The recent failure of two US banks, SVB and Signature, have understandably triggered a major re-appraisal of Fed tightening prospects. This has seen two-year EUR/USD swap rate differentials move to the narrowest levels since October 2021. One could expect EUR/USD to be trading substantially higher than this, but risk sentiment is likely holding it back

Market Is Close to Pricing the Fed Tightening Cycle as Over

In a complete U-turn from its reaction to hawkish Powell testimony last week, markets today struggle to price one further 25bp hike from the Fed. This is a far cry from last week's +75-100bp of extra tightening. The re-pricing of the Fed is understandable as US authorities struggle to put a floor under the evolving banking crisis. Indeed, the KBW Regional Banking index is off another 10% today – not what authorities wanted to see after promising at the weekend to make all depositors whole and introducing new liquidity provisioning schemes.

This dramatic re-pricing of the Fed cycle has outpaced anything seen amongst European monetary cycles and delivered a huge narrowing in two-year EUR/USD swap differentials. Normally, rates at the short end of the curve are solid drivers of exchange rates (signifying the path of respective monetary policy).

The sharply narrower spread would be expected to drive EUR/USD a lot higher. EUR/USD has turned around from its 1.0525 lows seen last week, but what stops it from trading substantially through 1.08? We think a look at the key short-term drivers of EUR/USD provides the answers.

Equities Have Out-Shadowed Rate Differentials as EUR/USD Drivers...

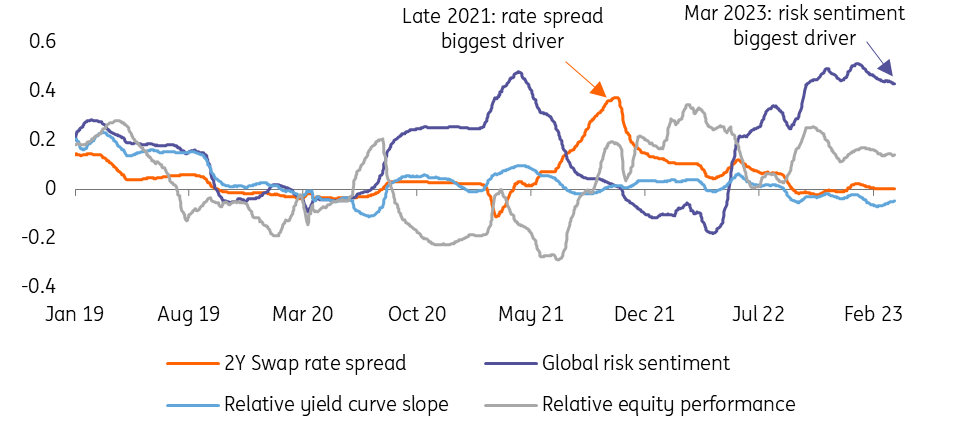

Our financial fair value model takes into account an array of market factors to estimate mis-valuation in FX in the short term. A closer look at the swings in the coefficients of the EUR/USD model helps us understand why the pair has been capped despite falling US rates.

In late 2021, the last time the two-year swap spread was as narrow as 80-90bp, EUR/USD was trading around 1.15. However, short-term rate differentials back then were the single most important driver of EUR/USD (chart below). At the same time, the coefficient of two-year swap spreads is now very close to zero, meaning that even a very large move in the spread statistically implies only a small move in EUR/USD. And this is exactly what we are observing now.

Rolling Betas of Our EUR/USD Short-Term Fair Value Model

Source: ING

At the moment, equity factors – both global (i.e., risk sentiment) and relative (i.e., the performance of European equities versus US equities) – are steadily on the driver’s seat when it comes to EUR/USD. Risk sentiment, in particular, determines the majority of the pair’s moves: that’s probably because we’re at the end of a unique business cycle, and investors are more fearful about stagflation and central bank over-tightening than they are about relative yield differentials.

…But a Clean EUR/USD Rally Is Possible

The fact that EUR/USD cannot benefit from the large move in its favor in the short-term rate differential does not intrinsically exclude a short-term EUR/USD rally though. The conditions for such a rally would simply be different.

A Fed nod to markets can trigger a clean EUR/USD rally

At the moment, markets are speculating on a Fed’s U-turn but are equally pricing in a greater degree of contagion in the banking sector turmoil, which is ultimately weighing on risk sentiment and preventing EUR/USD to break higher. This does not appear like a sustainable environment: markets will either receive a nod or disapproval by the Fed when it comes to a sudden re-calibration of the tightening path to ease systemic financial risks. Should the Fed accommodate market hopes, there would be ample room for market sentiment to rebound, as risk assets would benefit from the combination of significantly lower rate expectations and systemic financial risks being priced out. That is what a clean EUR/USD positive scenario would look like.

Our Base Case: A Moderately Bullish Bias for EUR/USD

As discussed in our ECB market preview, the recent developments suggest the impact of this week’s ECB announcement and press conference on EUR/USD may be less pronounced and short-lived than the February meeting. In other words, if the positive scenario highlighted just above materializes, the ECB would take a very big dovish surprise to prevent a EUR/USD rally.

Drawing a base case in such a noisy market environment is not easy. As we said, the Fed's role is key: central bankers, just like governments and market participants, are still fully assessing the effective health of the US and global financial sector.

The size of a EUR/USD rally depends on the Fed's "overreaction

Based on the information we have at the time of writing, we would expect at least some unwinding of the recent hawkish rhetoric by the Fed, which could help stabilize sentiment and translate into a stronger EUR/USD. In our view, the size of a EUR/USD rally entirely depends on the Fed’s “overreaction” to the recent turmoil. For now, we target 1.08-1.09 by the end of this week.

In the rest of the G10, expect other safe-haven currencies (CHF and JPY) to remain in demand until the Fed has effectively restored confidence. After that point, here AUD and NZD remain the two currencies that can probably offer the best combination of fundamentals in a risk-on rally, thanks to exposure to China and undervaluation. CAD’s vicinity to the US financial turmoil means it could lag other high-beta currencies.

Disclaimer: This publication has been prepared by ING solely for information purposes, irrespective of a particular user's means, financial situation, or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal, or tax advice, or an offer or solicitation to purchase or sell any financial instrument. Read more