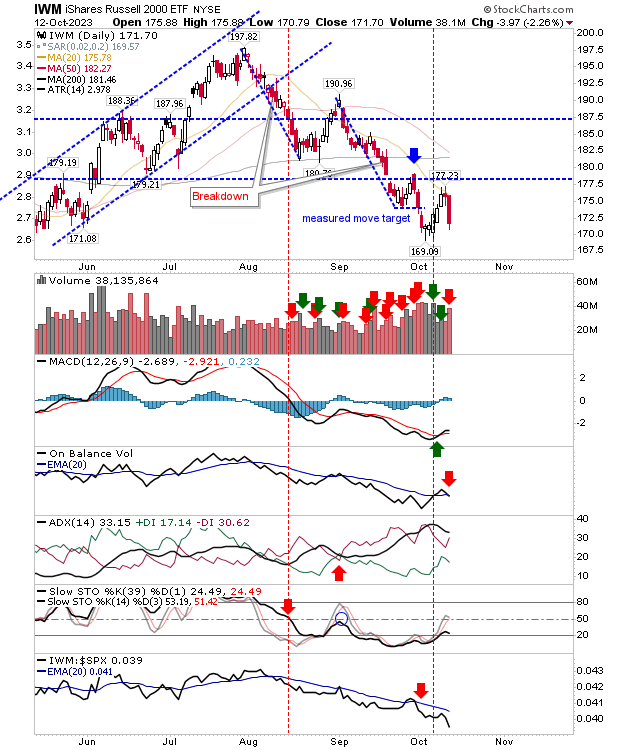

The Russell 2000 (IWM) is the canary in the coal mine for markets and yesterday's action is not great news for the S&P 500 and Nasdaq, despite the latter indexes doing 'okay' yesterday. Selling volume rose to rank as distribution with a 'sell' trigger for On-Balance-Volume.

Relative performance accelerated in its decline against the S&P 500 (and Nasdaq), but this has been the case since August. The only positive is the residual MACD 'buy', but this signal occurred well below the MACD zero line, not a good trade signal and one liable to fake out.

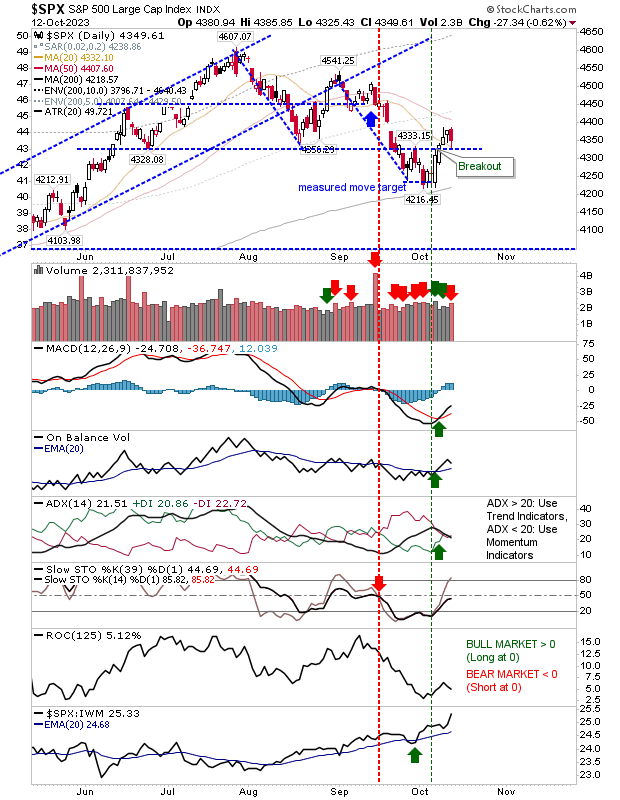

The S&P 500 eased back on higher volume distribution to test support, but with the action in the Russell 2000, it's hard to see this support holding over the coming days. The index still has bullish technicals for ADX, On-Balance-Volume, and MACD, but stochastics [39,1] remain on the bearish side of the mid-line.

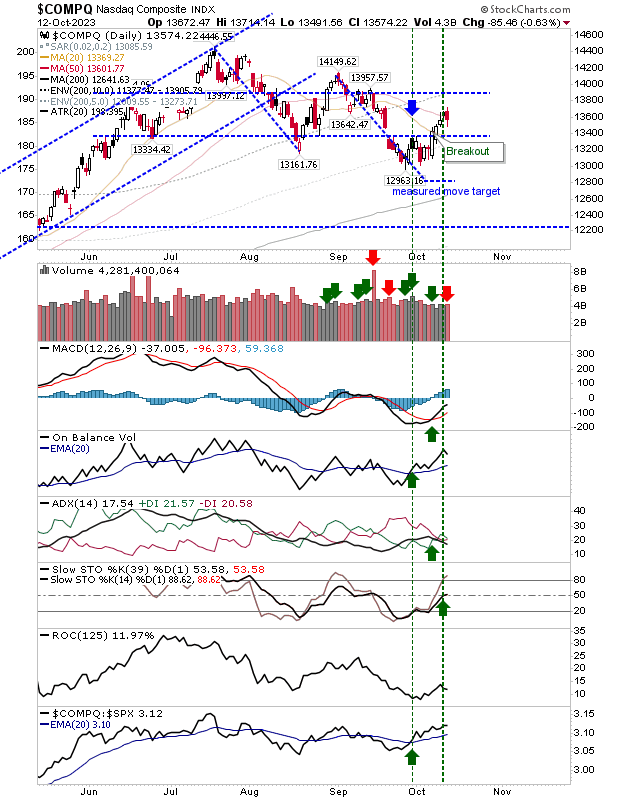

The Nasdaq is holding on to its 50-day MA and its net bullish technicals despite yesterday's selling. Again, if the Russell 2000 hadn't done what it did yesterday, I would be more positive about this index going forward. However, until the price confirms with a break, this is still "okay".

We are coming to the end of the week, with Friday's trading and the weekly candlestick to post, it will be interesting to see how this impacts the Russell 2000. I would be pessimistic about the Russell 2000, but the weekly chart is firmly inside a trading range and likely a few weeks away from a decline should the selling continue.