US stocks took another hit yesterday as the carry trade unwound and the effect was felt in Japan when the Nikkei 225 plunged. Since then, the Nikkei has rebounded 10.2%, almost erasing the 12.4% decline on Monday that pushed it into bear market territory. This morning, Wall Street is showing signs of stability, with S&P 500 futures rising 1.5%.

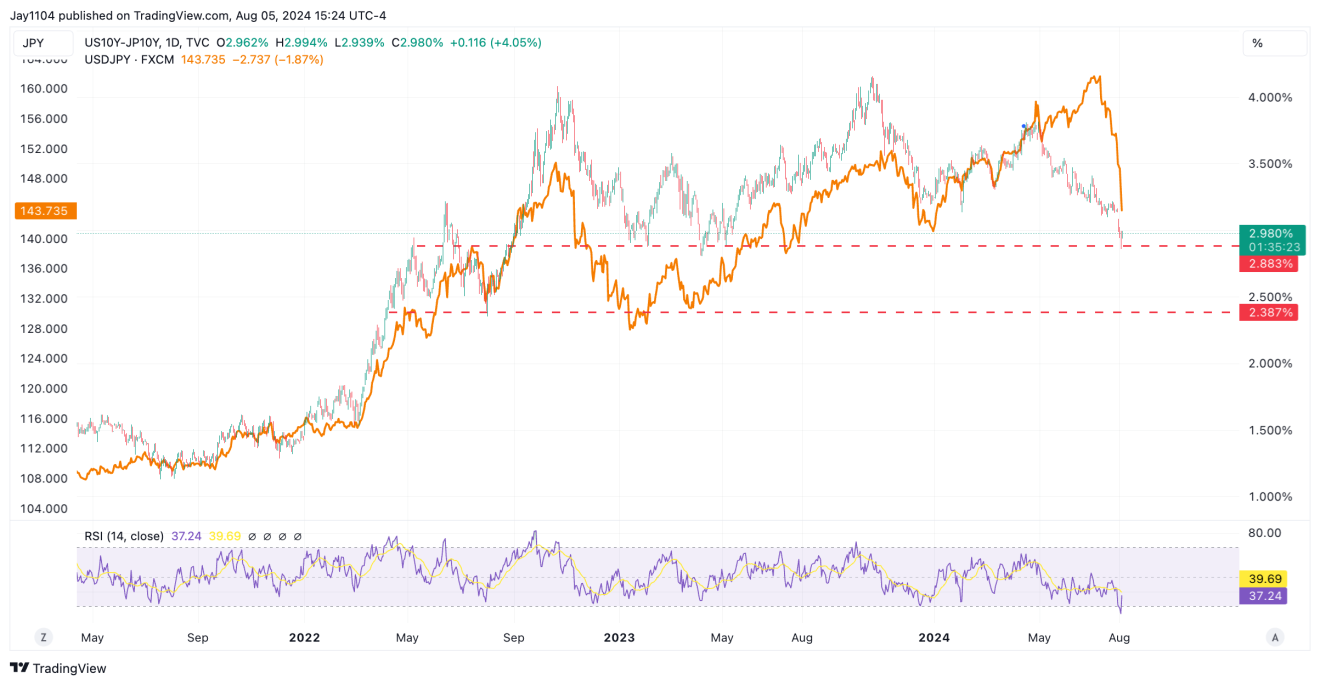

The biggest thing that needs to be understood is how far the unwind goes and what the equilibrium point is because that will tell us when the worst is behind us. By looking at where the spreads are between the US 10-year and Japan 10-Year, we are at some kind of inflection point for this yen carry trade because the spread is around 2.9%. A break of support at this 2.9% region likely leads to further narrowing of the spread and the yen moving lower.

If the spread stabilizes, then the USD/JPY will stabilize. It is that simple.

Calls for Emergency Cuts Are Absurd

The S&P 500 isn’t even down 10% yet, and people are calling for emergency rate cuts. Yeah, the S&P 500 falls 10%, and the Fed will start cutting rates between meetings at 75bps clips. Give me a break, come on. The worst thing the Fed could do is cut rates at this point because it would create even more moral hazard risk than what already exists and cause interest rate spreads to collapse, only making the recent move in the USD/JPY worse.

The S&P 500 can fall much further before this is over, and it will still be a lot from October 2023, when it rallied for no reason other than the fact that financial conditions eased as implied volatility melted. The USD/JPY helped to facilitate some of those conditions, and now those conditions are being unwound, and we are even seeing the high yields spread widening. That means financial conditions are tightening again.

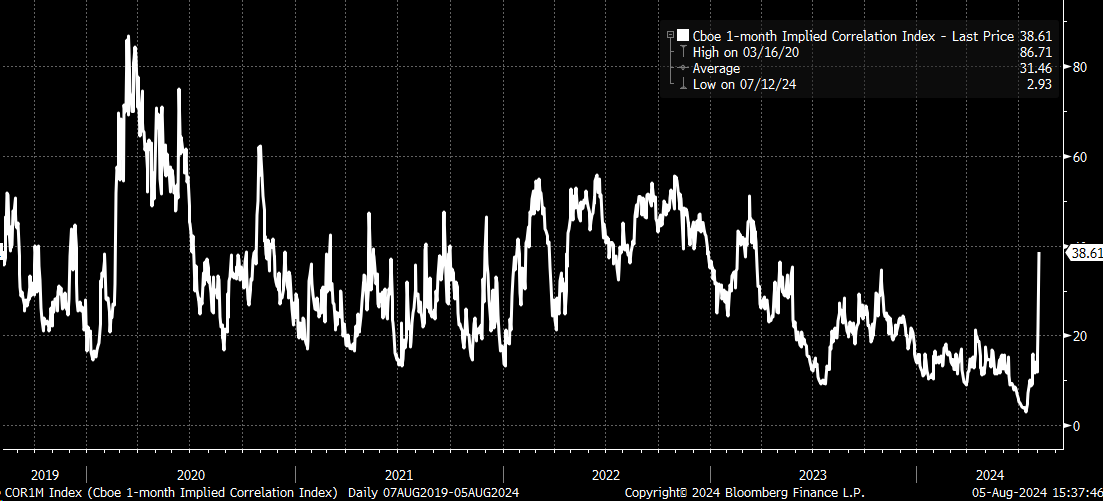

Meanwhile, volatility dispersion is well behind us, as the implied correlation index hit 38 yesterday. How dumb does that reading below three on July 12 look now?

Anyway, that is all for this abbreviated session. So, could the market bounce sometime this week? Sure. Will it feel nice, yeah, for a day or two? But the BOJ hiked rates; that’s not changing. The Fed appears intent on cutting rates at some point; that’s not changing. The higher-for-longer trade is dead. We haven’t touched on the fact that money that was flowing from bonds into stocks is now unwinding as well.