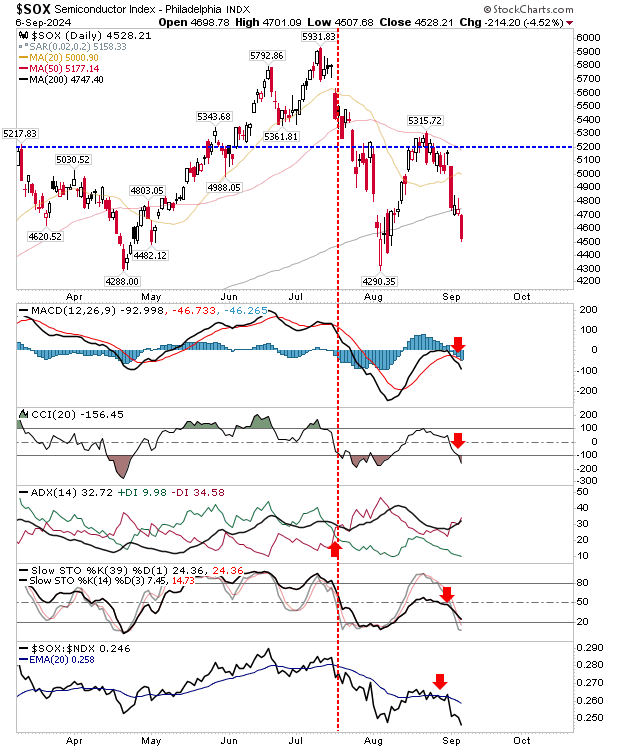

If a precedent was set by Friday's undercut of the 200-day MA in Semiconductors, then it could be a rough few weeks ahead for indexes.

The loss of the 200-day MA after such a recent test was not surprising, but given technicals are net bearish and not oversold, then the likelihood of a further support loss of the 4,290 swing low has increased.

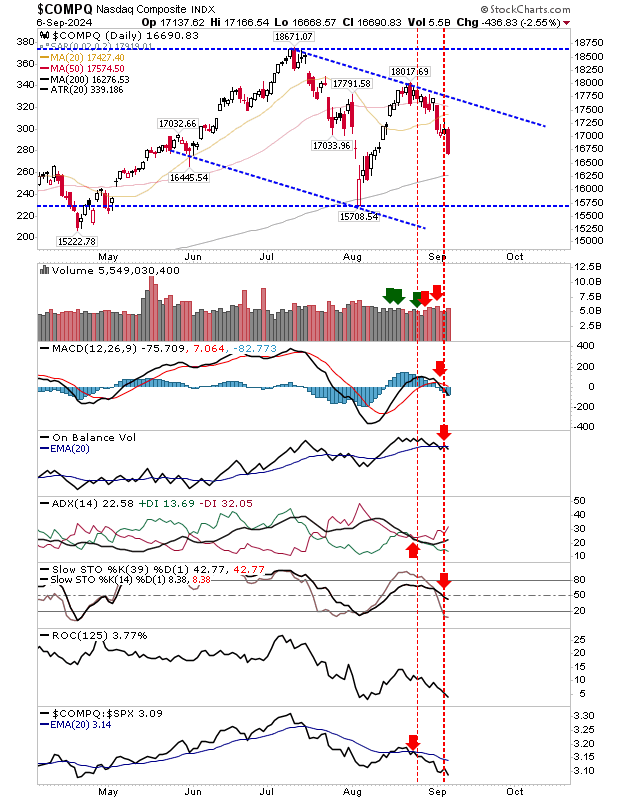

How losses in the Semiconductor Index are reflected in the S&P 500 and Nasdaq in the next couple of weeks remains to be seen, but a downward trend in Tech indexes has been established.

The mid-line of Stochastics was undercut by Friday's close, suggesting this is just the start of a decline, rather than the end of one.

Given the proximity of the last test of its 200-day MA, I would not look to the next test - if it was to occur in the coming weeks - as one likely to hold.

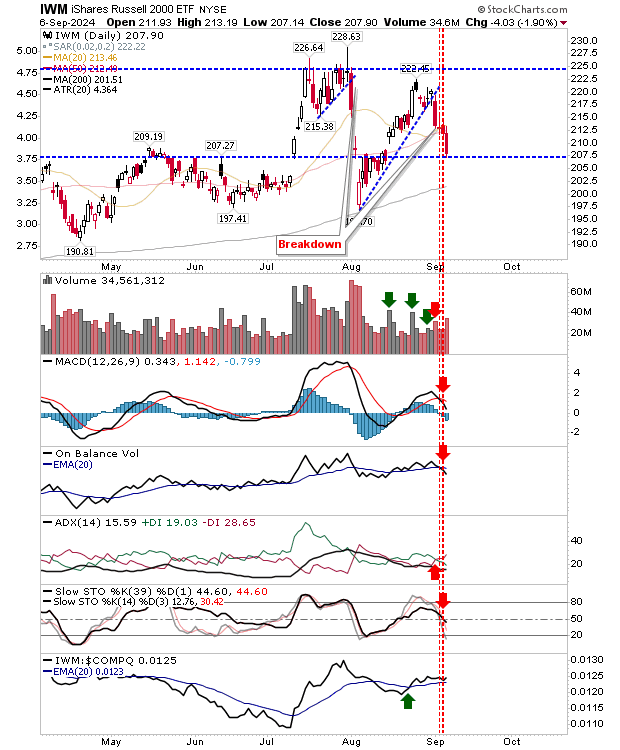

The Russell 2000 (IWM) undercut converged 20-day and 50-day MAs on higher volume distribution as it makes its way to its 200-day MA. There is a little more for help for bulls with $200 support near its 200-day MA, before April swing lows come into play.

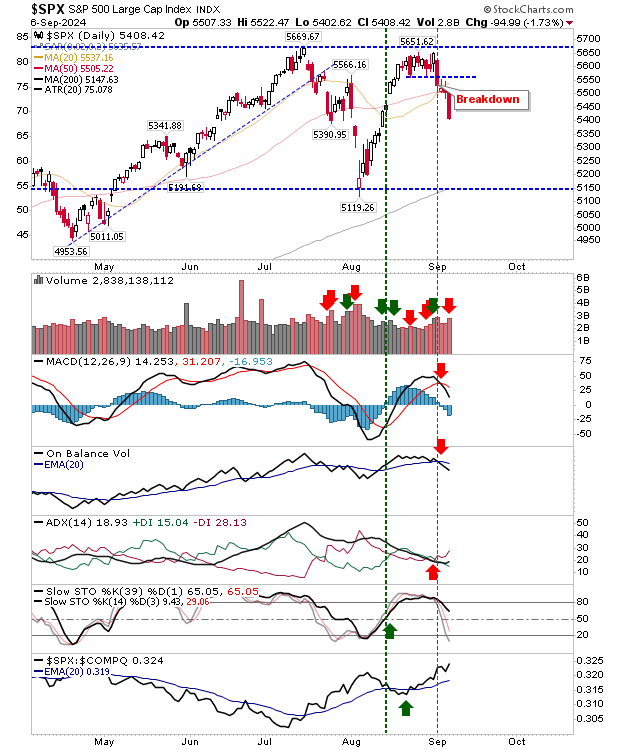

The S&P 500 also undercut its 50-day MA on bearish technicals and higher volume distribution. Unlike other indexes, there is quite a bit of room to the next support level at 5,150 (also near the current 200-day MA), plus, Stochastics are sill in bullish territory. The index is outperforming peer indexes, so if there is an index to attract buyers, then this should be it.

Much will depend on how indexes react to losses in their moving averages this week. A quick reversal (before the week is out) would be very bullish, but if things drift, then it could be a long run out to the election and end-of-year.