The US dollar gained against most of the major currencies last week. A notable exception was the Japanese yen. Steep equity losses and a drop in bond yields provided the yen with the customary fillip.

The various economic reports, including the August jobs data and the volatility of the stock market, left Fed expectations unchanged. The September Fed funds futures contract closed at 99.83 (implying a 17 bp effective average Fed funds rate this month). It has closed there each of the past three weeks.

It is clear that the prospects of a rate hike by the Fed later this month have become somewhat murkier due to the volatility of financial markets and potential global headwinds. However, the divergence theme, which in our assessment is the main driver of this, the third dollar bull market since the end of Bretton Woods, was not tied to the precise timing of the Fed's lift-off.

The divergence was driven by both sides of the equation—other areas, including continental Europe, Japan, China, and many emerging market countries easing policy, as well as the eventual start of the normalization of US monetary policy. This theme remains very much intact, despite some fears that the US was slipping back into a recession and some high-profile calls for another round of asset purchases (QE4).

The dollar's technical tone is mildly constructive. The five-day moving average of the Dollar Index is about to cross above the 20-day average for the first time since August 12. The RSI is neutral though the MACDs are pointing higher. Initial support is seen just below 96.00. A move above 97.00 is required signal gains toward the upper end of the three-month range near 98.00.

The euro finished the week with two consecutive closes below the 20-day moving average for the first time in a month. The euro's five-day average crossed below the 20-day average. With the week's losses, the euro has completely reversed the gains scored amid the large position unwind spurred by the mini-devaluation by the PBOC. There is a band of support between $1.1000 and $1.1030. Without more clarification of the September FOMC meeting, it may be difficult to sustain a break of this area. On the topside, initial resistance is seen near $1.1180 and $1.1240.

The role of the yen as a financing vehicle (ie funding currency) rather than a flight destination for global investors to the Japanese bill market, as is the case for the US, helps account for the yen's strength during chaotic market episodes. With steep equity losses before the weekend, and the prospects of more volatility from China—which re-opens after being closed September 3-4—leaves the dollar vulnerable to additional losses. These concerns likely outweigh the prospects of additional easing by the BOJ, which many continue to see as likely as early as next month.

The dollar could slip back to JPY118, if not a little further. The lower Bollinger® Band is near JPY117.55. We suspect the spike to JPY116.20 on August 24 is unlikely to be repeated given the significant clearing of positions that have already been seen. Resistance is pegged in the JPY120.20-JPY120.50 range.

Sterling has fallen for nine consecutive sessions against the US dollar. This is the longest losing streak since 2008. Over this period, it has depreciated 4.1% or 6.5 cents. It overshot our $1.5200 target, and finished a touch below the lower Bollinger Band (~$1.5177). Although it appears over-extended, there is no compelling technical evidence that a low has been reached. The next target is in the $1.5080 area.

Sterling has fallen against the euro for five consecutive weeks. This is the longest such streak since September 2012. Technically, the euro seems close to peaking, but there appears to be nothing from a technical perspective preventing another test on the GBP0.7400 area.

The five-day moving average crossed below sterling's 20-day moving average on August 28. The Swiss franc's averages, like the euro's crossed before the weekend. The acceleration of deflation in Switzerland reported late last week underscores the risk of more action by the SNB. The -1.2% year-over-year rate reported for August on the harmonized calculation, matches the cyclical low set in February 2012 and June 2013. The national measure stands at -1.4%, the lowest since 1959.

Technical factors are constructive for the dollar against the franc. Both the RSI and MACDs are moving higher. The initial hurdle comes in near CHF0.9800 and then CHF0.9860. Given the technical condition of the euro outlined above, and the dollar-franc outlook, it suggests potential for the euro-franc cross to return to the post-cap highs near CHF1.0960.

The dollar-bloc currencies remain weak. Between the impulses from the slowing of China, the surplus of oil being produced, and the prospects of a Fed hike, further losses are likely. The Australian dollar has convincingly broken the multi-year trend line on the monthly charts going back to 2001. That trend line is found near $0.7025, and previous support becomes resistance. While $0.6500 may have psychological importance, nothing stands out on the charts until $0.6000.

The volatility has widened the range for the Canadian dollar, but it has not changed the fact that it is trading broadly sideways. Even the modest narrowing of the premium that the US pays over Canada to borrow money for two years has been unable to generate much of a recovery in the Canadian dollar. The smaller than expected trade deficit provide a short-term lift, but this was not sustained. The US dollar has built a shelf near CAD1.3120. The top end of the range is seen around CAD1.3320. The RSIs are turning up. The MACDs have been trending lower since late July and have not been particularly useful

The October light sweet crude oil futures contract closed higher for the second consecutive week. The high for the week was set on Monday just below $49.35. The 50% retracement of the slide since the June 24 high near $61.60 was found near $49.65 Monday also saw the five-day average cross above the 20-day average for the first time since last June. As long as inventories are still seasonally high and still rising, we think prices have not fallen to a level that will bring supply and demand into more reasonable balance. However, technically, it appears more likely to see a retest on the highs than a return to the lows in the coming days. A move above $47.65 may be an early signal such a move. A break of $43 would likely signal the end of the correction.

US 10-Year bond yields began last week on their highs and finished on their lows. It was the first close since August 25 below the 200-day moving average (~2.125%). The downside risk extends toward 2.00-2.02%. We look for Chinese reserve figures due out early in the week ahead to lend credence to our suspicions that its sales of Treasuries have been exaggerated.

Nor do we find compelling that official use of custodians in Belgium or Switzerland has somehow concealed a larger decline in reserves than the official data reveals. Our argument, following Occam's Razor (simpler solution is preferable), is that the roughly 2/3 decline in China's reserves over the year has been a function of valuation. It makes no sense simply repeating the decline in reserves as if it represents quantities instead of prices. Some of the remaining declines may be explained by transfers to other government arms, such as the China Development Bank.

It does seem clear that some capital has left China. However, as we have argued, a good part of the so-called internationalization of the yuan has been Sino-ification of Hong Kong Flows out of mainland China which have gone to its Special Administrative Region, Hong Kong, This has driven the Hong Kong dollar to the top of its band and compelled the HKMA to intervene.

After closing near its highs last week, the S&P 500 traded lower at the start of the week but seemed to find better traction after the Chinese markets closed for the extended holiday. However, the selling pressure resumed before the weekend. The technical indicators and price action do not give reason to pick a bottom yet. A break of 1900 would signal a test, and possible penetration, of the 1867-1872 lows seen last month.

A word about a couple of other markets that we often don't include in this weekly technical note, but given circumstances, may also be particularly interesting. The German DAX is vulnerable from a technical perspective. A break of 9930 now warns of a re-test on its August 24 spike low near 9338. This would jeopardize the four-year uptrend on the weekly bar charts. A spike lower opening on Monday is a distinct possibility given the weak close and the steep decline of the US market.

Chinese markets were closed last Thursday and Friday. The closing price of the S&P 500 on Tuesday, September 1 was the last price to which Chinese traders could respond. It was slightly below 1914. The S&P 500 finished this week little higher than this at 1921. A return of some semblance of stability in China may go a long way toward helping stabilize global equities, even if the channel is primarily psychological and less financial. The initial obstacle is seen near 3235 on the Shanghai Composite. Above there is a gap between roughly 3388 and 3490 that could draw prices. On the downside, a break of 3000 warns of a retest on the recent low near 2850, and possible 2800.

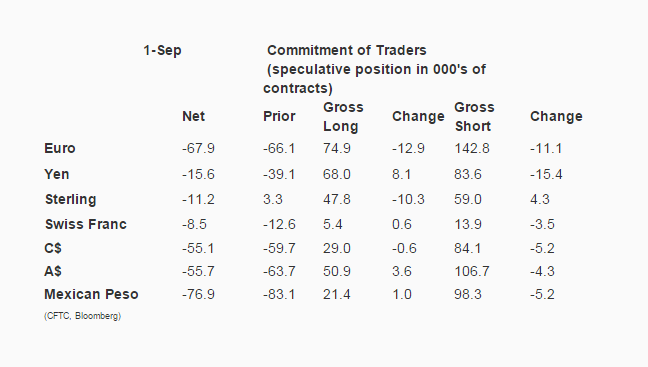

Observations based on speculative positioning in the futures market:

1. There were four significant (10k or more contracts) gross position adjustments in the CFTC reporting week ending September 1. Both gross long and gross short euro positions fell by more than 10k contracts. The gross longs were cut by 12.9k contracts (to 74.9k), and 11.1k gross short contracts were covered (leaving 142.8k shorts). Gross yen shorts reduced by 15.4k contracts to 83.6k. The gross long sterling position was slashed by 10.3k contracts to 47.8k.

2. The sharp reduction of sterling longs and a modest (4.3k) increase in gross short positions saw the net position swing back to the short side (11.2k contracts) from 3.3k net long in the prior period.

3. The general pattern was for speculators to reduce gross short positions. The only exception was sterling. Speculators mostly added to gross long positions, but two of the three exceptions were substantial (euro and sterling, which we have already discussed), and the third, the Canadian dollar was minor (-600 contracts).

4. The speculative net short euro position peaked in late March at 227k futures contracts. It is just below 68k contracts as of September 1. What happened? The gross long position has risen almost 40k contracts to 87.8k in late August. The gross short position peaked in late-May near 271k contracts. It stands at 142.8k as of September 1. This means that in terms of the net position adjustment short-covering accounts for roughly three-quarters of the change.

5. For the first time since mid-July, the net speculative position in the US Treasury market is short (2.8k contracts). This was a result of the bulls pressing by adding 16.9k contracts (to 412.2k) into the rally. The bears sold into that rally, adding 21k contracts to the gross short position (now 415k contracts).

6. The net long speculative light sweet crude oil futures position increased by 4.8k contracts to 220.3k. Bulls and bears both found reasons to act. The bulls added 13k contracts to their gross long position, lifting it to 487k contracts. The bears grew their gross short position by 8.2k contracts; now having 266.8k contracts.