Australian households spent 0.7% less in July '23 compared to '22, the first annual decline since February 2021.

- Australian household spending dropped 0.7% over the twelve months to July.

- Discretionary spending was down 3.3%, the biggest annual drop since October '2020.

- Spending on services was up 2.4%, lending weight to the suggestion service price inflation could mean more rate hikes in the coming months.

Discretionary spending dropped 3.3% throughout the last 12 months as Aussies responded to tough economic conditions by curbing spending.

Non discretionary spending still grew by 1.7%, but again, this is the lowest annual increase since early 2021.

The Northern Territory saw the biggest decline to spending, dropping 6.7% in the 12 months to June, with declines also recorded in NSW, Victoria and Tasmania.

The overall drop in spending lends further weight behind the expectations of most economists that the RBA will once again hold rates steady at 4.10% in tomorrow's monetary policy meeting.

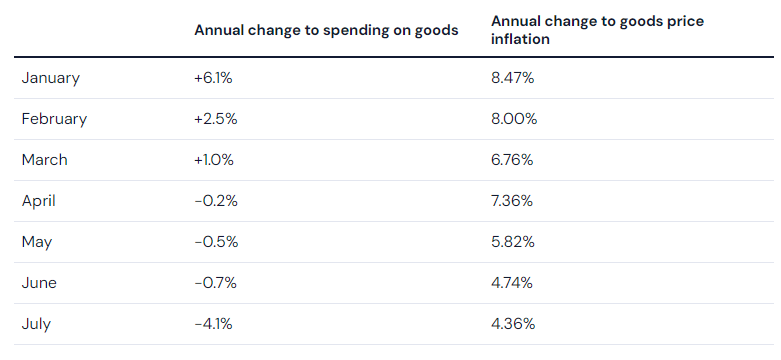

Goods spending saw the largest decline since July '21, dropping 4.1%, which corresponds with goods price inflation steadily dropping since the start of the year according to the CPI indicator.

Services spending still a friction point for RBA

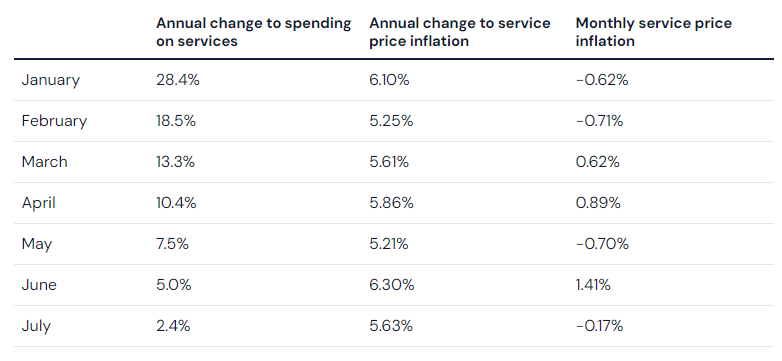

For any mortgage holders anxiously trawling through the data trying to figure out the chances of a thirteenth rate hike tomorrow, the annual growth to spending on services was likely a point of interest.

All of the big four banks, as well as the ASX RBA market tracker are in agreement that we are very unlikely to see a rate hike tomorrow, with Westpac, CommBank and ANZ all believing the current rate of 4.10% will be the peak.

NAB economists though, still apprehensive about service price inflation, have refused to rule out one last 25 basis point hike.

NAB's Tapas Strickland said the RBA's inflation forecasts appear 'too conservative' given large price increases in some service sectors.

"[Insurance prices] have seen increases of 15-20%, and those increases are going to be continuing through the rest of the year." Mr Strickland said.

"It's the same story with the telecommunications industry...there are definitely some acute inflationary pressures still to come in Australia, and that's the reason why we think the RBA forecast of getting inflation back to 3% by mid 2025 is going to be challenged over the next couple of months."

In July, spending on services increased by 2.4%, driven by increased spending on health, transport and miscellaneous services.

This is the slowest annual growth since February 2021, where the reference period was affected by Covid lockdowns, with spending on services steadily declining throughout this year.

However, service price inflation has proved harder to shift, continuing to sit near 6% despite the slowdown in spending.

CPI service price inflation from July '23 to '22 was 5.63%.

On a monthly basis, the ABS observed a 0.17% deflation in service prices from June to July, but this was also the case in January, February and May, after which prices increased again.

"Household spending drops for the first time in two and a half years" was originally published on Savings.com.au and was republished with permission.