Forex News and Events

Australia: recovery not a sure thing yet (by Arnaud Masset)

The Australian jobs market continues to show signs of improvement as the unemployment rate fell to 5.8% in November (versus 5.9% previous reading and 6% median forecast), a level last seen in May last year. Net hiring rose to 71,400 workers, compared with an expected loss of 10,000. On the top of it, the participation rate ticked up to 65.3% verse 65% consensus. However, the recovery in the jobs market is still in early stages and is conditional on a weak Australian dollar. Indeed, exports were one of the strong growth driver in the third quarter, highlighting the dependency of the Aussie economy to a weak currency. Even though Governor Stevens demonstrated a relative satisfaction regarding the RBA’s current monetary policy, the bank closely monitor the FX market and patiently wait the Fed to help them through a rate hike. We therefore believe that the risk remains on the downside in AUD/USD as a strong currency could derail the budding recovery.

BoE meeting to be a non-event (by Peter Rosenstreich)

Today’s Bank of England rate decision and meeting minutes is likely to be a non-event. We anticipate no change in policy or shift in voting pattern (only one member voting for a rate hike). The tone of the minutes will remain dovish as the strength of the sterling has dampened inflation expectations, while signals from global demand are concerning. As expectation for the BoE to raise interest rates in 2016 drift away, policy divergence should favor the USD. The GBP/USD recovery rally bullish momentum is waning (current intraday range pattern). Failure to clear 1.5200 suggests an extension to 1.5232 (55d MA) looks unlikely. Exhaustion reversal to 1.5160 support would be the first real test of our downside call.

CHF strengthens on disappointment from the SNB (by Yann Quelenn)

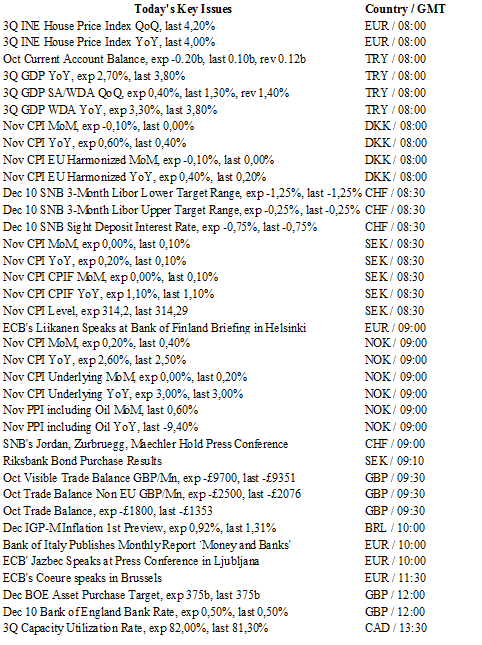

Following in the footsteps of last week’s ECB meeting when Mario Draghi disappointed financial markets, the Swiss National Bank has announced this morning that its rates will remain on hold. The SNB’s sight deposit rate holds at -0.75% and the Libor target is still be ranging from -1.25% to -0.25%. Indeed, despite the ECB rate cut on the deposit facility rate to -0.3% from -0.2%, there was no desire for the SNB to react as markets in fact over-priced Draghi’s delivery and finally ended up disappointed. As a result, pressures on the EUR/CHF were limited and left some room for the SNB to react. However, the inflation forecast has been set higher for 2016 at -0.5% and lower for 2017 at 0.3% instead of 0.4%. The GDP forecast has also been revised down in the short-term at 1% this year and 1.5% next year.

Yet, we believe that the CHF will face increasing pressures as economic and also political uncertainties in Europe grow. Europe should not expect better results from their QE program, knowing that neither Japan nor the U.S experienced positive results quickly. Moreover, Europe is a set of fragmented countries each with its own set of governmental and fiscal rules, meaning that there will be more than one occasion when the ECB monetary policy will be questioned. The main risk for the SNB is a renewed strengthening of the Swiss franc as Swiss industry is mostly oriented towards Europe. The SNB has two tools to defend the Swiss franc, the sight deposit rate as well as the intervention on the FX market.

Officially, according to the sight deposits of domestic banks, the SNB is not intervening in the market despite some rumours stating the opposite. Over the past five years the SNB has shown a propensity towards aggressive action. However, even a further rate cut may not be sufficient and so we are expecting some surprises from the SNB within the next few months. In our opinion the EUR/CHF will not be allowed to set up below 1.0500

The Risk Today

Yann Quelenn

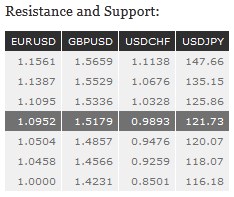

EUR/USD has increased and the pair is now is now in a clear bullish momentum. Hourly resistance at 1.0981 (03/12/2015) has been broken. Hourly support lies at 1.0796 (07/12/2015 low). Stronger support lies at 1.0524 (03/12/2015 low). Expected to target resistance at 1.1096. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD's medium-term downside momentum remains lively. The pair is now struggling to increase above 1.5200. Hourly resistance is given at 1.5336 (19/11/2015 high). Stronger resistance can be found at 1.5529 (22/09/2015 high). Hourly support can be found at 1.4985 (02/12/2015 low). Expected to show further weakness. The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY has declined and hourly support at 122.23 (16/11/2015 low) has been broken. Hourly resistance still lies at 123.76 (18/11/2015 high). Strong support can be found at 120.07 (28/10/2015 low). Expected to bounce back toward resistance at 123.76. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF is heading downwards and the pair is still holding below parity after last week's sharp decline. Hourly support is given at 0.9876 (27/10/2015 low) while hourly resistance is given at 1.0034 (04/12/2015 high). Expected to show further consolidation. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured