Today was one of those days where I was waiting (and waiting) for the profit-taking to kick in, but by the time sellers made their appearance I had reached my loss limit for the day and so that, was that.

You can see all of my whipsaw trades here. For the record, I only work off price action, looking at support/resistance and tells like rapid stop takeouts, usually a good sign for a reversal.

Given that, we can see sellers had plenty of motivation to take profits and jumped in on afternoon trading.

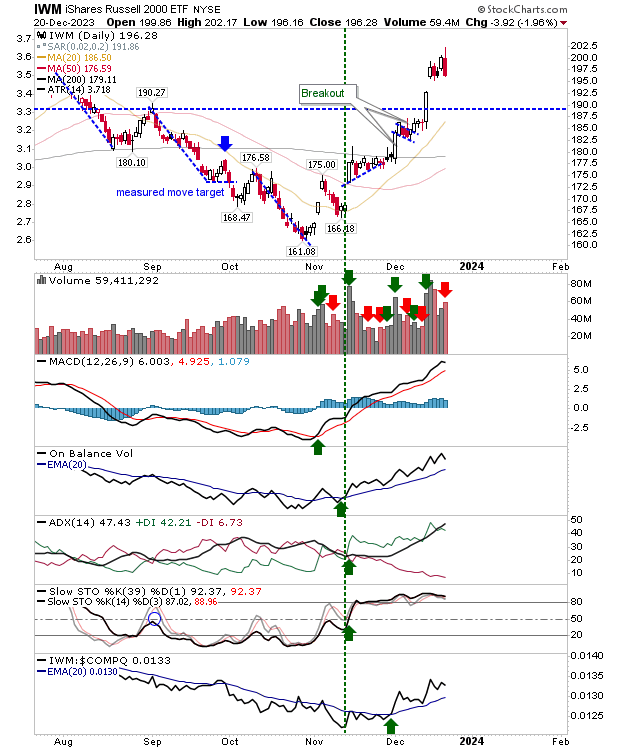

While there was a big reversal in the Russell 2000 (IWM) it still didn't come into the breakout gap; I suspect we will see this today. Volume climbed to register as distribution.

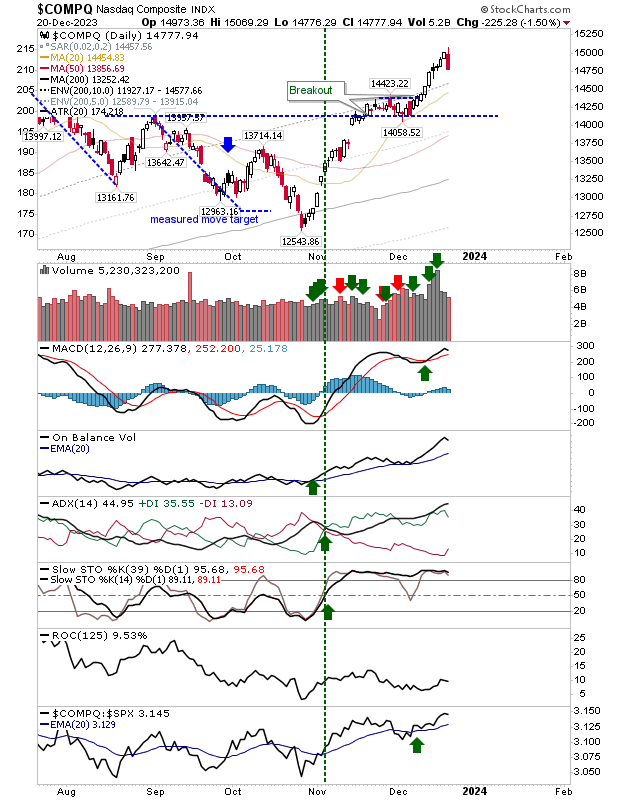

The Nasdaq held up a little better on bullish net technicals. There was no distribution and I could see buyers making some inroads today, but even if the selling continues there is support at the 20-day MA.

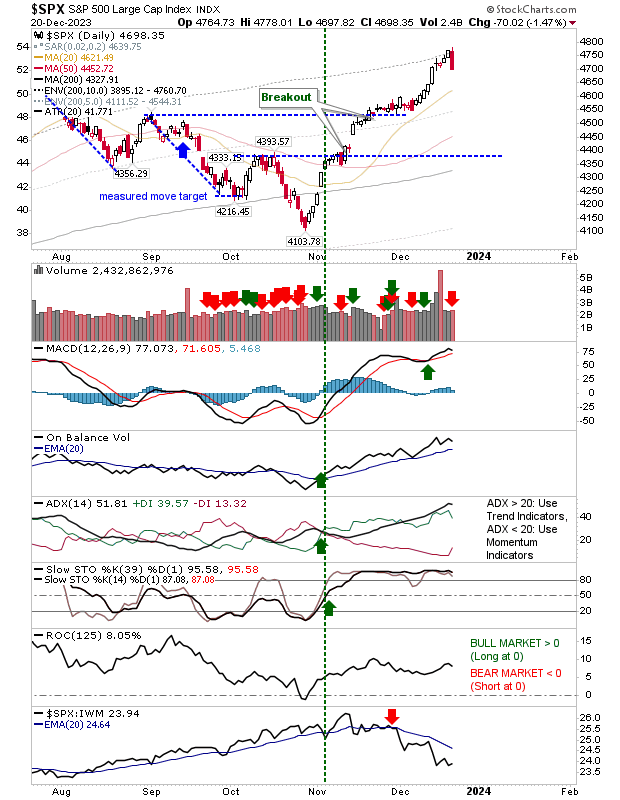

The S&P 500 had its own round of selling on higher volume distribution. The index is underperforming relative to its peers since November so I would be looking for more selling pressure here. The next key support is the 20-day MA.

For today, I would be looking for some buying support although it may be a bit of a scratchy day.

Markets do have to consolidate October gains and today may be the start of this. If sharp selling continues, then look to 20-day MAs as a place where buyers may feel confident of stepping in.