DXY bounced Friday night:

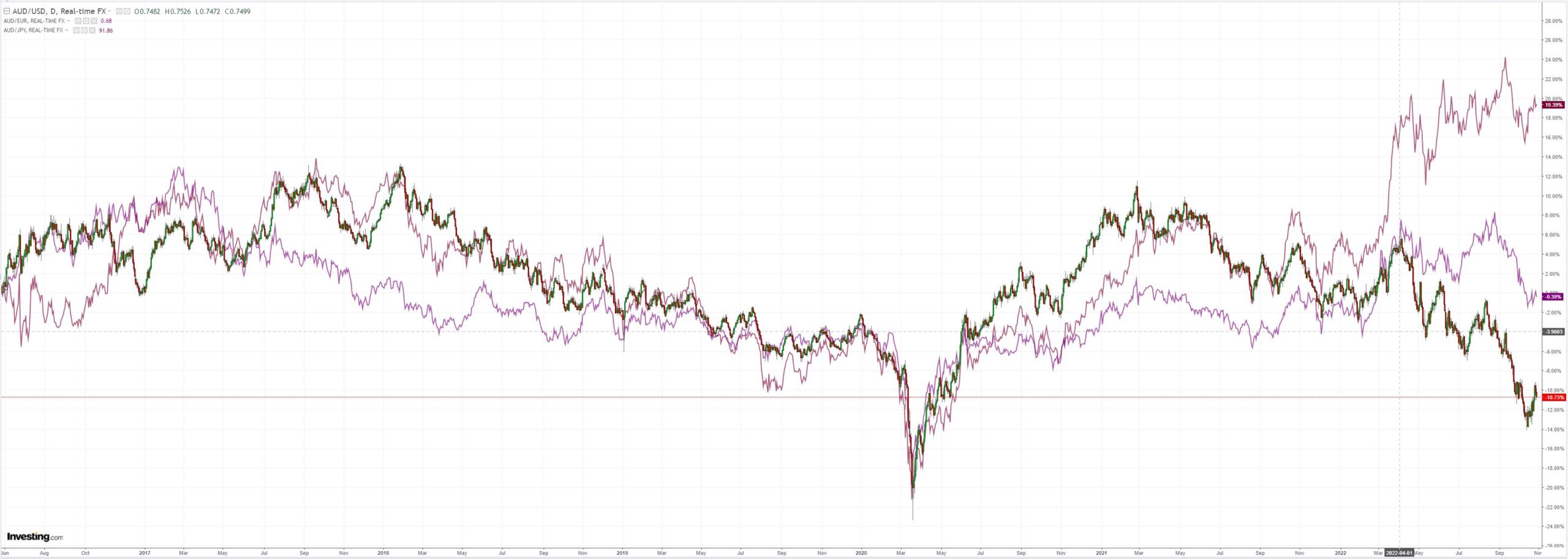

AUD sank:

The yuan was pasted again:

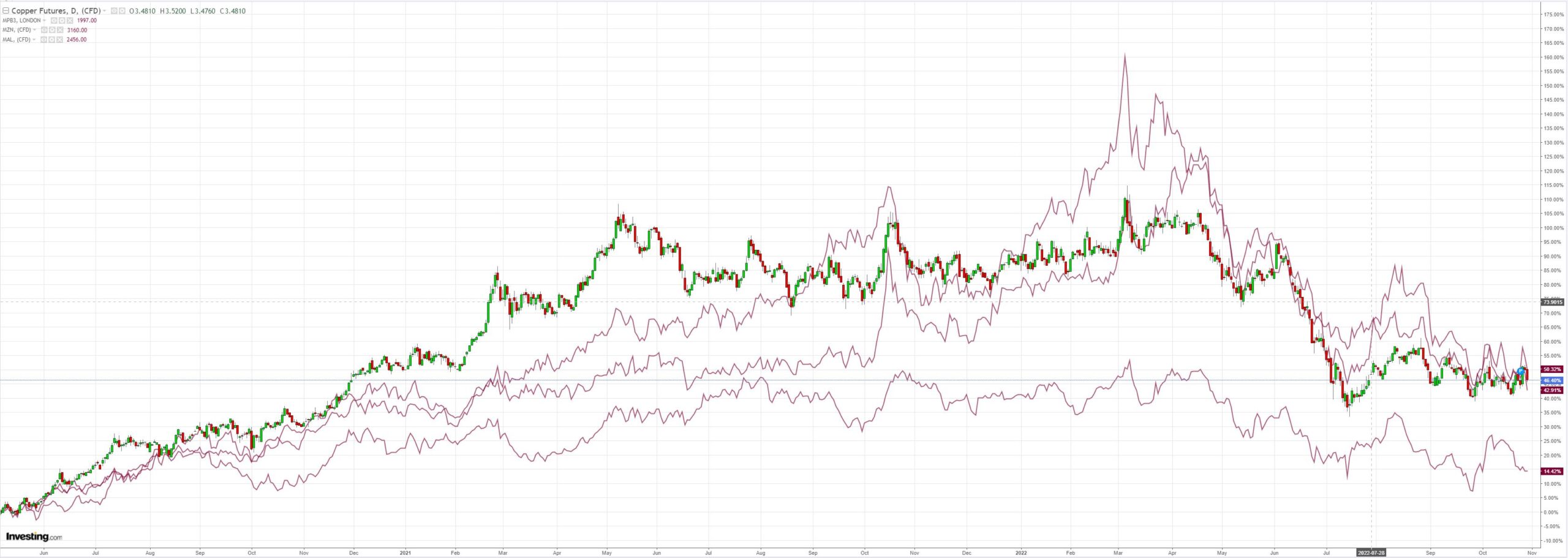

The rest of the action is bizarro world. Oil and commods were soft:

Big Iron is breaking down. COVID lows next?

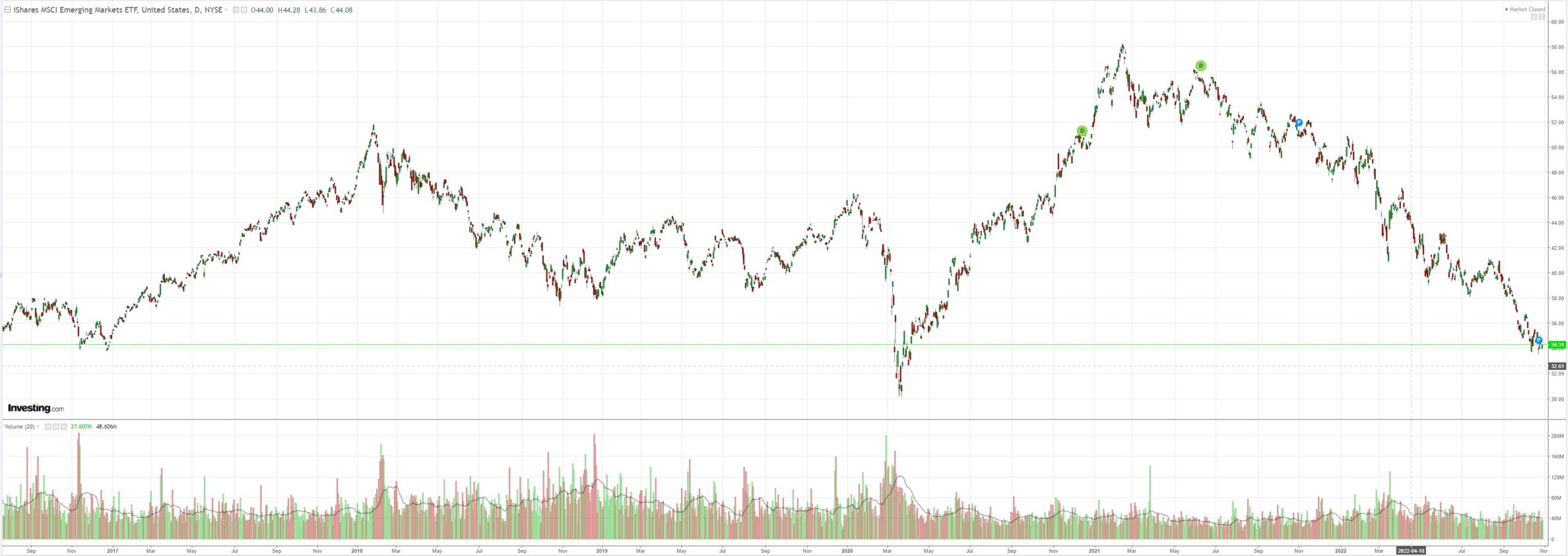

EM stocks are having no part of any rally:

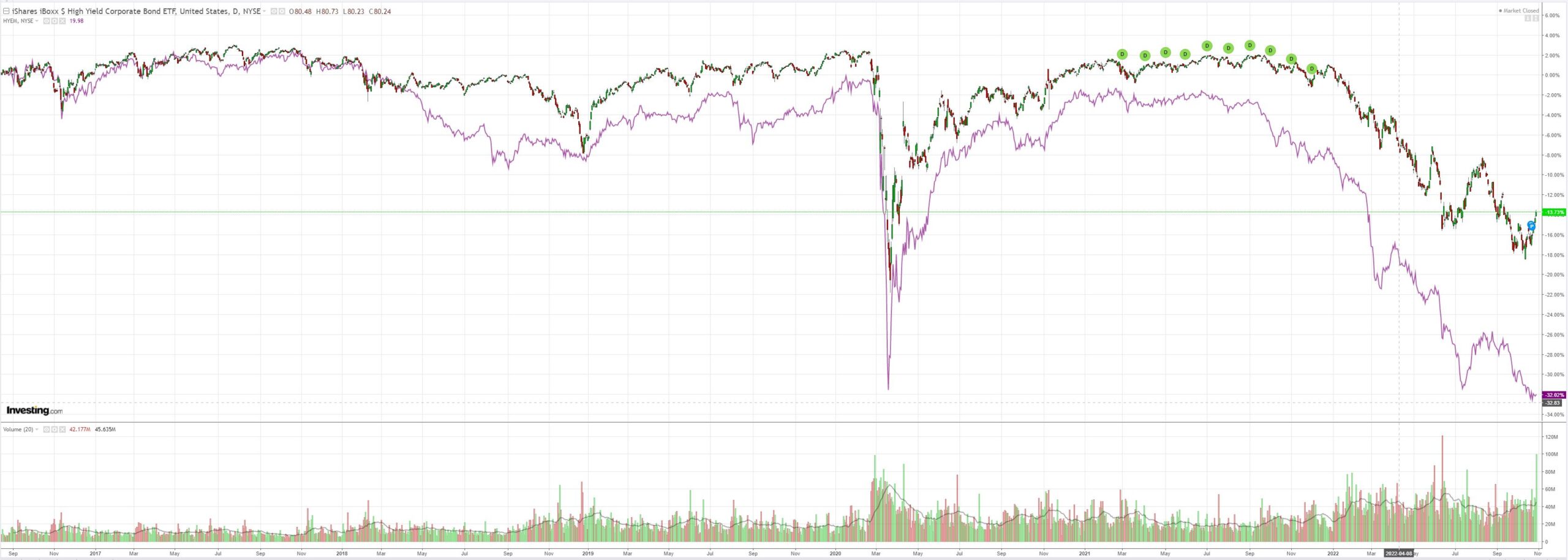

US junk is off to the moon while EM is pancaked:

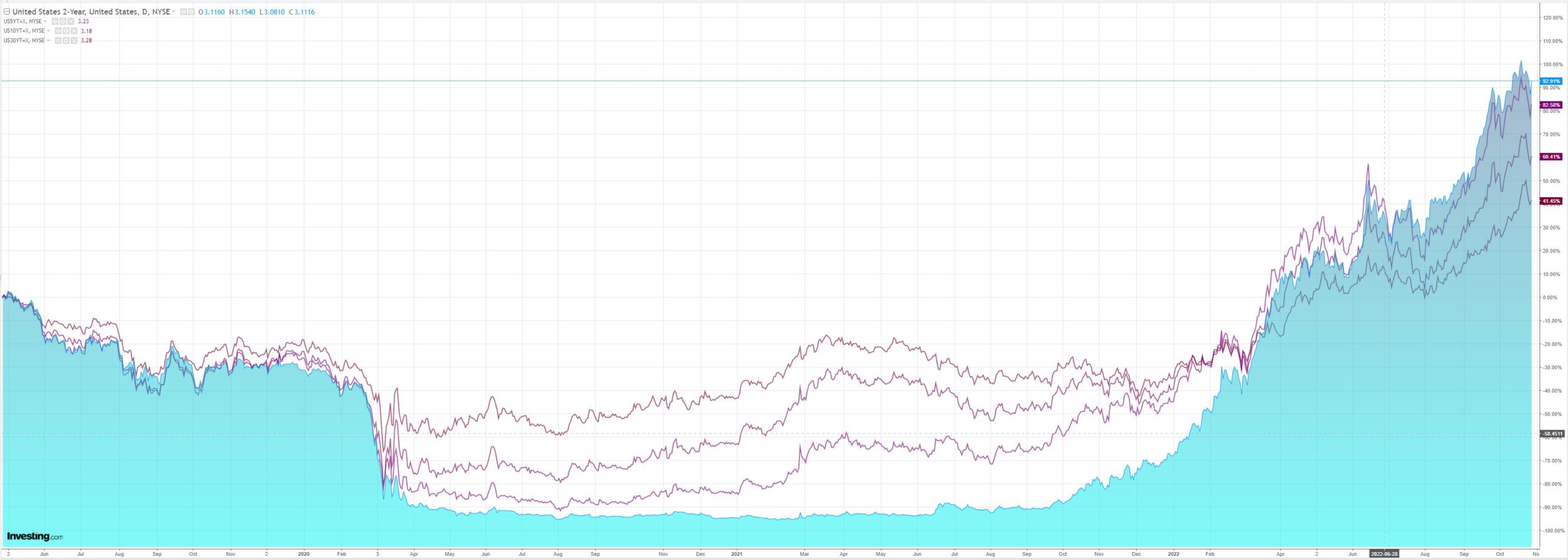

US yields lifted:

And stocks partied with junk:

The data flow was very bad for all concerned as US wages and PCE were strong. Goldman:

The September core PCE price index rose by 0.45%month-over-month, in line with consensus expectations, and the year-over-year rate increased to 5.15%. Personal spending increased a bit more than expected, personal income increased in line with expectations, and the saving rate dropped to 3.1%. The Employment Cost Index rose 1.2% in Q3 (not annualized), with firm underlying details. Our composition-corrected wage tracker—which adjusts median weeklywages and average hourly earnings to control for workforce composition—nowstands at +5.4% (yoy) in Q3 (vs. +5.5% in Q2). Our quarterly annualized composition-corrected wage tracker based on average hourly earnings and the Employment Cost Index stands at +5.2% (qoq ar) in Q3 (vs. +5.3% in Q2). We will launch Q4 GDP tracking following the mid-morning data.

The Fed is not done. Sticky inflation is, if anything, getting stickier. Unprecedented capital flight is taking hold of Chinese markets. The ECB is dropping an anvil on a war and energy ravaged Europe. Global recession is the firm base case. An inventory cycle unwind of the scale of the GFC is coming. Buy stonks because, you know, Santa!

AUD has not bottomed.