It’s expected the central bank's board will contemplate if last fortnight’s shock inflation read is worthy of a thirteenth rate hike tomorrow.

- The RBA board will meet tomorrow to decide for or against a November cash rate hike

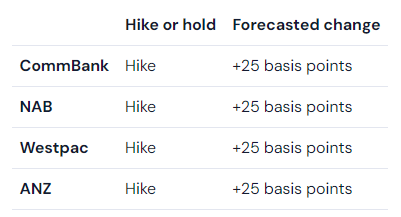

- The vast majority of experts are forecasting a 25 basis point increase, bringing the cash rate to 4.35%

- It comes after inflation surprised on the upside late last month

Headline inflation came in at 5.4% on an annualised basis last quarter – higher than most experts had predicted.

Prices were also found to have risen 1.2% over the months of July, August, and September, largely driven by fuel prices (up 7.2%) and rental costs (up 2.2%).

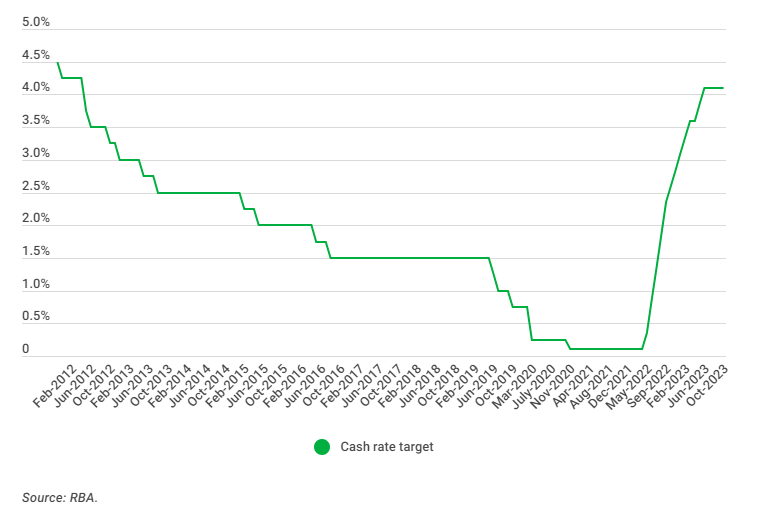

Many Australians are already struggling under the weight of a dozen hikes put forward since May 2022, lifting the cash rate to 4.10% right now.

Roy Morgan recently found a record 30.3% of home loan borrowers are now ‘at risk’ of mortgage stress.

However, RBA Governor Michele Bullock recently insisted the central bank “will not hesitate” to hike rates if inflation continues to surprise.

Though, she later left room to play the dove at Tuesday’s meeting, refusing to commit to labelling the latest inflation read “material”.

Likely adding to the grief of the RBA board (and those struggling with loan repayments) is the continuously low unemployment rate and still-rising consumer spending.

Making the decision tomorrow will be a panel of eight – a replacement deputy governor hasn’t been appointed following Ms Bullock ascension to the top job.

Will the RBA hike tomorrow? Big four banks say ‘yes’

NAB economists have locked in expectations of a cash rate hike at tomorrow’s RBA board meeting, having tipped such an outcome for many months.

CommBank's head of Australian economics Gareth Aird and economist Stephen Wu revealed a change of heart last month.

They said the previous forecast of a November hold was based on expectations inflation would lift just 1.0% in the September quarter.

They noted the RBA anticipated inflation to rise even less, predicting the September quarter would see a 0.9% increase back in August.

“We are not sure what constitutes a ‘material upward revision’ to the RBA’s inflation forecasts,” Mr Aird and Mr Wu said.

“But we consider the lift in underlying inflation over the third quarter of 2023 to be sufficiently strong for the RBA to act on their hiking bias at the upcoming board meeting.”

ANZ head of Australian economics Adam Boyton followed suit in October, predicting the RBA to up the cash rate to 4.35% tomorrow before embarking on an extended pause.

Perhaps most telling, however, was a shift in direction from Westpac’s new chief economist Luci Ellis.

Until last month, Ms Ellis was an assistant governor at the RBA.

“We assessed that it would take a significant upside surprise to induce the RBA board to raise rates at the November meeting,” she said on the back of the inflationary surprise, revealed by the Australian Bureau of Statistics (ABS).

Westpac had predicted inflation would rise 1.1% in the September quarter.

“A 0.1% difference might not seem like a lot, but the underlying detail was sobering,” Ms Ellis said.

“So yes, I’ve seen enough to make my first-ever rate call to be a prediction of a hike.”

Is there a case for a fifth consecutive cash rate pause?

Of course, the show isn’t over until the RBA board sings and there have been many arguments against a hike put forward by commentators.

It’s worth mentioning that, with Australia’s cash rate being lower than that of many other advanced economies right now, we may soon be on the brink of a spate of rate cuts across the globe.

Thus, holding out for a little while longer may be a more prudent monetary policy move for the RBA to make.

Further, many of the factors driving up inflation – rents, the cost of fuel, and energy prices – won’t be greatly impacted by a rising cash rate.

Perhaps the more likely reason the RBA board could feasibly hold the cash rate steady tomorrow is if it deems inflation is falling fast enough that another hike could prove unnecessary.

As of market close on Friday, only 50% of ASX traders were predicting a rate hike at tomorrow’s meeting, according to the ASX RBA Rate Tracker.

"All eyes on November: Experts predict RBA will hike rates" was originally published on Savings.com.au and was republished with permission.