Forex News and Events

Will Santa visit this year ?

The year is almost over and the market is, as usual, counting on the traditional Christmas rally to end up the year on a high note. However, this is not a done deal yet as a few clouds are starting to appear on the horizon. First of all the geopolitical tensions surrounding the Syrian situation could derail the usual Christmas rally as investors would rather opt for a risk-off approach. The assets that could benefit from an escalating situation are gold, crude oil and defence stocks. However, looking at the political news, it seems that both Turkey and Russia want to ease the tension and resolve issues in a peaceful way.

Secondly, the latest data from the world’s biggest economy disappoint somehow. The first revision of third quarter GDP came in roughly in line with expectations at 2.1%q/q (annualized) from 1.5% first estimate. Low energy prices continue to support substantially consumption, however personal consumption, which is the biggest growth driver, eased to 3%q/q (annualised) from 3.2% first estimate. Moreover, the higher revision in inventories is casting over the Q4 growth as inventory levels are still elevated.

The Christmas rally is not done deal this year as investors are too occupied to lock-in the profit now, while most equity indices are close to historical highs.

Norway: Unemployment rate remains unchanged

Today traders were closely watching the Norwegian the unemployment rate which has been released unchanged at 4.6%. There were still significant concerns that the negative trend kept going. Indeed, in 2014, the unemployment was around 3% and it has not stopped to deteriorate. Yet, the level of unemployment is still very acceptable and many countries will sign for such labour market. Anyway, the unemployment rate remains very close to the full employment. For the time being, the negative trend is mostly due because of oil revenues which accounts for the major parts of the Norwegian economy. Even if oil prices has bounced back from $40 a barrel to $43. Prices remain very low and the volatility is very high in a context of market oversupply.

As a result of the global uncertainties regarding oil prices, it has already been announced that major Norway’s oil and gas companies will reduced their exploration investment during the year 2016. We believe that oil prices won’t pick up during the first semester 2016. Over the past seven years, when the oil price could only go up, investment from Norway tripled. Now, the sector is cooling down and we may expect lower GDP next year. USD/NOK is set to appreciate. The pair is heading towards 9.00.

Commodity market

Impact of weak oil can now be seen in Canadian economic data. With expectations for a recovery in crude prices limited additional weakness in the Canadian economic should be anticipated. Canada has been struggling to rebalance their economy into non-commodity. Canadian generally is exposed to the negative effect of the Fed tighter policy, meaning CAD generally appreciates. To offset the strong CAD, the BoC will have to ease further. In the commodity currency group AUD should outperform. Recently the AUD has been more resilience to USD volatility and rather sensitive to commodity prices and regional growth expectations. RBA has been more optimistic on the domestic outlook while concerned over external developments. Fall in commodity prices has pushed AUD lower against the USD yet remains firm against NZD. On the data front, Australia’s construction work done fell -3.6% in 3Q, lower than expected 2.0% and upwardly revised 2.1% in 2Q. Yet, skilled vacancies rose 0.6% m/m in October, weaker then downwardly revised 1.1% surge in September. Australia’s central bank Governor Glenn Stevens today suggested that markets should “chill out” on speculating on further interest rate cuts.

AUDUSD - Further Bullish Gains

The Risk Today

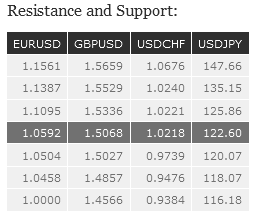

EUR/USD has been range-bound after piercing 1.0600 yet remains in a downtrend channel. The technical structure is clearly negative. Hourly support is given at 1.0591 (23/11/2015 low). Hourly resistance can be found at 1.0763 (19/11/2015 high). Stronger resistance stands at 1.0897 (05/11/2015 high). Expected to show consolidation of the pair. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is holding below 1.5200. Hourly support at 1.5109 (23/11/2015 low) has been broken. Hourly support lies at 1.5027 (06/11/2015 low). Strong resistance can be found at 1.5529 (22/09/2015 high). Expected to show continued weakness. The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY has reversed recent bullish momentum, correcting sharply lower. Support is located at 122.23 (16/11/2015 low). Expected break of the support at 122.23. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF is targeting again the hourly support at 1.0122 (18/11/2015 low). Hourly resistance is given at 1.0226 (23/11/2015 low). The technical structure still suggest that the upside momentum is at stake. Expected to show reversed momentum. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.