DXY took a breather:

Which releases pressure on the Commodities Complex. AUD dead cat bounced:

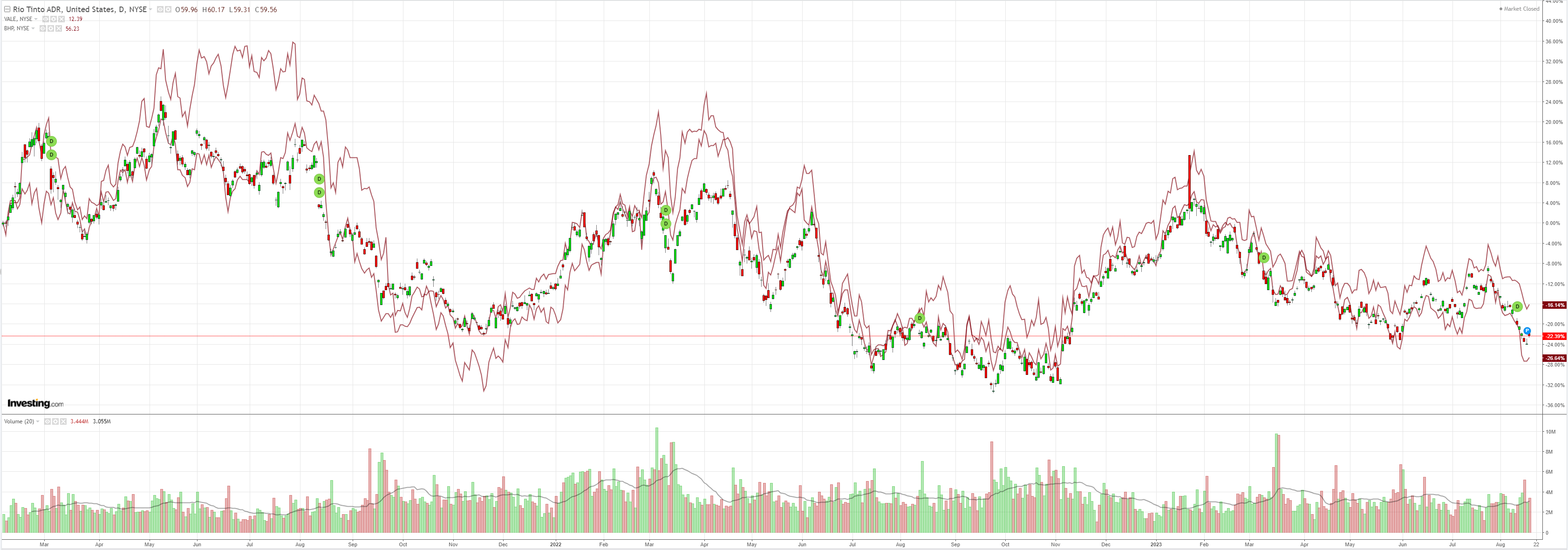

Dirt too:

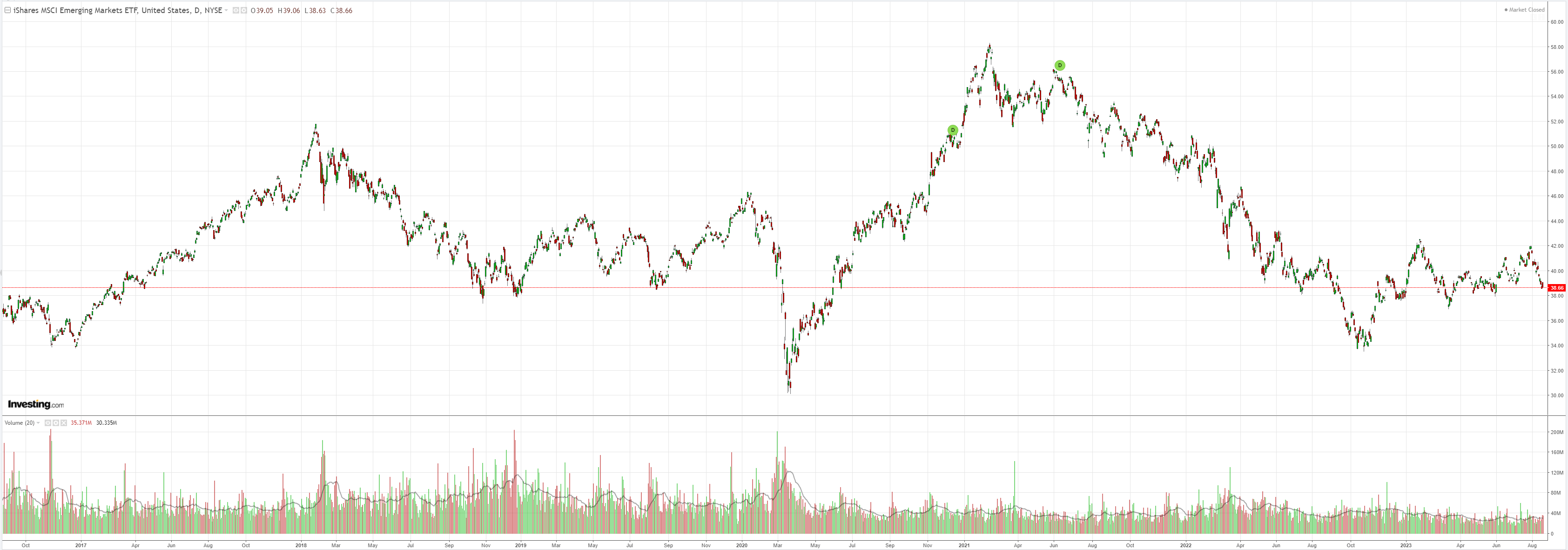

Plus miners and EM:

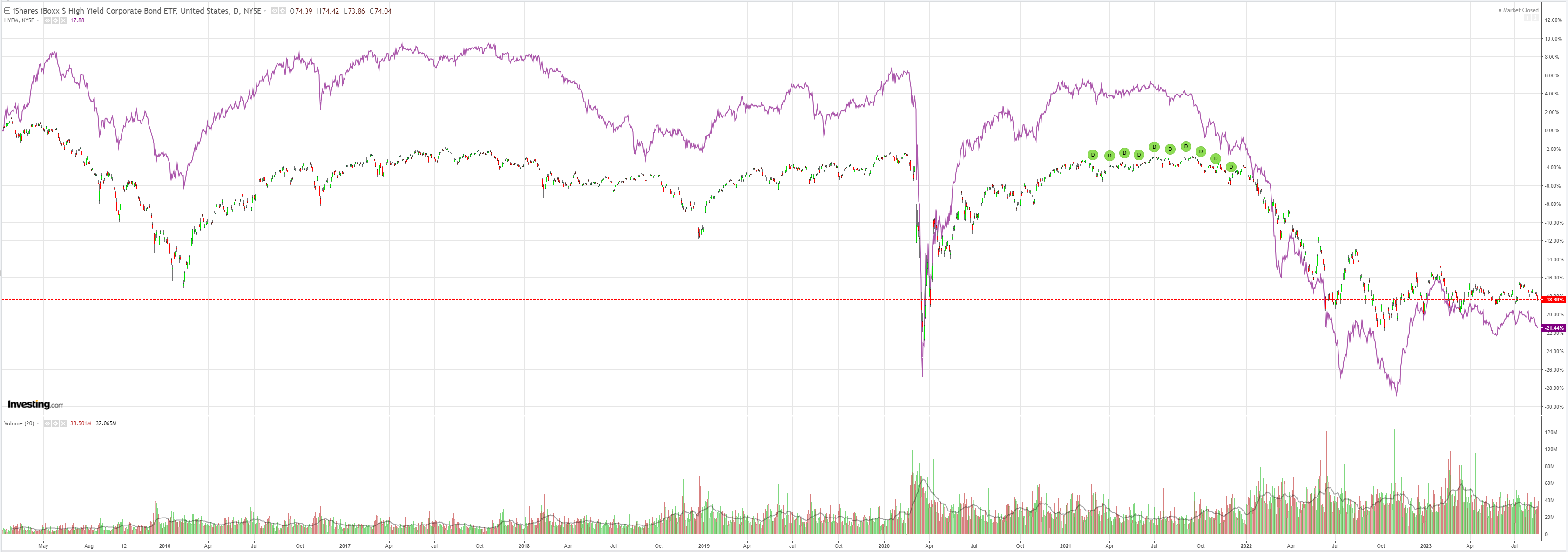

But junk is the tell:

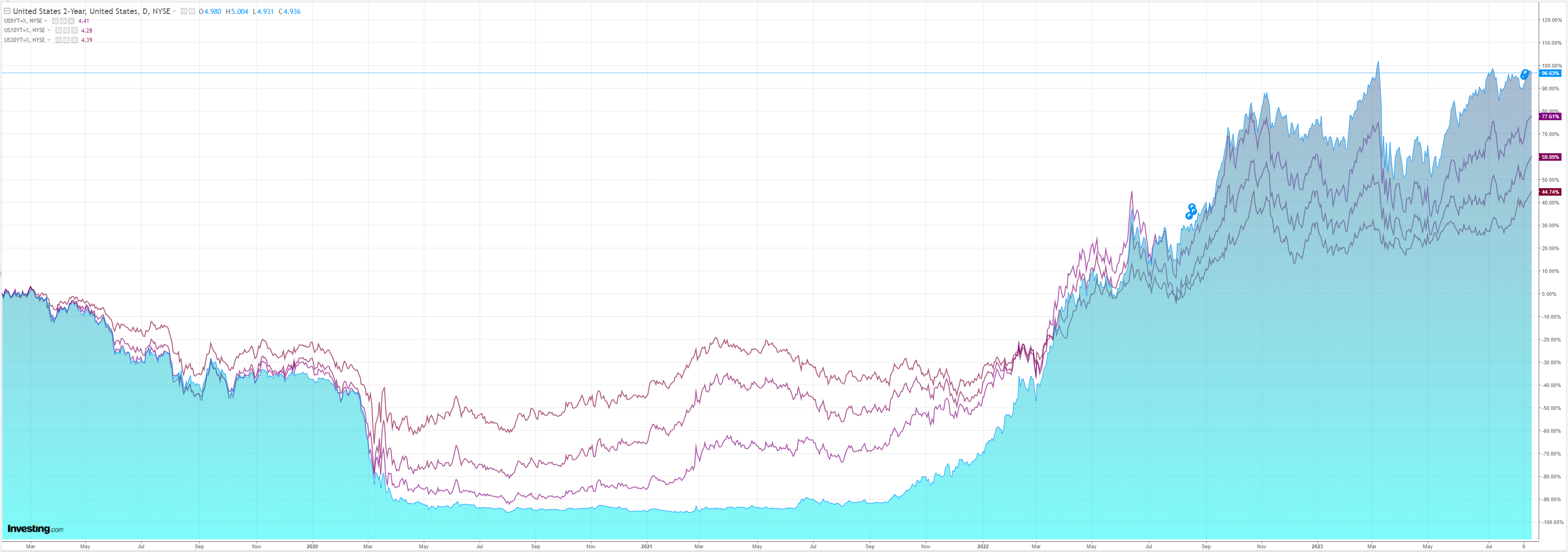

As the maniac bear steepener rocks the stock market:

I am not a believer. This bond vigilante revenge looks as convincing as the stock market rally before it.

These markets are flopping at the margins, creating and crushing mini-recoveries while the underpinnings of the global business cycle deteriorate.

China and Europe are in recession, which will worsen as inflation is squeezed from the system via falling activity and deflating commodities.

Emerging Markets are effectively finished as an asset class (other than those that can friendshore). The Chinese bust is a structural reset to lower growth and much lower CNY, which will crash EM commodity exports and price them out of DM markets.

The US is the last man standing, but stalling fiscal, crashing bank lending, rising DXY, falling stocks, and the bear steepener are a dramatic FCI tightening. It is going to slow or stall too.

This is still an AUD nightmare scenario.