DXY is up and away! Everybody is long EUR, so watch it fly:

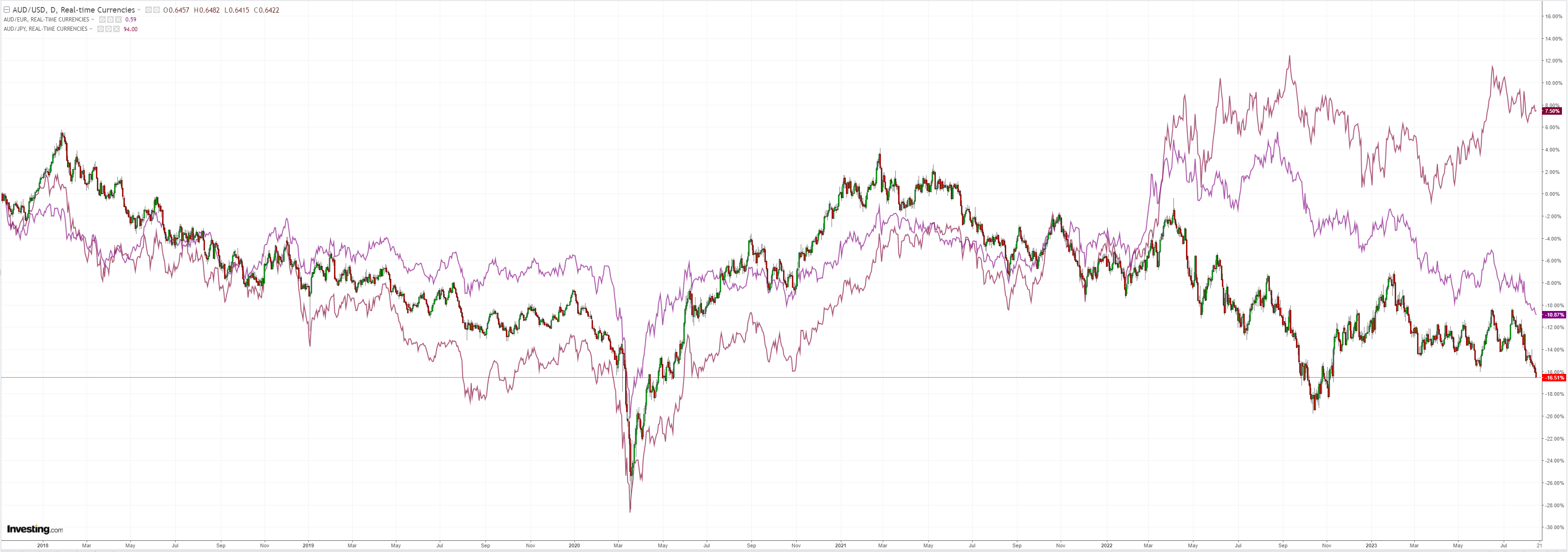

AUD is global whipping boy:

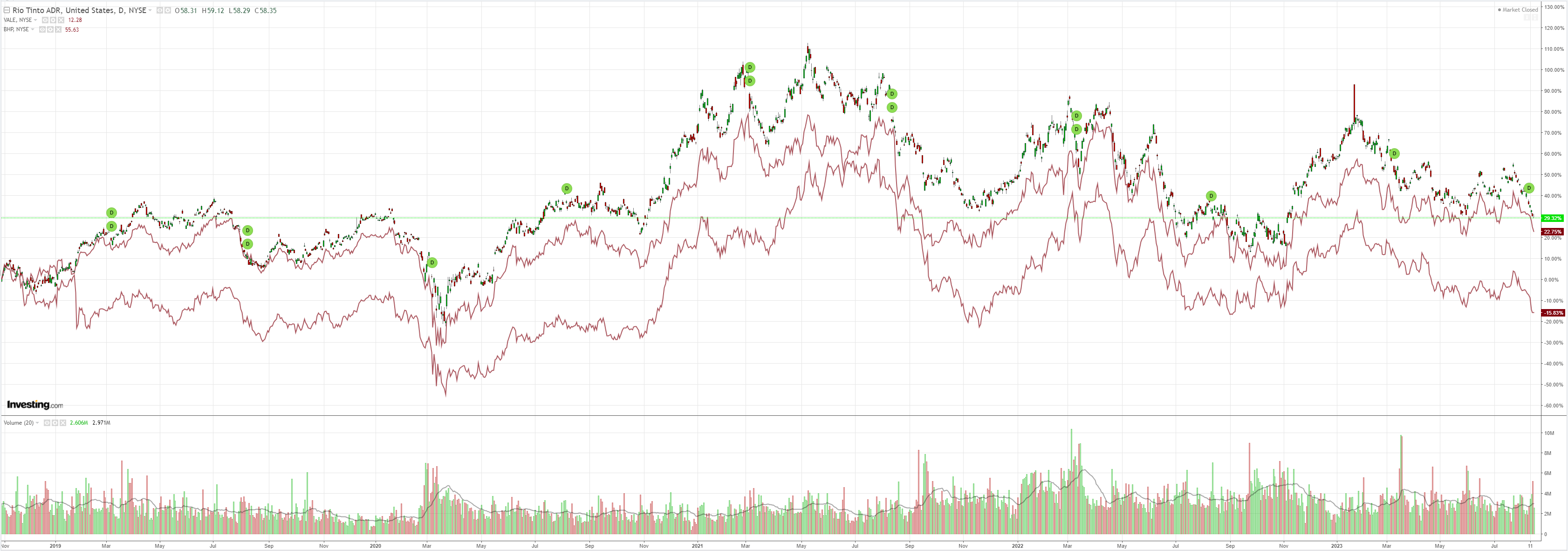

Commodities are waking in fright to a strong US and China accident:

Big miners have horrible descending triangle patterns:

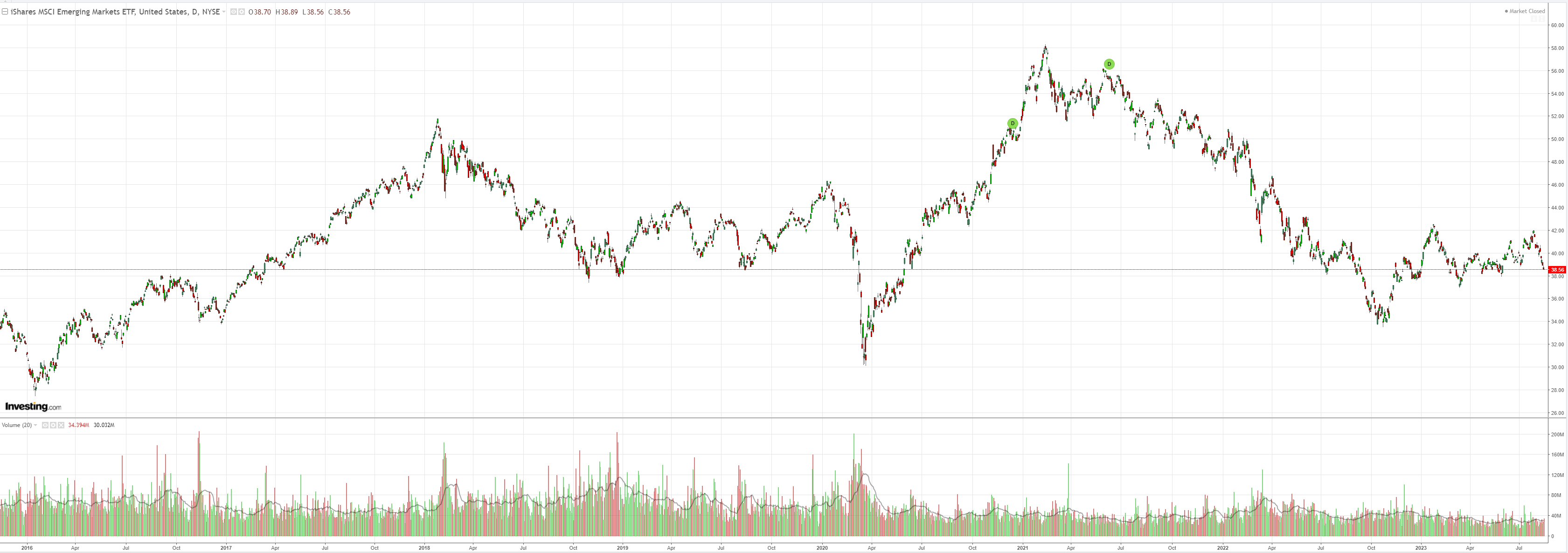

EM stocks are literally finished:

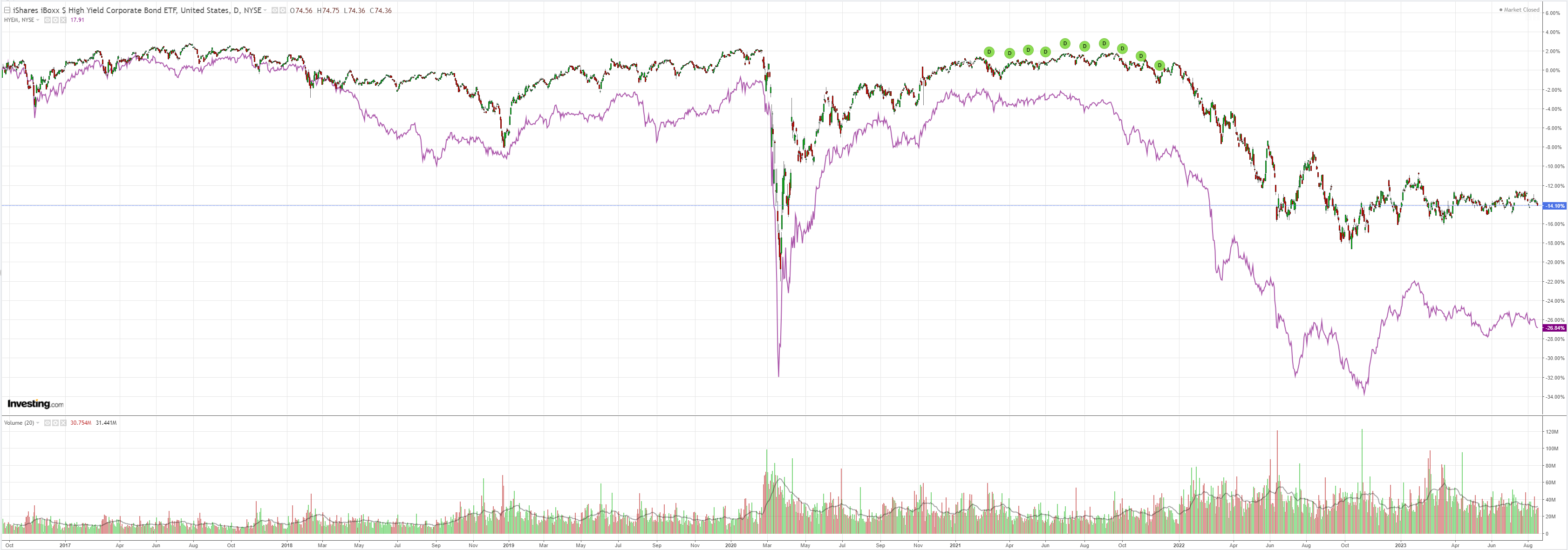

Junk is fading:

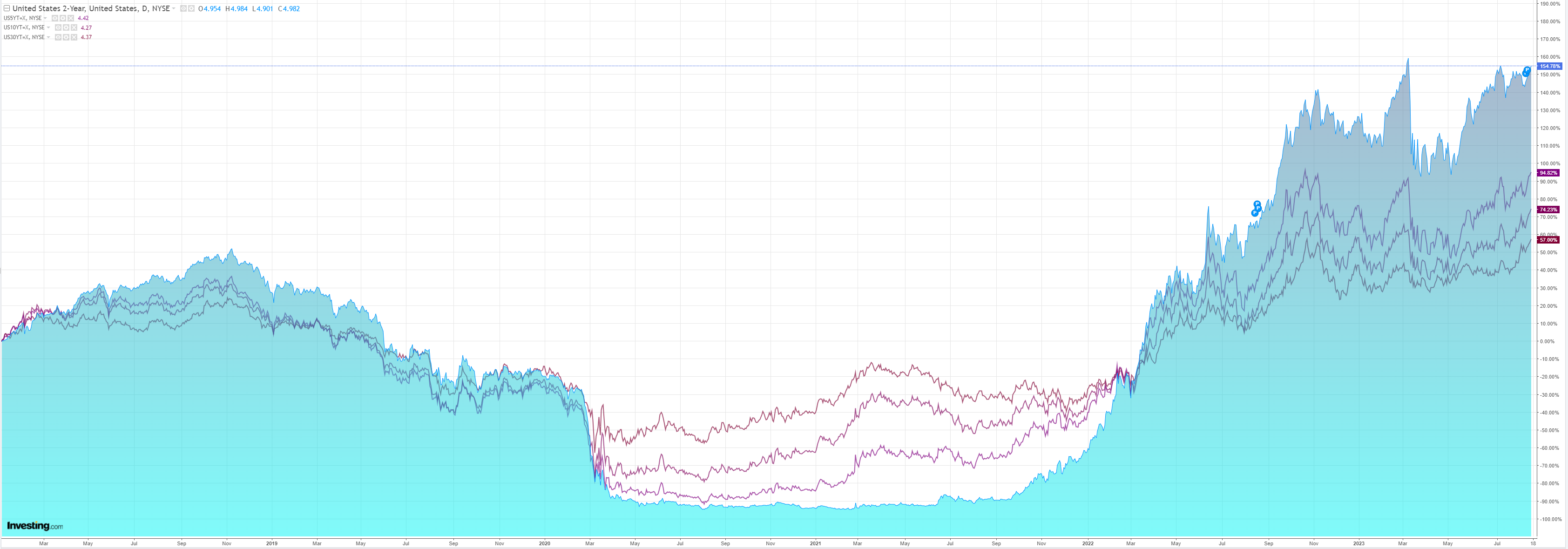

A stupid bear steepening rolls on:

Smashing stocks:

The market is in turmoil. The soft landing narrative is falling apart on two fronts.

First, China is in an outright crisis. The property crash is turning into a credit crunch. In my view, it is irreversible at this point. The best markets can hope for is a stimulus to cushion the blow.

Second, the soft landing rally has generated its endpoint in the US. The Fed is not satisfied its job is done (even though it is, as China detonates a global deflationary shock).

Minutes were hawkish:

The economic forecast prepared by the staff for the July FOMC meeting was stronger than the June projection. Since the emergence of stress in the banking sector in mid-March, indicators of spending and real activity had come in stronger than anticipated; as a result, the staff no longer judged that the economy would enter a mild recession toward the end of the year. However, the staff continued to expect that real GDP growth in 2024 and 2025 would run below their estimate of potential output growth, leading to a small increase in the unemployment rate relative to its current level.

The staff continued to project that total and core PCE price inflation would move lower in coming years. Much of the step-down in core inflation was expected to occur over the second half of 2023, with forward-looking indicators pointing to a slowing in the rate of increase of housing services prices and with core nonhousing services prices and core goods prices expected to decelerate over the remainder of 2023. Inflation was anticipated to ease further over 2024 as demand–supply imbalances continued to resolve; by 2025, total PCE price inflation was expected to be 2.2 percent, and core inflation was expected to be 2.3 percent.

The staff continued to judge that the risks to the baseline projection for real activity were tilted to the downside. Risks to the staff’s baseline inflation forecast were seen as skewed to the upside, given the possibility that inflation dynamics would prove to be more persistent than expected or that further adverse shocks to supply conditions might occur. Moreover, the additional monetary policy tightening that would be necessitated by higher or more persistent inflation represented a downside risk to the projection for real activity.

…Participants generally noted a high degree of uncertainty regarding the cumulative effects on the economy of past monetary policy tightening. Participants cited upside risks to inflation, including those associated with scenarios in which recent supply chain improvements and favorable commodity price trends did not continue or in which aggregate demand failed to slow by an amount sufficient to restore price stability over time, possibly leading to more persistent elevated inflation or an unanchoring of inflation expectations. In discussing downside risks to economic activity and inflation, participants considered the possibility that the cumulative tightening of monetary policy could lead to a sharper slowdown in the economy than expected, as well as the possibility that the effects of the tightening of bank credit conditions could prove more substantial than anticipated.

The Fed, like Wall Street, does not understand China. It is not some magical land that is entirely immune to depression economics. As its structural denouement transpires, debt-deflation dynamics can be managed but not reversed.

There will be credit events. There is one underway right now. There will be rescues. But none of it will stop the collapse in growth, which will, in turn, drop an anvil on Europe, all of EM and, eventually, the US economy via a tearaway currency and crushed offshore profits.

Worrying about commodity inflation in this environment is pure rear-vision mirror policymaking.

It is shredding the Australian dollar.