Originally published by guppytraders.com

The Shanghai Index developed a very strong rebound rally from the low near 2450. This rally is consistent with a double bottom pattern. The first part of the pattern is the low on 2018 October 19. This is a long-term pattern with the lows separated by 4 months. Double bottom patterns are often associated with a longer-term trend reversal.

Success in a rally rebound depends on four factors.

The first factor is the period of time between the two points in the double bottom pattern. The strongest and most reliable trend reversal come when the two low points are separated by several months rather than several days or weeks. The current double bottom has this feature.

The second factor is the degree of separation in the long-term group of averages in the Guppy Multiple Moving Average (GMMA) indicator. This group of averages provides a guide to the way that investors are thinking. A wide separation shows selling pressure is strong. Ideally, the long term GMMA should compress in reaction to the rally rebound. This has not yet developed, but investors will watch closely for evidence of compression because this will confirm an increased probability of a trend change.

The third factor is the downtrend line. This, along with the upper edge of the long term GMMA, is a significant resistance feature. The index must be able to move above and stay above, the value of the trend line.

The fourth factor is the strong historical resistance level near 2690. This has been a major resistance and support level. Any move above the value of the downtrend line is treated as a rally until the index is able to move above the value of resistance near 2690.

Traders will actively trade the breakout above the trend line and use the resistance level as an exit target. They exit for short term profits because the index will probably consolidate around 2690 before developing a longer-term breakout.

Aggressive investors enter the market when the breakout above the trend line is confirmed. Conservative investors wait until the index is above to move above 2690.

A sustained retreat away from the value of the trend line is bearish and leads to a retest of support near 2450. The current rally rebound is treated as a temporary rally until it is able to move above the value of the downtrend line.

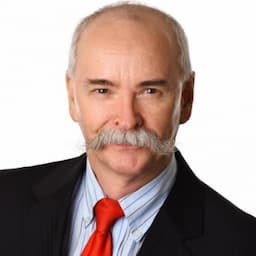

Daryl Guppy is a leading international financial technical analysis expert and special consultant to Axicorp. Guppy appears regularly on CNBC Asia and is known as "The Chart Man". Disclaimer: Daryl Guppy is not a financial advisor. These notes are for educational purposes only and provide an example of applied technical analysis.