There is officially few to no affordable rentals in Australia for vulnerable renters, with increasing demand sending rents skyrocketing in both capital cities and regional areas.

- Soaring rents have left vulnerable renters facing an unaffordable housing market in 2023, the latest Rental Affordability Index has revealed

- The median cost of renting a one bedroom dwelling now exceeds the JobSeeker allowance in most capital cities

- Regional Queensland is the nation's most unaffordable area, with average rents eating up 30% of average incomes

- Sydney is the most unaffordable city for renters

The median weekly rent for a one bedroom dwelling now exceeds the JobSeeker allowance in all capital cities, with the exception of Adelaide and Hobart, the joint report by SGS Economics and Planning, National Shelter, Brotherhood of St Laurence, and Beyond Bank found.

Meanwhile, there is no city or state in which a single pensioner can comfortably afford the median rental costs of a single bedroom home.

Such costs were found to represent between 32% and 82% of the recently increased maximum Age Pension, plus assumed income from super and investments.

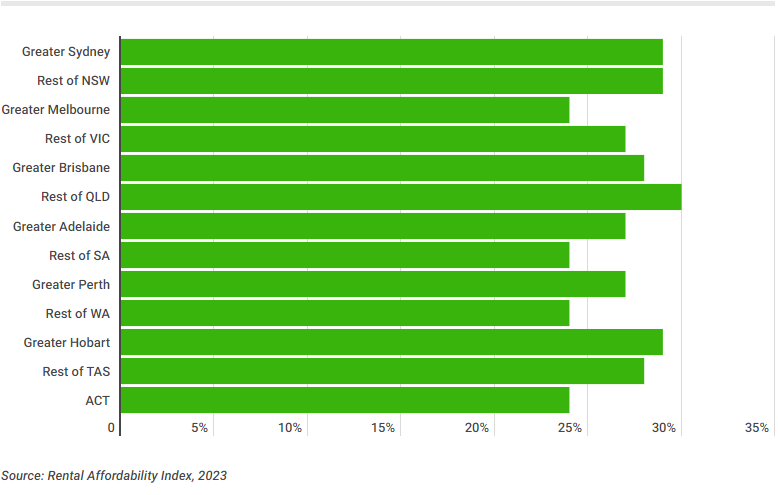

A household spending 25% to 30% of their income on rent is said to be facing moderately unaffordable housing costs.

Another with 20% to 25% of their income going towards rent are spending an ‘acceptable’ amount, with rent consuming 20% or less of a household’s income said to be affordable.

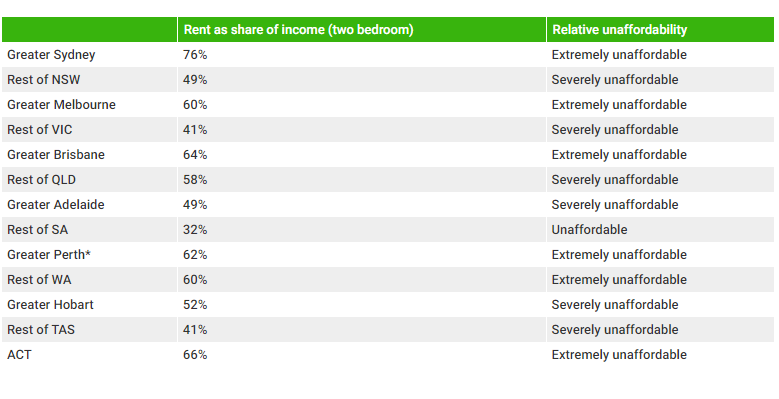

Rental affordability in Australia

“This is a social challenge but also a deep economic problem,” said Ellen Witte, principal and partner at SGS Economics and Planning and the report's lead author and analyst.

“We need a serious plan to provide the right housing at the right price to people who really need it.

“And we need to back that up, by supporting and empowering renters, not just homeowners.”

Nearly six in 10 lower income households renting on the private market were spending more than 30% of their weekly income on housing in 2019-20, the Australian Bureau of Statistics (ABS) found.

Meanwhile, research from the Parliamentary Library, commissioned by the Greens, found renters typically spend the equivalent of a house deposit on rent every five years.

“This downward spiral has now reached the point where very few affordable long-term rentals are on offer,” Ms Witte said.

“We need to address this problem from multiple angles.”

Such angles include expanding social and affordable housing investment, re-thinking tax subsidies for housing, and strengthening renters' rights, she said.

The cost of renting is largely being driven higher by soaring demand.

The national rental vacancy rate hit a record low last month, PropTrack found.

“Just 1.02% of rentals were vacant in October, with vacancies down in both capital city and regional areas and record lows reached in New South Wales, Victoria, and Queensland,” PropTrack Economist Anne Flaherty said.

“The national vacancy rate has been trending down for well over three years now – a trend that looks likely to continue off the back of strong population growth and a slowdown in the supply of new housing.”

Australia’s most unaffordable areas for renters

When it came to the country's most unaffordable areas, Regional Queensland took out the top spot.

Average rents in the Sunshine State’s regions came in at $553 a week, representing 30% of the average income.

The increasingly unaffordable cost of renting in regional areas is a common theme across the nation, with only Tasmania bucking the trend.

“Unaffordability has spread from the cities well into the regions,” Ms Witte said.

“Households will have to live further away from where the jobs are to access affordable rents, and businesses are struggling to find workers.”

Much of the demand bolstering prices in regional Australia is driven by pandemic-related population movements and natural disasters, such as fires in 2020 and floods in 2022, impacting rental stock and new development.

Meanwhile, the average household renting in Greater Sydney spends 29% of their income on rent, with the average rental costing $650 a week.

Those renting in the Sydney suburb of Seaforth spend around 54% of the city’s income on rent, making it the nation’s most unaffordable area for renters.

"Affordability crisis: JobSeekers forced to spend majority of income on rent" was originally published on Savings.com.au and was republished with permission.