There’s no shortage of threats lurking, ranging from inflation, elevated interest rates that may go higher still, and various geopolitical threats. But market sentiment has improved recently, climbing a wall of worry and suggesting that investors are presuming that the worst has passed for the world economy, based on various ETF pairs through yesterday’s close (Mar. 6).

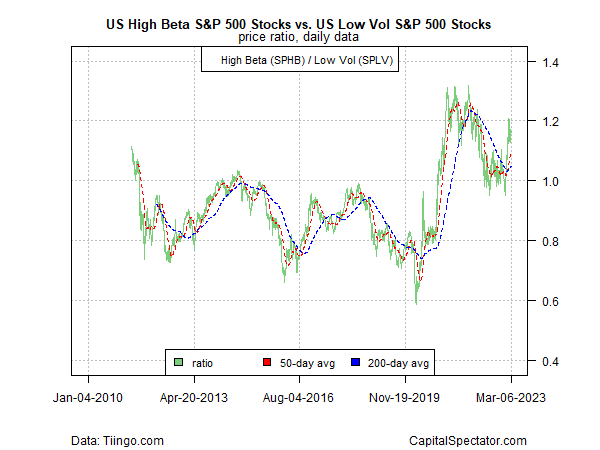

Consider the ratio between high beta US stocks (NYSE:SPHB) and their counterpart via low-volatility shares (NYSE:SPLV). This measure of appetite for risk has shot higher recently and is holding near the highest level in a year.

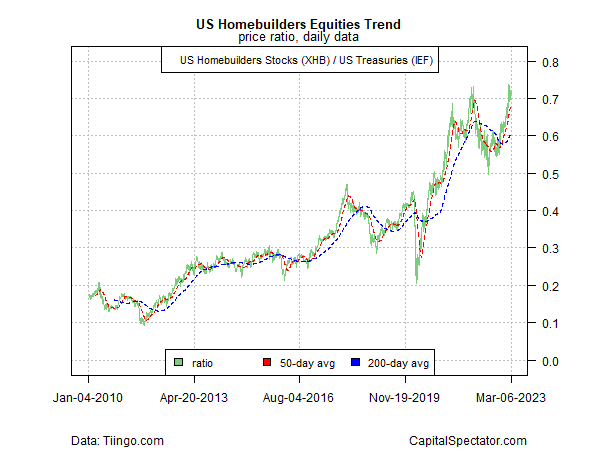

Despite the headwinds for housing, shares in the industry are also pricing in higher odds that the sector has turned a corner. Homebuilding stocks (NYSE:XHB) vs. US Treasuries (NASDAQ:IEF) have rebounded to levels that prevailed before last year’s sharp correction took the wind out of the bull market.

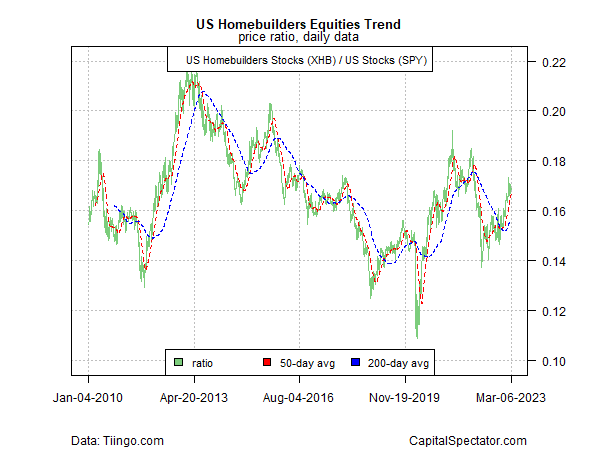

The homebuilder recovery relative to the US stock market (NYSE:SPY) overall is less pronounced, but it’s still hard to miss the bounce of late.

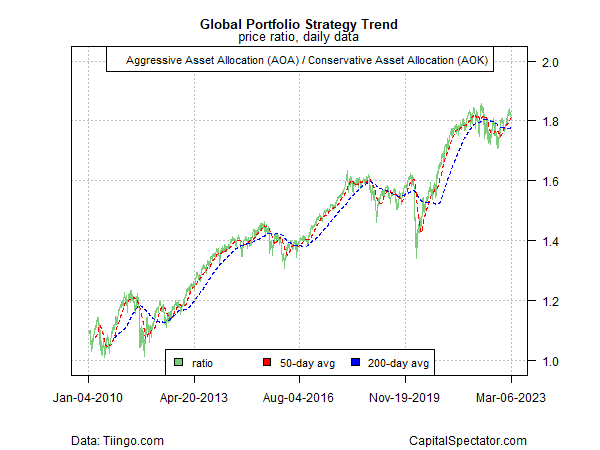

There are also signs of improving sentiment on a global basis, based on a pair of asset allocation funds.

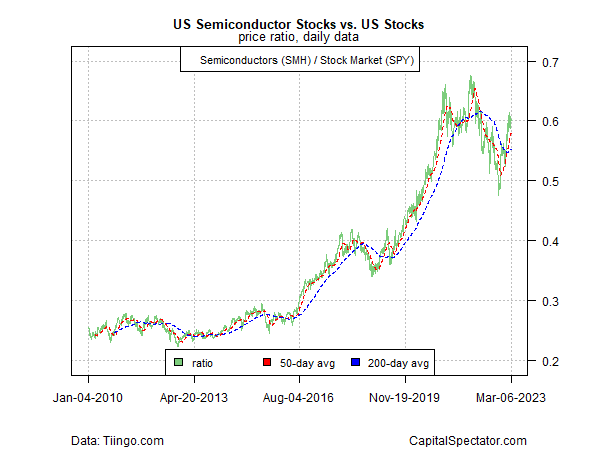

A sharp recovery in semiconductor stocks via SMH (a proxy for business-cycle expectations) relative to US shares (SPY) also hints at better days ahead.

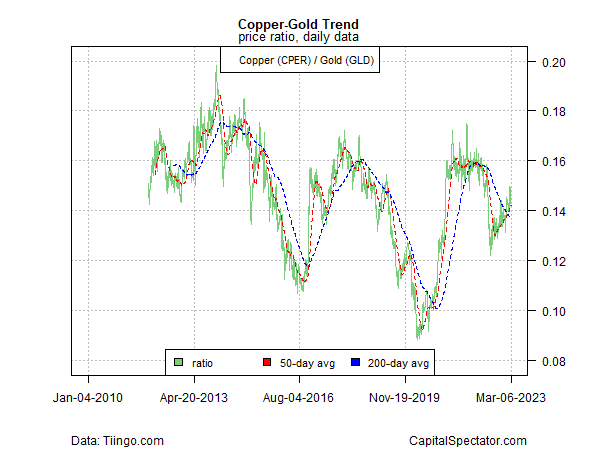

The copper-gold trend has improved, too. The assumption here is that the price of copper (NYSE:CPER) is a leading indicator for economic activity and so to the extent that it outperforms gold (NYSE:GLD), a safe haven, it’s a sign that expectations are improving.

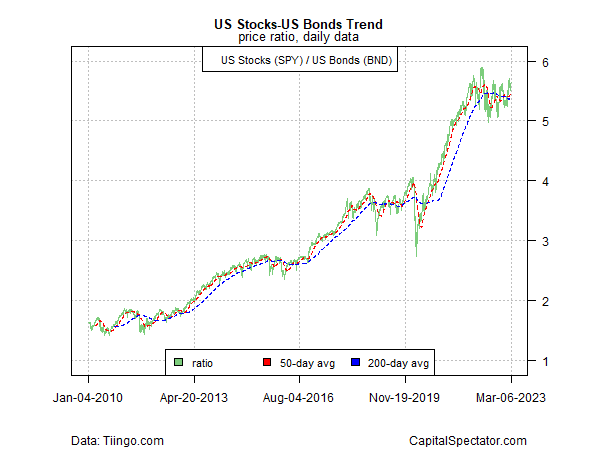

Finally, the ratio of US stocks (SPY) vs. US bonds (NASDAQ:BND) continues to hold well above its recent low, which suggests that the risk appetite has improved significantly after taking a beating last year.

The question is whether the recovery in sentiment is more than a bounce off of extreme bearish conditions or the start of new bull market? Until several of the ratios above break decisively higher and hold above previous highs, it’s premature to assume that the aftershocks of 2022 are ancient history and that something better than a trading range awaits in the near term.