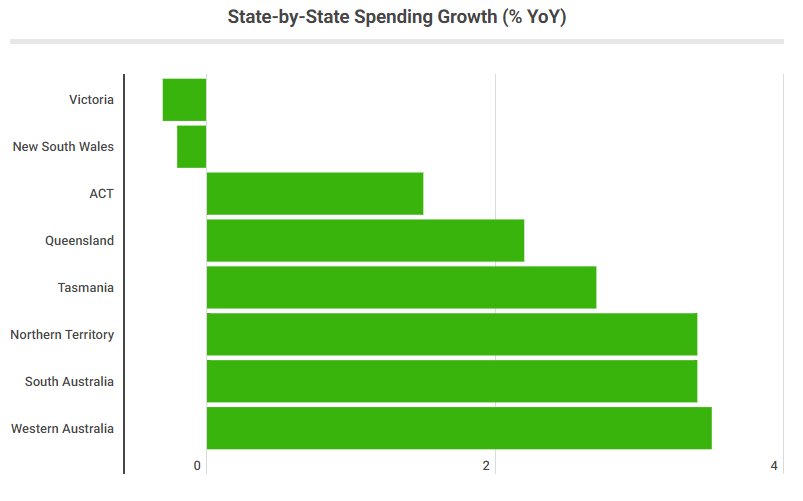

- Households in NSW and Victoria are feeling the brunt of rate hikes, with consumer spending declining by 0.2% and 0.3% respectively.

- Spending in cinemas rose 65% in the monthly to July due to the Barbie and Oppenheimer movies.

- CBA expects the RBA to cut rates by a full percentage point in 2024.

The figures are based on an analysis of online and card transaction data from the bank’s seven million customers - represents 30% of total spending nationwide.

In the states with the highest average mortgages, consumer spending fell by 0.3% in Victoria and 0.2% in NSW over the past 12 months.

ABS data for June showed the average loan size for NSW and Victoria was $725,000 and $589,000 respectively.

CBA Chief Economist Stephen Halmarick said the data suggested the squeeze from 400 basis points’ worth of rate tightening was hitting households hard.

“Monetary policy is restrictive and financial conditions will continue to tighten in the months ahead on the lagged effect of the interest rate hikes and the fixed rate mortgage refinancing task,” Mr Halmarick said.

“We continue to expect household spending to weaken further over the remainder of 2023 and into 2024.”

Despite high interest rates and cost of living pressures, households are still making space to budget for ‘fun’ experiences.

Spending on recreation was 7.1% higher in the year, driven by strong growth in online travel bookings, commercial airlines, cruise lines, and travel agency bookings.

The popularity of two cinema debuts, Barbie and Oppenheimer, saw spending through cinemas lift by 65% in the month to July.

Despite the strength in recreation spending, households have had to fork out more on essential items such as insurance (+13.2%) over the year.

Research from the Actuaries Institute found median home insurance premiums surged by more than $400 in the 12 months to March, reaching an all-time high of $1,894 across all states.

Rising university costs and private school fees pushed spending on education up by 9% over the past 12 months, while health purchases rose by 8% driven by a higher spending on GP and dentist appointments.

The weakness in household spending may bring relief to homeowners, as a decline in consumption growth typically leads to a fall in inflation and thus less likelihood of rate hikes.

However, the central bank does not want spending to fall low enough to trigger a recession.

Mr Halmarick expects the RBA to cut rates by a full percentage point in 2024, followed by two further cuts in 2025.

"Barbie and Oppenheimer lift cinema spending despite a plateau in overall household spending" was originally published on Savings.com.au and was republished with permission.