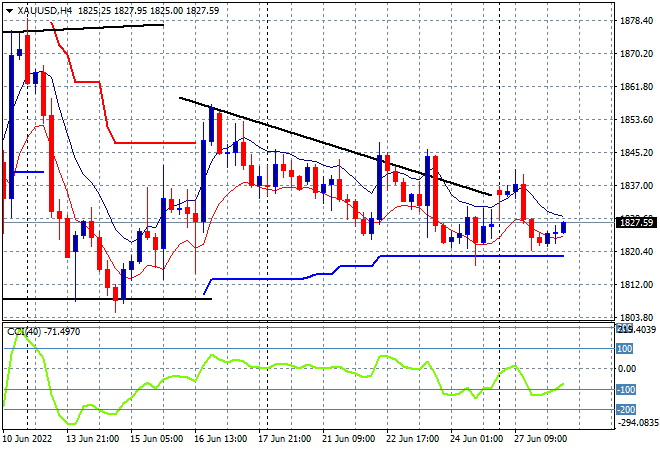

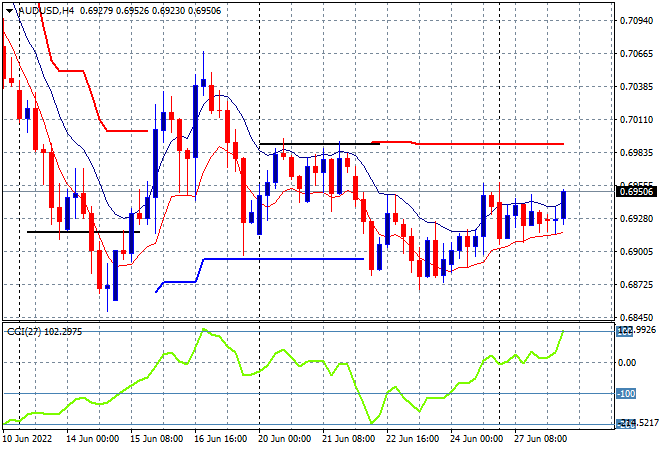

Asian share markets continue to do well with risk sentiment firming despite pullbacks on Wall Street overnight. The USD is weakening a little against most of the undollars, with the Australian dollar trying to push a little higher above the 69 mid level. Oil prices are trying to stabilise after their falls on Friday night with Brent crude now pushing above the $112USD per barrel level while gold is still really struggling to make headway here, still quite depressed at the $1820USD per ounce level:

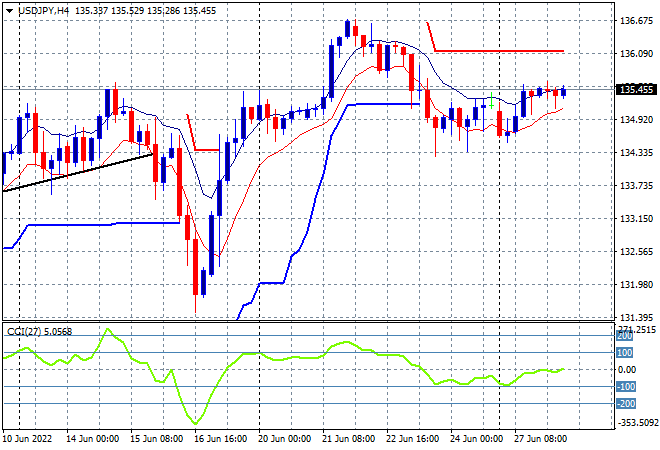

Mainland Chinese share markets are again pusher higher into the close with the Shanghai Composite up more than 0.5% to 3397 points while the Hang Seng Index is steadying with a 0.4% gain, currently at 22317 points. Japanese stock markets are also doing well, with the Nikkei 225 index closing 0.6% higher at 27049 points while the USDJPY pair is remaining fairly depressed, hovering at its Friday session lows just above the 135 handle:

Australian stocks put in some outsized gains with the ASX200 finishing more than 0.8% higher, closing at 6763 points. The Australian dollar is still trying to find a bottom here, having been depressed below the 70 cent level against USD all last week, with a strong session this afternoon pushing it above the 69.50 cent level, possibly making another run at the 70 handle tonight:

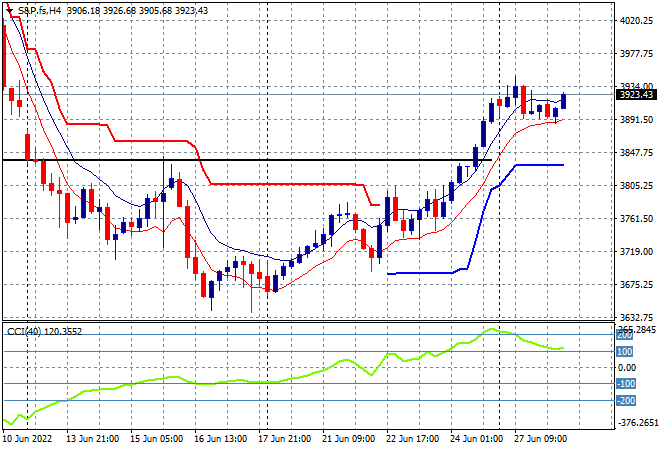

Eurostoxx and Wall Street futures are holding steady going into the European open, with the S&P500 four hourly futures chart showing price action wanting to launch from this holding position above the 3900 point level with a bullish inverse head and shoulders pattern now complete:

The economic calendar includes a slew of speeches from ECB and BOE bankers, followed by German consumer confidence and US house prices.