In retail, employees are often told that the consumer is always right. While this isn’t always true, it is a reminder that patient customer service usually wins the day.

In investing, it also appears that the consumer is always right. But it depends on which consumer.

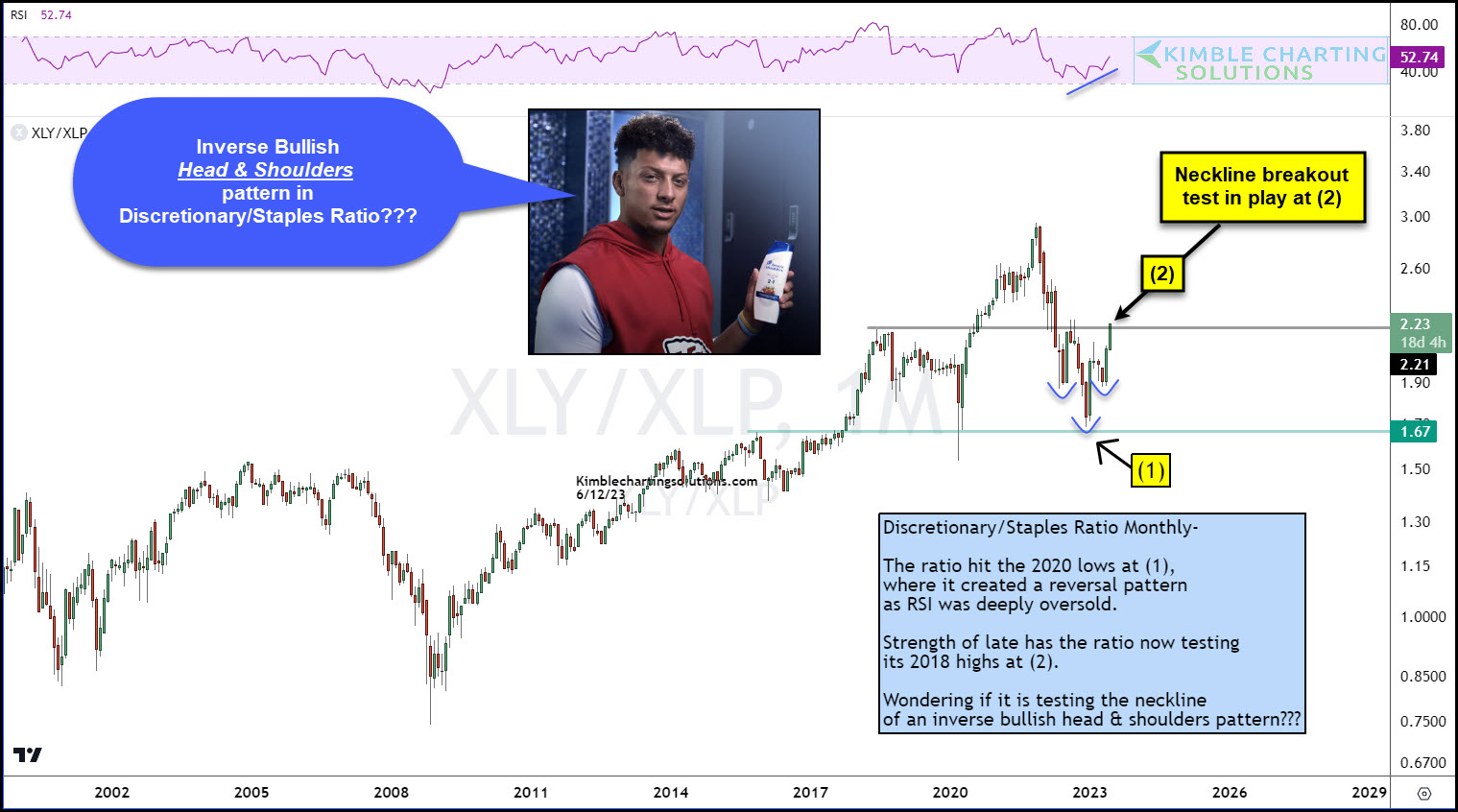

In today’s chart we highlight a key consumer ratio over a long-term “monthly” timeframe: the Consumer Discretionary Select Sector SPDR Fund (NYSE:XLY) to the Consumer Staples Select Sector Fund (NYSE:XLP).

Since Discretionary represents bullish additional spending and staples represent bearish essential spending, it is important for bulls to see this ratio heading HIGHER.

Looking at the chart, we can see that the XLY/XLP ratio formed a low near the 2020 low at (1) and is showing strength while testing the 2018 and 2022 highs at (2). The price action has formed a bullish inverse head & shoulders pattern that is testing resistance at the neckline.

This appears to be a big test for the XLY/XLP ratio at (2). A breakout here would be HUGE for stock market bulls. Stay tuned!