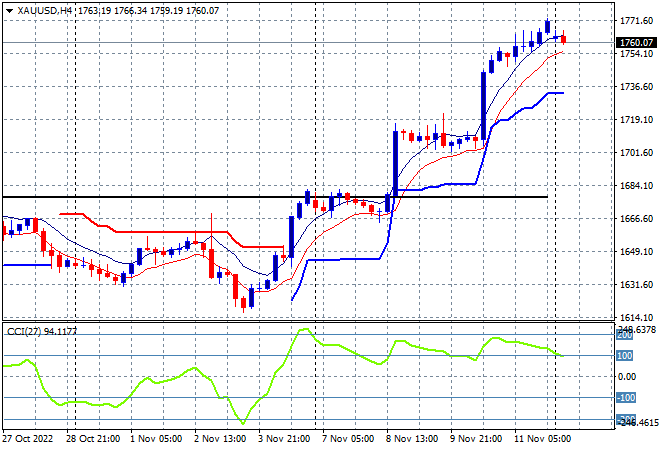

Asian stock markets are having a mixed start to the trading week with mixed reactions to the finish on Wall Street on Friday night and the over exuberance in USD selling. In fact, most major currencies have gapped fairly lower this morning in response to the big surge in undollars on Friday night , with Euro getting back above the 1.03 level while the Australian dollar moved below the 67 cent level. Oil prices are still looking weak however with Brent crude just above the $95USD per barrel level while gold is surprisingly holding on to its recent big surge, currently at the $1760USD per ounce level:

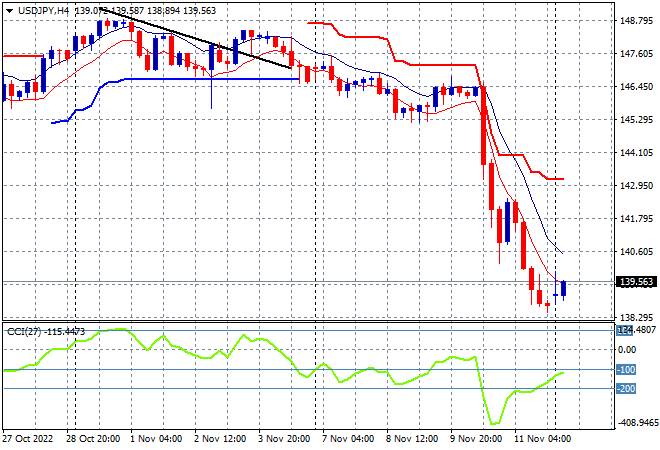

Mainland Chinese share markets are more modest with the Shanghai Composite looking to finish up slightly at 3093 points while the Hang Seng Index is still surging, currently up more than 2% at 17783 points. Japanese stock markets are the biggest losers in the region, with the Nikkei 225 closing 0.8% lower at 28037 points, while the USDJPY pair has gapped slightly higher this morning after its epic slump last week, trying to stabilise but looking very weak at just below the 140 handle:

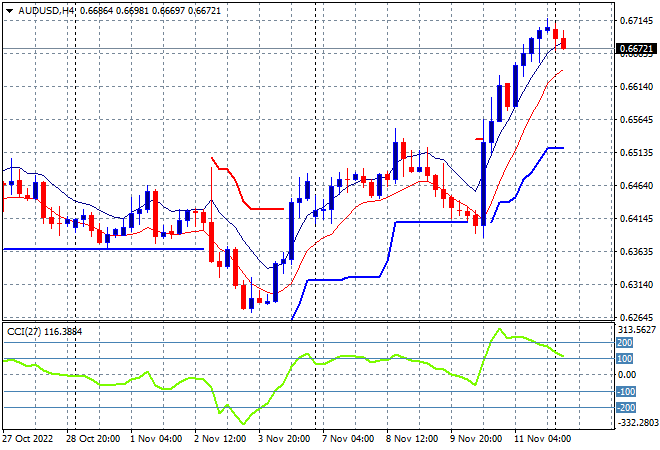

Australian stocks treaded water today with the ASX200 closing 0.2% lower, finishing at 7146 points. The Australian dollar also gapped lower, pulling back from the 67 handle after getting ahead of itself on Friday night with the four hourly chart still putting former resistance at the October high position behind it:

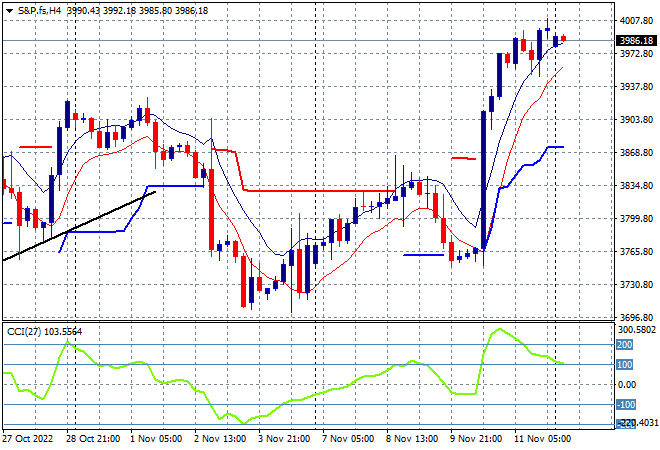

Eurostoxx and US futures are wanting to build on last week’s gains but are finding some buying fatigue here, with the S&P500 four hourly chart showing price action contained just below the 4000 point level:

The economic calendar starts the week with a whisper rather than a bang with some tertiary level industrial production numbers from Europe and not much else.