Cash is no longer trash, courtesy of sharply higher interest rates. Trailing yields on risky assets are looking up too.

The source for the change in payout rates, of course, is a run of rate hikes by the Federal Reserve and other central banks around the world. The most conspicuous shift is in cash and cash equivalents, such as 3-month Treasury bills, which currently yield 4.84% as of Feb. 22.

The allure of short-maturity government bonds, money market funds, and the like are the most attractive in years, reminds an analyst. Jim Bianco of Bianco Research says:

“You are going to get two-thirds of the long-term appreciation of the stock market with no risk at all. That is going to provide heavy competition for the stock market. That could suck money away from the stock market.”

Higher yields equate with lower prices for risky assets and so Bianco’s warning can’t be dismissed. At some point, the higher payout rates in stocks, longer-dated bonds, and real estate shares are too good to pass up. Are we at the point of maximum payout rates? Perhaps not, in part because the Fed is still expected to lift rates at upcoming FOMC meetings. But there’s no cost for looking.

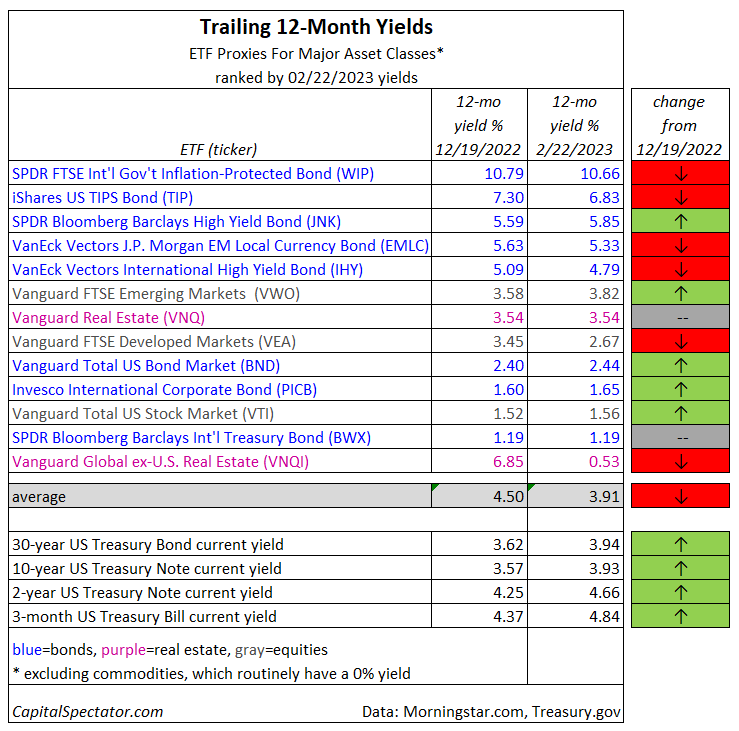

Reviewing trailing yields for the major asset classes, based on a set of ETF proxies, shows a competitive field overall vs. cash. Deciding if those higher payouts are the genuine article on an ex-ante basis requires careful analysis. But as a first approximation, it’s useful to compare the latest yields. On that front, payout rates remain relatively attractive overall.

The average yield for the major asset classes fell to 3.91%, based on trailing data through Feb. 22, according to data from Morningstar.com. That’s down from a 4.50% average in our previous update in mid-December, although it’s still up sharply from a year or two earlier.

Notably, the risk portfolio is competitive with U.S. Treasuries for 10- and 30-year maturities. You can earn a higher yield in short-term governments, but going all-in with a 100% allocation to cash and equivalents is extreme and almost certain to underperform a diversified set of risk assets longer term. All the more so when you’re being paid more to endure short-term volatility in risk assets these days.

But as Bianco suggests, the short-term volatility could be troublesome for the foreseeable future. In other words, there are (still) no free lunches in the desperate search for yield. Risk management is still required. Diversifying across asset classes can help. Studying the payout history of a given fund, and guesstimating the future path for interest rates and other macro factors, is also recommended.

Rethinking the role of cash, and its rising yield, as an asset class deserves to be on the shortlist too. In addition, buying individual Treasuries, including the inflation-indexed variety, has appealed these days for locking in higher real and/or nominal yields.

Keep in mind, too, that trailing payout yields for stocks and other risk assets aren’t guaranteed (in contrast with current yields from government bonds). And there’s the possibility that whatever you earn in higher payout rates could be wiped out, and more, in lower share prices.

Nonetheless, the rise in payout rates is an indication that you’ll likely earn more in yield with a risk portfolio compared with the years before the Fed started hiking rates in March 2022. That alone isn’t a silver bullet, but it’s a new factor to consider for updating asset allocation strategies.