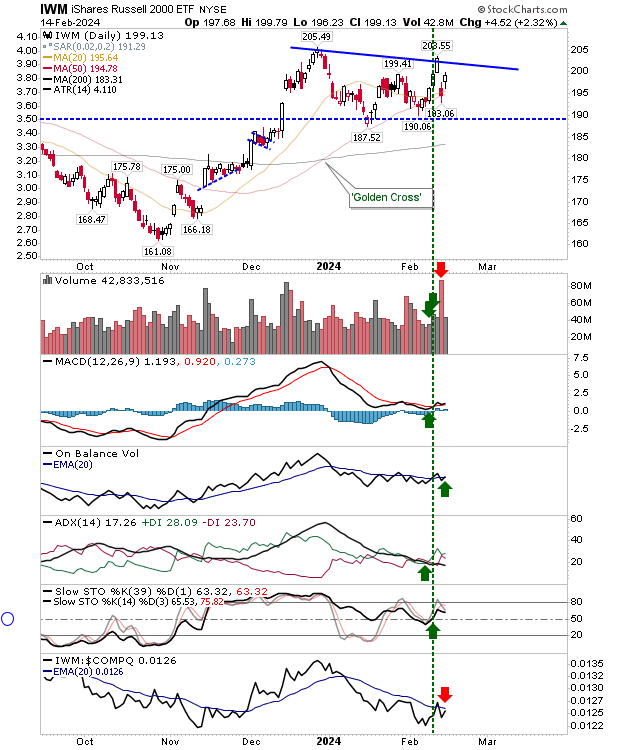

I wouldn't classify it as a "bull trap" as Monday's breakout in the Russell 2000 was an internal base breakout, but the drop back into this base places greater significance on support around $190.

Technicals are net bullish, but On-Balance-Volume is flipping around its 20-day MA trigger line and ADX is also a little topsy-turvy. The MACD might prove to be the bellwether here, and for now, there is a 'buy' trigger above the bullish zero line.

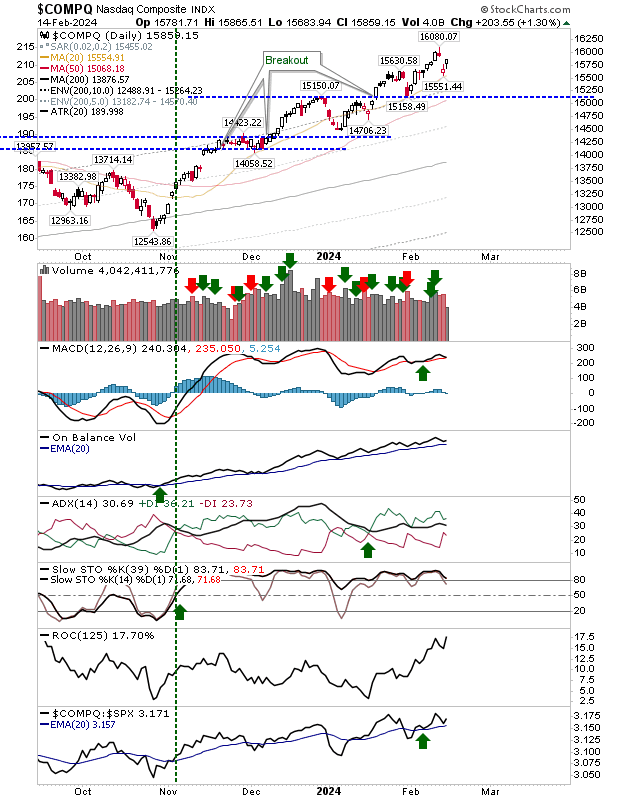

The Nasdaq is recovering from its gap down, although there wasn't too much technical damage from this gap.

Symmetry could be important here, and what happened in December could repeat here. If this proves true, the next breakout won't come until March. Technicals support this thesis.

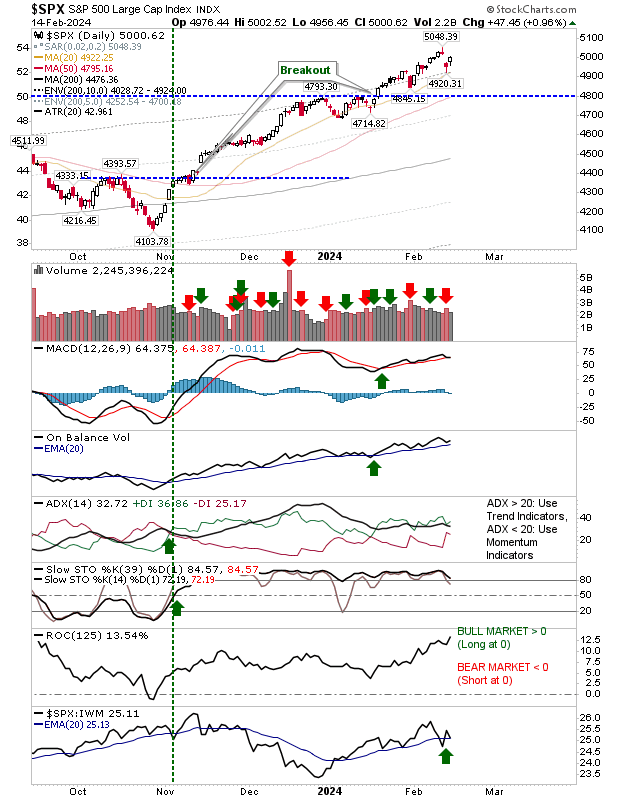

For the S&P 500, read the Nasdaq. Same setup and, the same potential outcome.

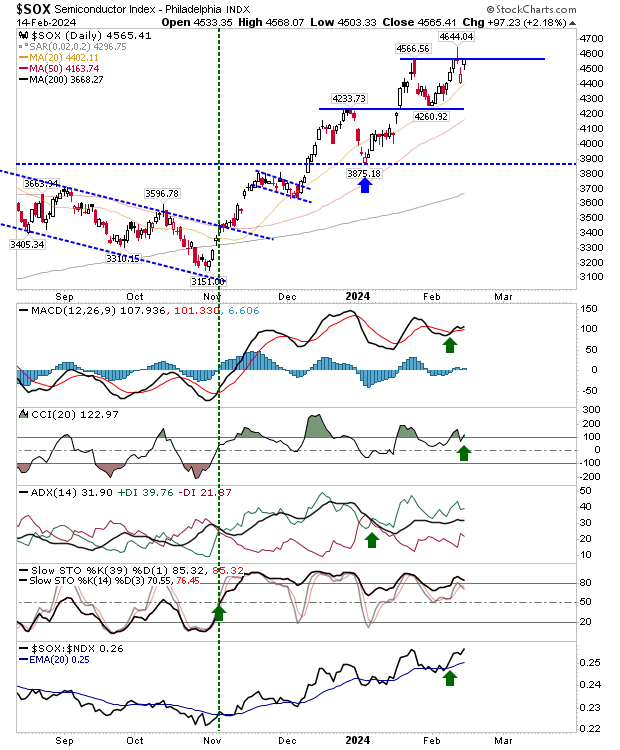

The semiconductor index has been performing relatively methodically, moving in step sequence through its bases. There are bearish divergences for both the MACD and CCI which blow up the breakout and complete a double top.

For today, we are probably looking at a support test of $190 in the Russell 2000 and a closure of the breakdown gaps in the S&P 500 and Nasdaq.

The Semiconductor Index is primed at resistance; any gain today would likely qualify it as a breakout, which would be positive news for both the S&P 500 and Nasdaq.