- U.S. equities dominate portfolios as 2025 approaches, but could Europe make a comeback?

- Wall Street’s focus on U.S. stocks remains strong, but tech-heavy gains drive the gap with Europe.

- Despite a stellar 2024, Europe still trails as the U.S. benefits from AI-driven momentum.

- Discover the top stocks poised to benefit amid the stock market's surge using InvestingPro's powerful tools - now up to 55% off amid the Extended Cyber Monday offer!

As we head into 2025, the U.S. stock market remains Wall Street’s clear favorite for investment, continuing the trend of the past few years. But could European stocks finally make a play for the spotlight?

Wall Street’s focus is unmistakable. According to Bank of America’s latest survey of mutual fund managers, U.S. equities dominate, now accounting for 36% of portfolios—the highest allocation in 25 years.

Meanwhile, managers have slashed liquidity levels to just 3.9%. With a significant shift toward financial stocks, their focus is on U.S. markets, while European equities and emerging markets take a backseat.

The reasons? Despite Europe’s solid performance, especially in 2024 (with the notable exception of the French CAC 40), many on Wall Street still believe that the U.S. will outperform.

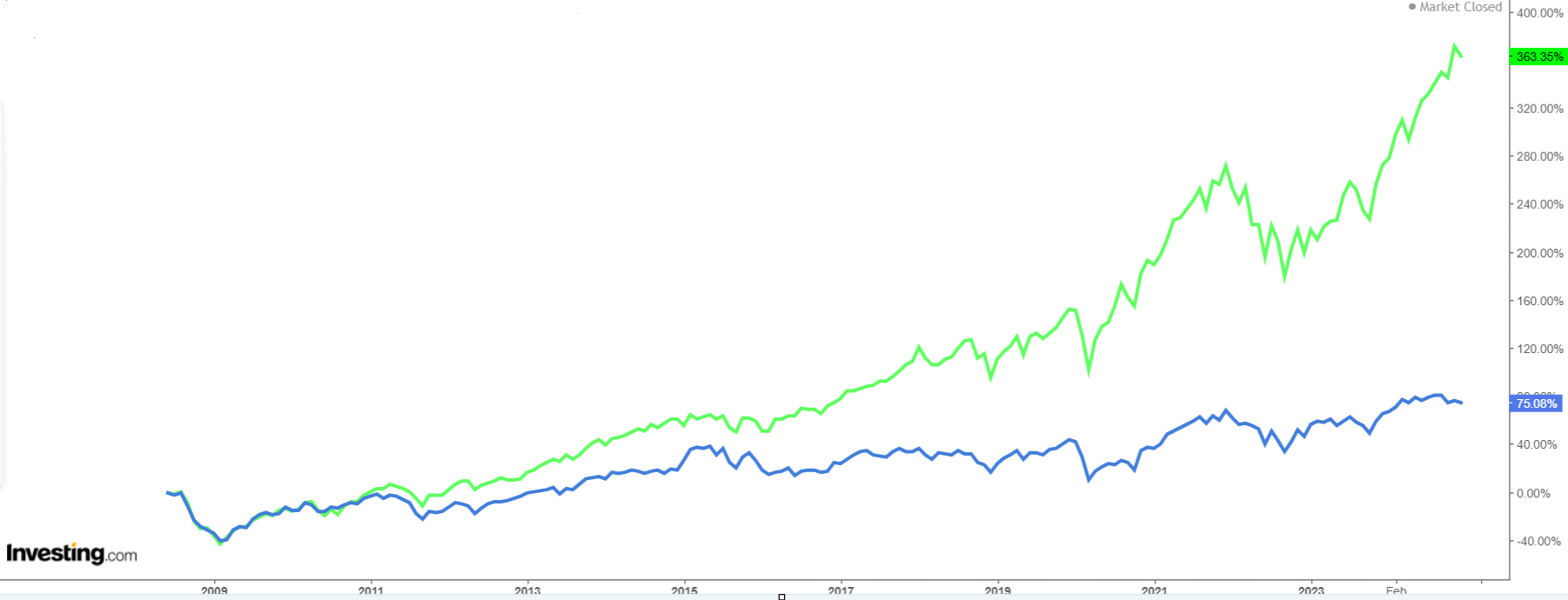

This trend isn’t new. In fact, 2024 marked the worst performance of the STOXX 600 relative to the S&P 500 in almost a quarter-century.

A key factor in this performance gap has been Europe’s lighter exposure to the technology sector—the driving force behind this year’s U.S. market gains.

While the top 10 U.S. stocks surged by double digits, six of Europe’s largest companies, including Novo Nordisk (NYSE:NVO), Nestle (OTC:NSRGY), and LVMH (EPA:LVMH), saw losses.

Take a look at the stark contrast between the STOXX 600 and the S&P 500 since 2011, and you'll see how the gap has widened substantially.

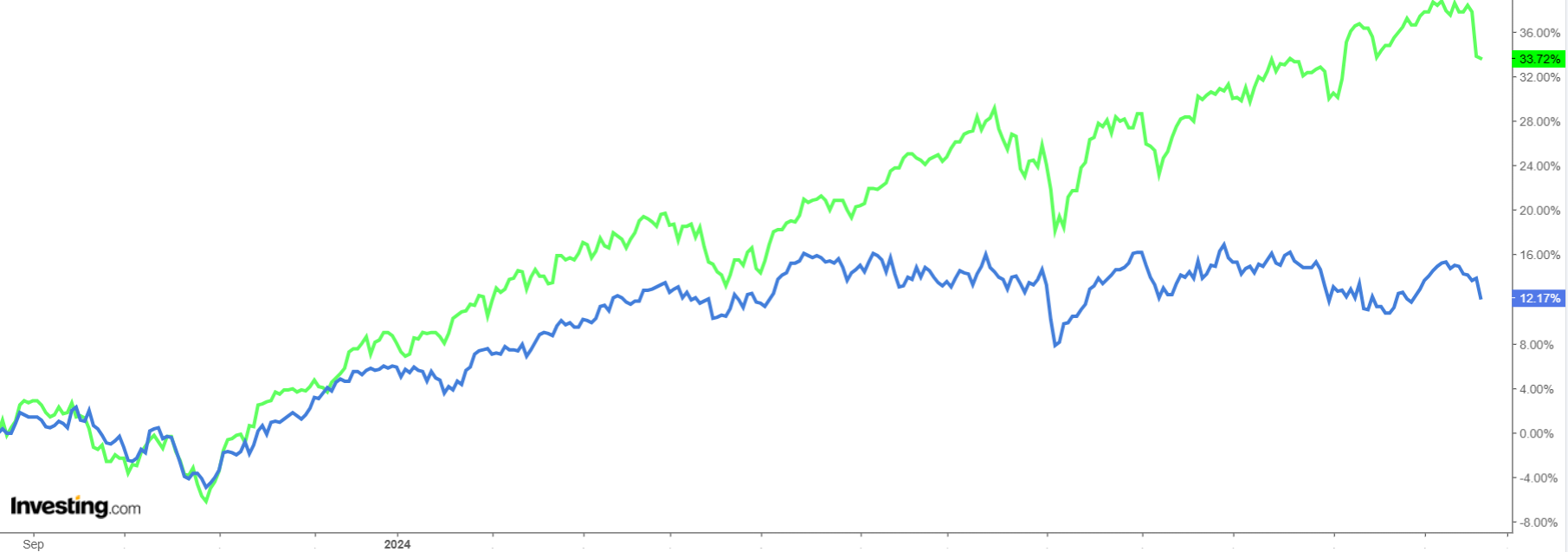

In 2024, this trend only deepened, as the U.S. benefited from its technology-heavy market while Europe lagged.

If you’re still betting on U.S. stocks, here are two top picks positioned to capitalize on the AI boom:

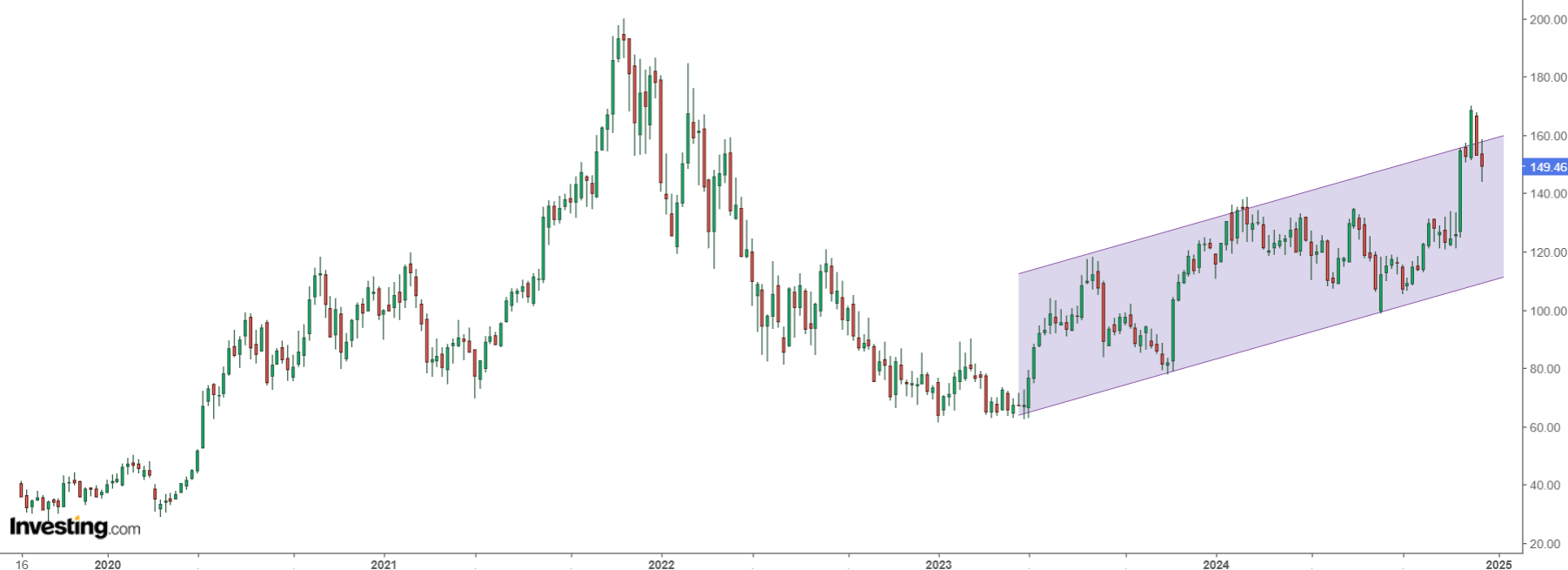

1. Fortinet (NASDAQ:FTNT): Known for its cybersecurity products, Fortinet stands to benefit from increased demand in tech security. Its partnership with CrowdStrike (NASDAQ:CRWD) adds to its competitive edge. With 44 ratings—17 buys, 26 holds, and just one sell—it’s a top choice for investors.

2. Datadog (NASDAQ:DDOG): This cloud-monitoring service has seen a 30% year-on-year gain and is well-positioned for AI growth. With 43 ratings, 40 of which are buy, Datadog remains a strong bet for the future.

While the U.S. market remains the go-to for many investors, could 2025 be the year Europe turns the tables? Seems unlikely now, but things could change.

***

Curious to learn how top investors are structuring their portfolios for 2025?

Take advantage of our Extended Cyber Monday offer—your last chance to secure InvestingPro at a 55% discount—and gain insights into elite investment strategies and access over 100 AI-driven stock recommendations every month.

Interested? Click on the banner below to discover more.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.