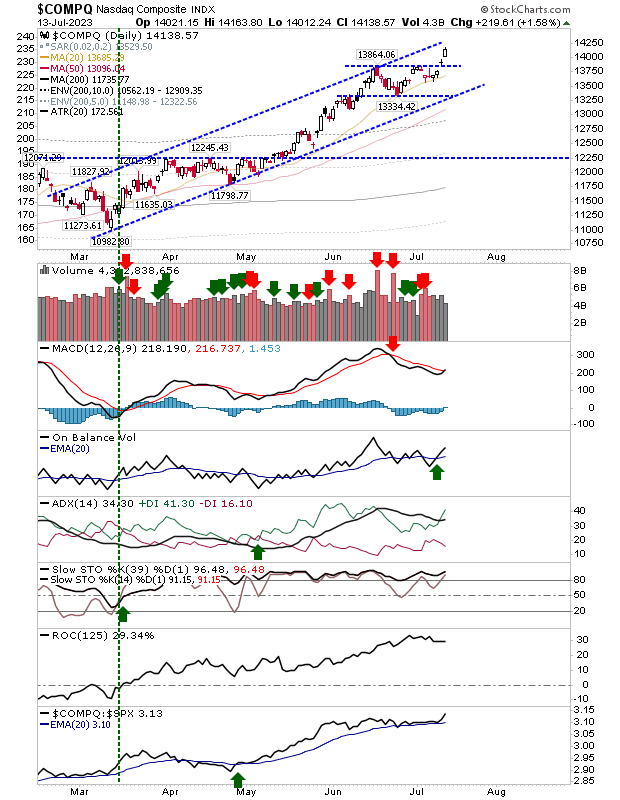

The Russell 2000 made its move, but today it was Nasdaq and S&P 500's turn. Technically, the breakouts for both of these indexes occurred yesterday, but doji doesn't really qualify because of the implied indecision and potential topping aspects of this candlestick. However, today's (small) white candlestick in these indexes was enough to count the move as a breakout. The MACD trigger 'buy' is an added bonus.

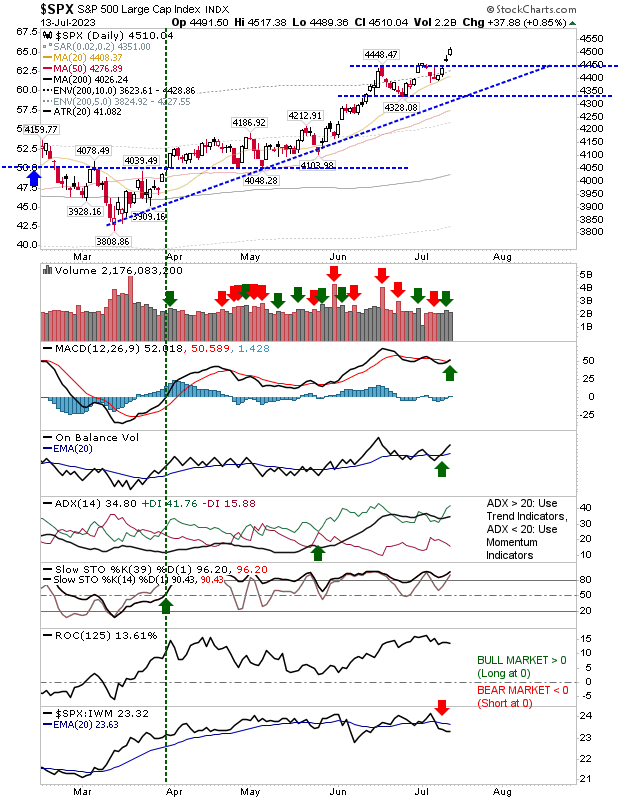

The S&P 500 played a similar move to the Nasdaq with its breakout. Volume was down on yesterday (the 'real' price breakout), but the MACD trigger 'buy' and the acceleration in the uptick in On-Balance-Volume compensate for this. The index is underperforming relative to the Russell 2000, which is bullish for the success of the broader rally, even if this means Large Cap stocks will lag Growth stocks.

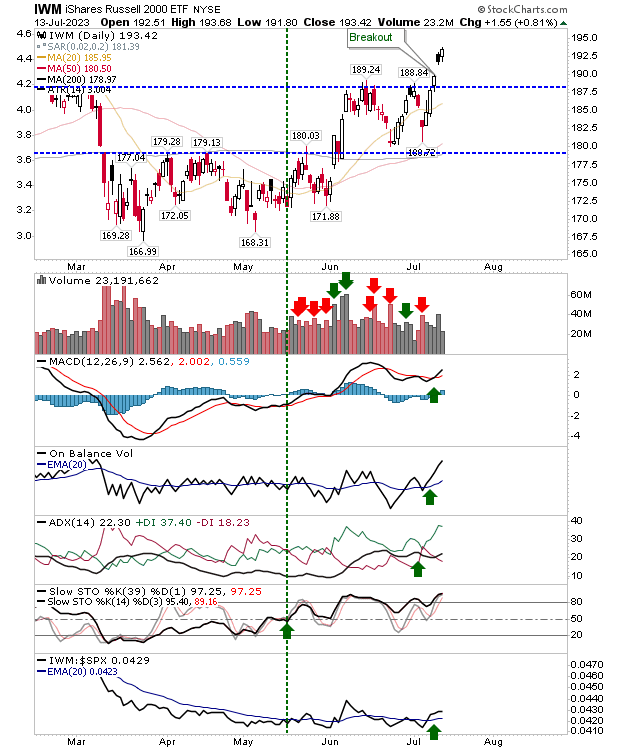

The Russell 2000 also had a good day. There was a worrying 'black' candlestick yesterday, but today's action helped negate the bearish implications of that candlestick. Technicals are net bullish, and while yesterday's volume was light, On-Balance-Volume ticked towards a new 3-month high.

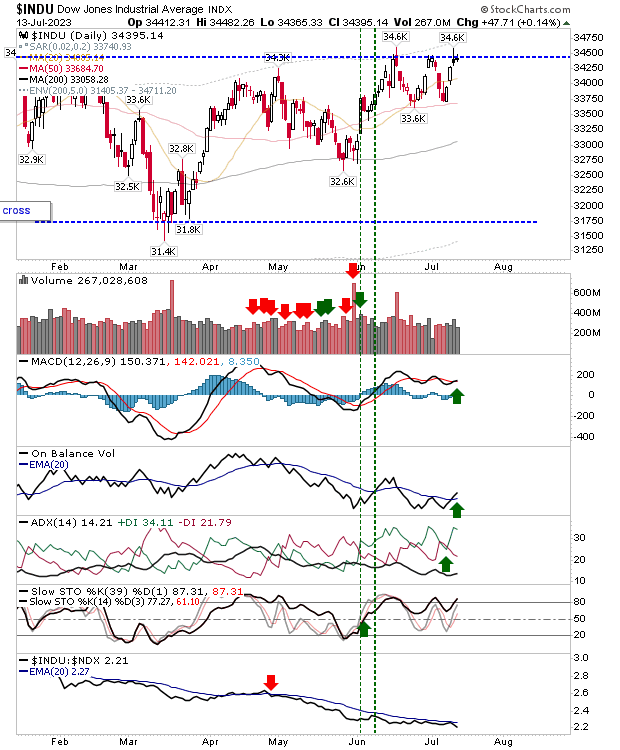

Of other indexes, the Dow Jones Index hasn't yet managed to follow the S&P 500 breakout higher. After a period of relative strength, it has now lost some ground. The relative underperformance to the Nasdaq 100 is particularly telling.

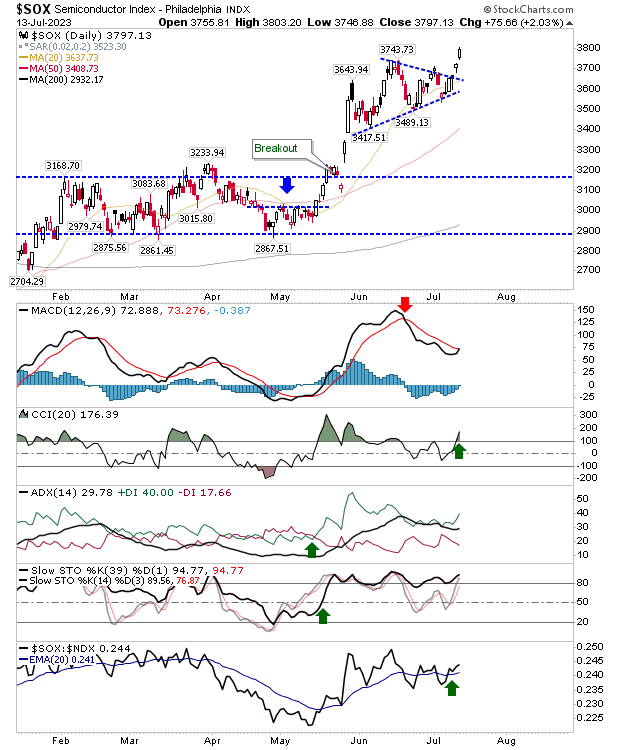

The Semiconductor Index has also managed a break from its consolidation triangle but hasn't quite managed to follow it with a MACD trigger 'buy.'

For tomorrow, we want to see these gains banked so that weekly charts show a strong finish. A doji or better would be better for any of the featured indexes.