DXY was bashed last night as the Jay Powell monster turned out to be the a cuddly toy:

AUD closed at breakout highs:

Oil popped:

Commods popped:

Everything popped:

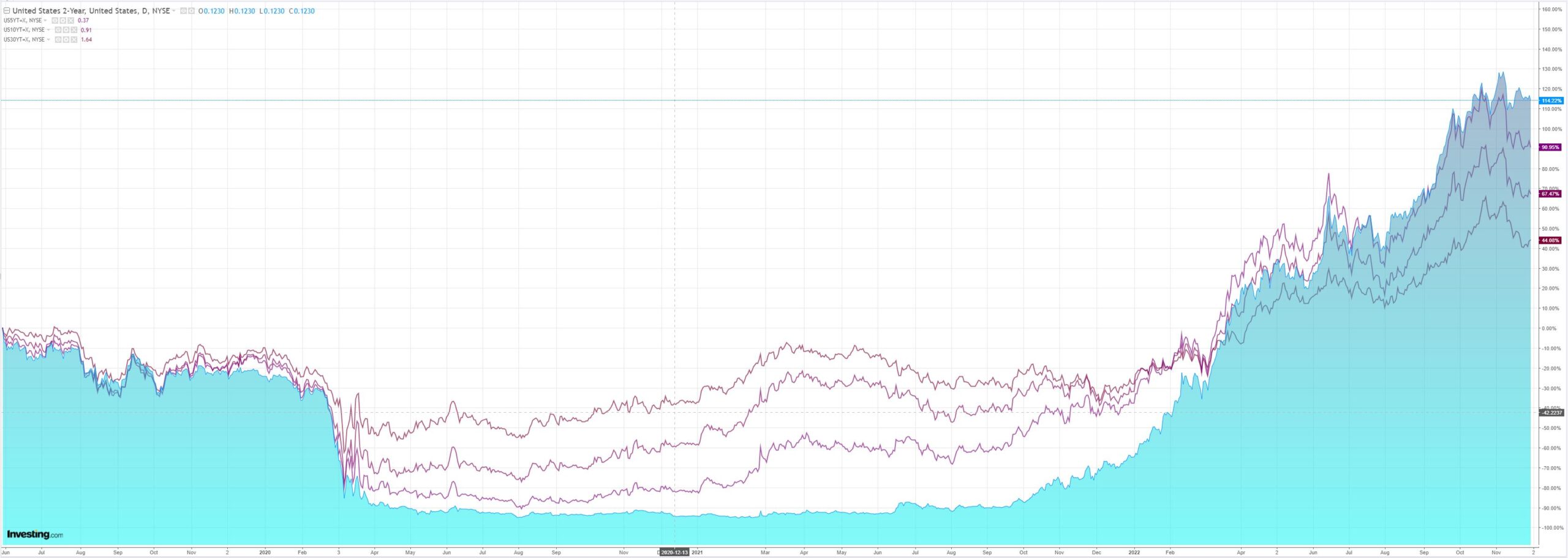

The Treasury curve steepened:

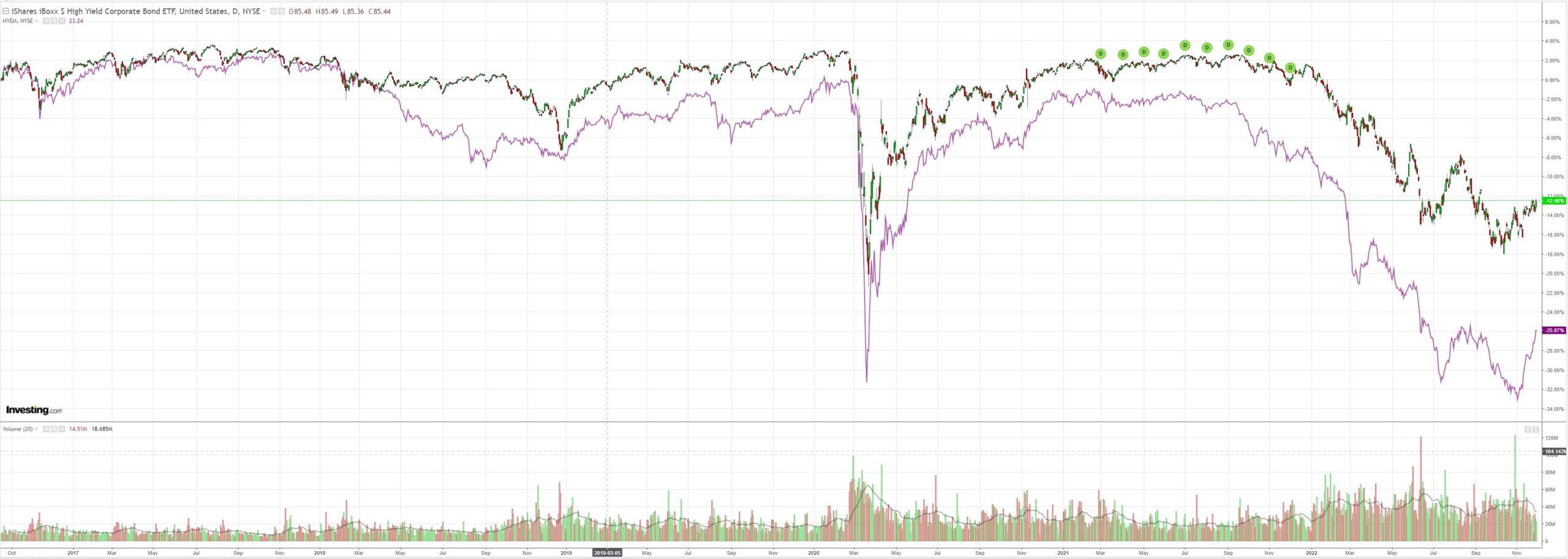

Stocks piled it on:

Data was poor with a crash in the Chicago PMI, dump in JOLTS, and soft ADP (NASDAQ:ADP). If this leads to a weak BLS then markets are going to the moon.

Jat Powell turned all mealy-mouthed:

Dovish:

- “The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in the text of his speech.

- On the Nov 2nd meeting Chair Powell s messaging stated “Our message is we have a ways to go with interest rates before we get to the level that is sufficiently restrictive”, but now he has altered this slightly, noting they “have made substantial progress towards sufficiently restrictive policy, but they have more ground to cover.”

- “If you are waiting for inflation to go down, it’s very difficult not to overtighten.”

Hawkish:

- *POWELL SAYS FED WILL NEED RESTRICTIVE POLICY FOR `SOME TIME’

- *POWELL: RATE PEAK LIKELY `SOMEWHAT HIGHER’ THAN SEPT. FORECASTS

- “Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

- *POWELL: CONSIDERABLE UNCERTAINTY OVER WHERE RATES WILL PEAK

- *POWELL: WILL REQUIRE SUSTAINED PERIOD OF SLOWER DEMAND GROWTH

- “It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.”

- *POWELL: HISTORY CAUTIONS AGAINST PREMATURELY LOOSENING POLICY

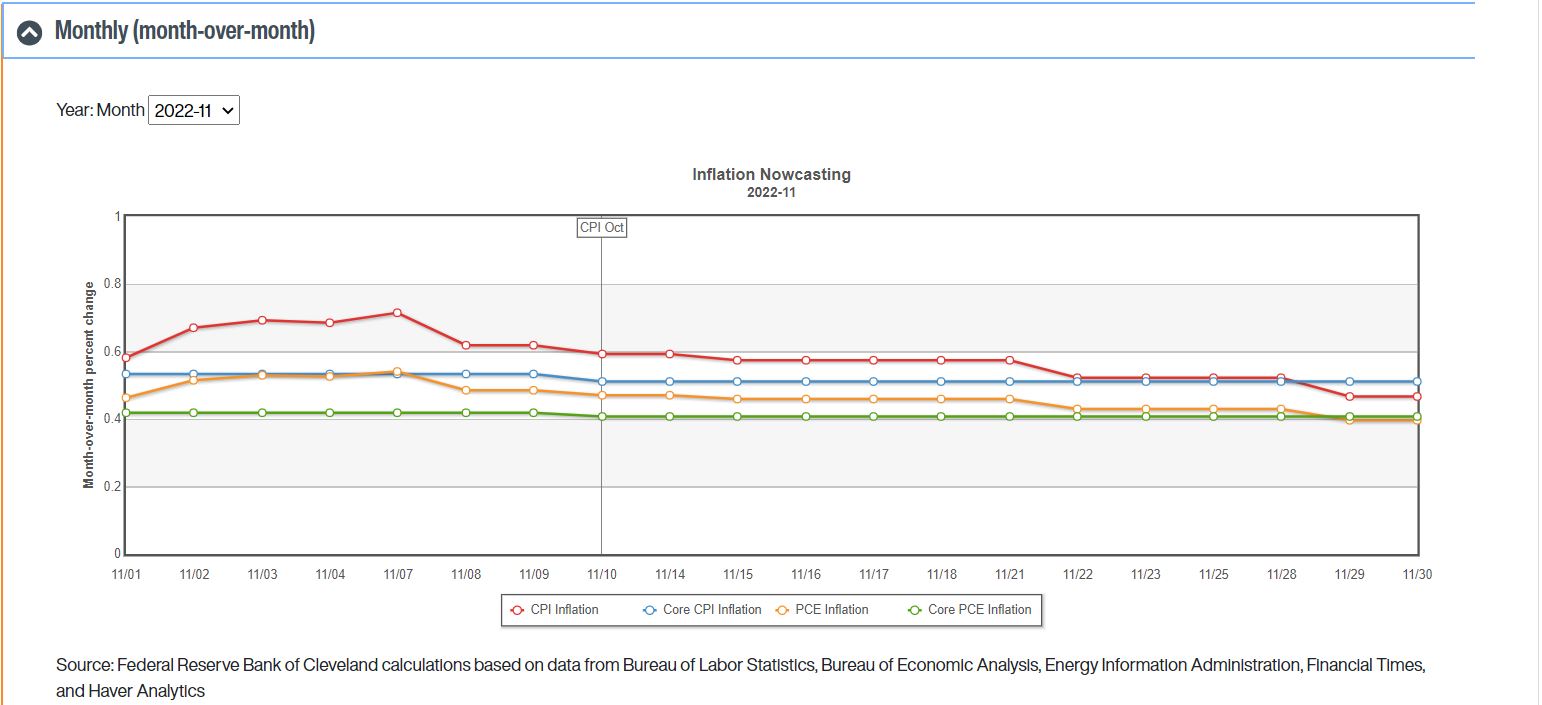

Meanwhile, CorePCE nowcast remains glued to 5%:

Powell may not be Arthur Burns but he sure ain’t Paul Volcker. Instead of a clear path to lower inflation we now have a priced 5% terminal rate warring with a roaring reflation pulse in stocks, EMs, and commodity markets.

I still think this is a tactical trade but the AUD is going higher.