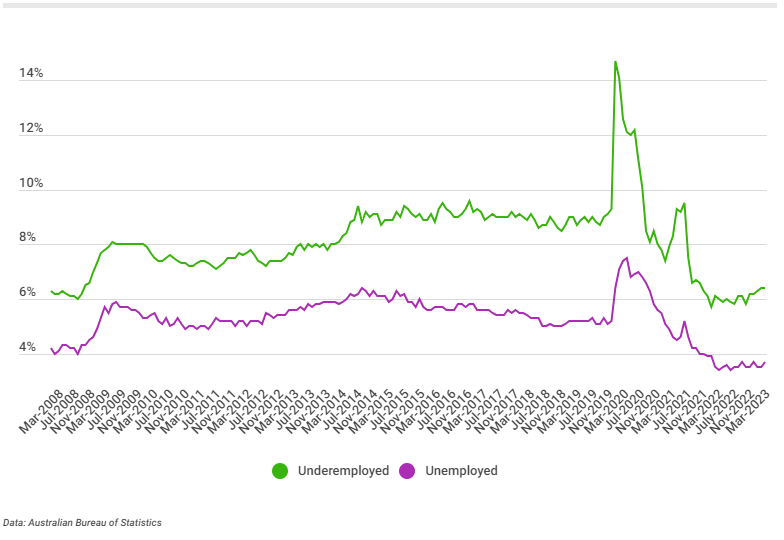

The metric is still circling around a 10-year low, having bottomed out at 3.4% in 2022.

The RBA has previously suggested that around 4.5% would be a non-inflationary unemployment rate.

Economists at NAB expect employment to have increased by around 50,000 in August, dragging the unemployment rate 10 basis points lower to 3.6%.

Over at ANZ July’s higher unemployment rate is expected to be a blip while Westpac experts think employment likely increased by 40,000 people last month.

“Within the context of a historically tight labour market with ample job opportunities, there are more individuals than usual who are moving between jobs – a dynamic, which recently, has tended to surface as a decline in employment during school holidays and a bounce in the following month,” Westpac chief economist Bill Evans said.

However, the banks agree that the unemployment rate will ultimately lift over the coming months.

While rising unemployment is rarely good news for anyone finding themselves without work, Mr Pickering noted that around 4% would be “ultimately a pretty good result” considering the challenging economic environment.

“The fact that the jobs market has proven to be so resilient is just a really good sign about how well we've absorbed the impact of this high inflation environment [and] the increase in interest rates,” he said.

“It's only natural that the labour market is going to slow down, but it's slowing down from a really strong position.”

Tightness in the labour market could also be a reflection of increasing immigration to Australia.

More than 100,000 long-term oversees arrivals hit Australian shores in July, a 65.5% year-on-year increase, the ABS revealed yesterday.

It comes as the nation continues to suffer against widespread skills shortages amid decade-high unemployment.

“It's actually really difficult for immigrants or new immigrants to not be filling some sort of role where there is a significant shortage, no matter what industry they go to,” Mr Pickering said.

“We’ve has seen a lot of workers coming into sectors such as retail and hospitality, backpackers coming to Australia and working while they're here, things like that.

“It's not fully addressing skill shortages, not by a longshot, but it's certainly helping recruiters … and, obviously at the moment, the economy is creating enough jobs that we can absorb that immigration intake.

“So there really hasn't been much downside to so many people coming into the country at the moment because the jobs are there, and they need to be filled.”

"Still a 'job seeker's market' as unemployment tipped to near 4% by year’s end" was originally published on Savings.com.au and was republished with permission.