By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

After getting a taste of the dangerously wild swings this week, investors continued to take profits and unwind their high-beta trades, driving the U.S. dollar and Japanese yen higher in the process. Part of that had to do with the wild intraday swings in the Dow, which was up more than 400 points in early NY trade but ended the day up only 80 points. The simultaneous consolidation in USD/JPY and slide in the euro and Canadian dollar confirm that traders were still liquidating into Wednesday’s rally. Many major currencies enjoyed strong moves over the past month and the recent volatility was a much needed wake up call. As we mentioned in Tuesday’s note, investors won’t return with the same enthusiasm and so far, in the FX market, they haven’t returned at all because U.S. yields continued to rise. There were no U.S. economic reports released Wednesday but we heard from a few Federal Reserve officials. FOMC voter Dudley dismissed the latest decline in stocks, describing it as not “that big of a bump.” He said it has no consequence to the economic outlook and would not impact his view unless it was sustained. This same sentiment was shared by Kaplan and while Evans did not touch on policy, he said the U.S. economy is firing on all cylinders and he’d support further tightening if inflation picks up. Neither is a voting member this year but Bostic who is, sees slow and gradual rate rises if growth remains robust. The dollar also received a boost from the 2-year Senate budget deal. It still has to pass the House but it will achieve the goal of avoiding a government shutdown. With no major U.S. economic reports scheduled for release on Thursday, the dollar will take its cue from risk appetite.

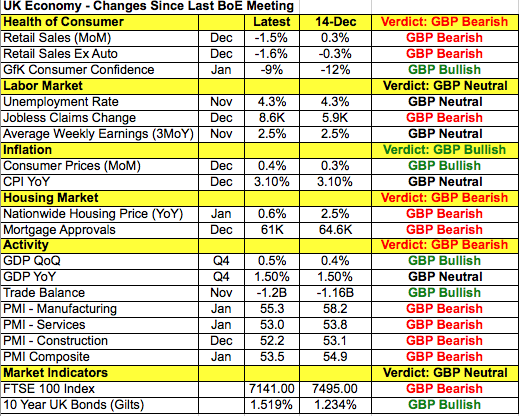

The Bank of England’s monetary policy announcement and Quarterly Inflation Report are the most important events this week. The BoE raised interest rates toward the end of last year and investors want to know when it will tighten again. At its last meeting, there was no mention about timing, but the Monetary Policy Committee likes to provide guidance with the Quarterly Report. Unfortunately there’s very little reason for the central bank to rush to tighten. Since the last meeting in December, manufacturing-, service- and construction-sector activity slowed. Although inflation ticked up, retail sales fell sharply. More importantly, GBP is up 5% against the dollar and 10-year Gilt yields are up 25bp since the last meeting, making financial conditions more difficult. Sterling's recent strength should also drive price pressures lower. While we believe that the general tone of the Quarterly report should be upbeat, the central bank will stress that inflation has peaked. How sterling reacts will depend on any forecast change and Carney’s comments. If the tone of the Quarterly Report is generally upbeat with upgraded forecasts for growth and little emphasis on downside risk (suggesting that another hike is on its way), GBP/USD will find its way back to 1.4150. However if the Quarterly Report falls short and BoE Governor Carney is not as hawkish as investors are hoping, GBP/USD could sink down to 1.3775.

Meanwhile the market completely ignored Angela Merkel’s coalition deal with the Social Democrats (SPD). This political win should have been overwhelmingly positive for EUR/USD but instead of rallying, the pair dropped below 1.23 for the first time in 2 weeks. The problem is that the agreement still needs to be approved by the SPD’s 460K members in a postal vote in the coming weeks and their support is not a done deal. A decline in German industrial production also added pressure on the currency. The impact of Thursday’s trade and current-account balances will be limited as the euro takes its cue from the market’s appetite for sterling and U.S. dollars. Thursday is a big day for EUR/GBP, which could either take off or reinforce the peak at 89 cents. The next support level in EUR/USD is 1.22.

The New Zealand dollar dropped like a rock on the back of the Reserve Bank’s monetary policy announcement. Although the RBNZ left interest rates unchanged, it surprised the market by lowering its GDP forecasts to 0.8% from 1.2% for the first quarter. This is a material change driven by concerns that the net impact of government policies will be less than expected. Although the bank still sees tight labor-market conditions, subdued growth and inflation, the data suggests it won’t be looking to raise interest rates anytime soon. As for the currency, RBNZ acknowledged that it has strengthened but attribute the gains to U.S. dollar strength and its projections assume that it will weaken going forward. With that in mind, in the press conference acting governor Spencer dismissed NZD strength saying it hasn’t moved too much and he's not concerned about its level. The Australian and Canadian dollars ended the day lower against the greenback as traders overlooked stronger data. Faster-than-expected construction-sector growth failed to stem the slide in AUD/USD while USD/CAD extended higher despite a stronger rise in building permits. Both currencies were affected more by the slide in commodity prices and the continued unwinding of risk than data, which will continue into Thursday with AUD likely to shrug off its business confidence report and CAD traders looking past housing data. China’s January trade balance report was due Wednesday evening and the results could have a short but significant impact on AUD and NZD.