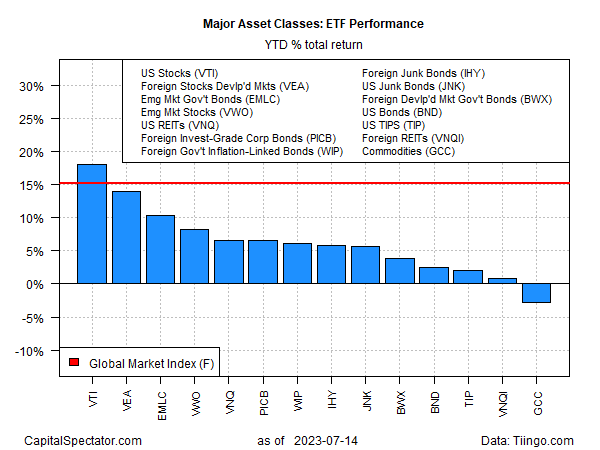

Across-the-board rallies in all the major asset classes last week strengthened year-to-date performances in markets around the world based on a set of ETFs. The downside outlier: a broad measure of commodities, which continues to post a moderate loss so far in 2023 as of Friday’s close (July 14).

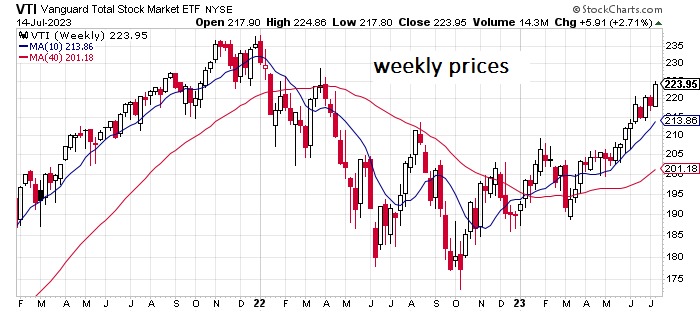

US equities remain in the lead this year. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) is up 18.1% in 2023, well ahead of the rest of the field.

“Equity strategists are boosting earnings forecasts for the S&P 500 Index over the coming year faster than they are marking them down, pushing a key indicator tracking the momentum of analyst revisions well off its November nadir,” reports Bloomberg. “After hitting negative 70% late last year, this metric — which focuses on forward earnings-per-share over 12 months — is closer to positive territory at minus 28%, according to data compiled by Bloomberg Intelligence.”

Corporate earnings could be a headwind, notes Jurrien Timmer, director of global macro at Fidelity. He advises that US stock market valuation has become increasingly “disconnected” from interest rates.

“But in more recent months, stocks have moved away from anchoring to interest rates and have been instead focusing on hopes of a recovery in earnings. This means that for this bullish pivot to be justified, earnings are going to need to come through. Currently, the consensus estimate is that S&P 500 earnings will contract by 9% in the second quarter and then bottom in the third quarter of this year before recovering in 2024. If that is correct, then the rise in stocks and increase in P/Es that we have seen since last October could be justified and could continue.”

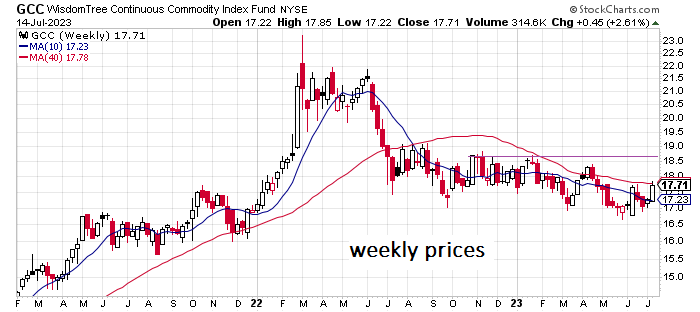

Commodities are still the downside outliers this year. WisdomTree Continuous Commodity Index Fund (NYSE:GCC) has shed 2.8% in 2023.

Some analysts advise that the worst has passed for raw materials overall. Analysts at Citibank, for example, last week predicted that commodities looked set to stabilize after this year’s decline. Catalysts supporting this outlook include weather risks, other seasonal factors, and year-to-date losses that may have gone too far.

From a technical perspective, commodities are already showing signs of stabilizing, based on GCC. The ETF has rallied off its recent low and is trading near a three-month high. But until the fund can move above its late-2022 highs – roughly 18.75 – the case will remain speculative/weak that commodities are breaking out of the flat/slightly negative channel that’s prevailed over much of the past year.