By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

- 6 Reasons To Trade Wednesday's FX

- Euro: Waiting on Greek Parliament

- CAD: Will Bank of Canada Cut Rates?

- AUD: Tons of Chinese Data on Tap Including GDP

- NZD Traders Await Dairy Auction

- GBP Lifted by Hawkish BoE Carney Comments

6 Reasons To Trade Wednesday’s FX

Strap on those seatbelts and get ready for a wild ride in Wednesday's foreign-exchange market. Most investors are focused on Fed Chair Janet Yellen's testimony on the economy and monetary policy but second quarter Chinese GDP numbers and the Greek Parliament's decision to reject or accept the latest bailout package will not be far behind in their potential impact on currencies and equities. As if these event risks were not enough, we also have a Bank of Japan meeting, UK employment and wage data, the Bank of Canada's monetary policy announcement and a dairy auction in New Zealand on the calendar. Each of the events can have a significant impact on their respective currencies and dilute the influence that Chinese GDP, Yellen and Greece will have on risk appetite. We discuss these events in more detail throughout this note but in a nutshell, these 6 event risks will make Wednesday a volatile and exciting day in the foreign exchange market:

- Chinese Q2 GDP > Impacts AUD and Risk Appetite

- Bank of Japan Meeting > Will they cut GDP forecast and send JPY lower?

- Yellen Semi-Annual Testimony > Impacts all USD pairs

- Greece Parliament Vote on Bailout > Impacts EUR and Risk Appetite

- UK Employment and Wage Data > Impacts GBP

- Bank of Canada Rate Decision > Impacts CAD

- New Zealand Global Dairy Auction > Impacts NZD

The Chinese government has gone to great lengths to stabilize their local equity markets and they successfully engineered a near-term bottom and after 4 days of gains, we only saw a small pullback in the Shanghai Composite Index overnight. Many companies are still halted from trading but the stability is slowly helping to restore investor confidence. If Tuesday night's retail sales, industrial production and second quarter GDP numbers surprise to the downside, it would be counterproductive and could revive the slide in equities. Obviously the Chinese government does not want their carefully engineered recovery in stocks to be threatened and as a result we believe the risk is greater for an upside than downside surprise.

As for Fed Chair Janet Yellen's testimony on the economy and monetary policy, we already know where the head of the U.S. central bank stands. She believes that rates will rise this year but is undecided on whether that will be in September or December. After Tuesday's disappointing retail sales report, the chance of a December tightening has risen. Consumer spending dropped 0.3% in June, which was much weaker than the market's predicted rise of 0.3%. Excluding autos and gas, spending fell 0.1%, making demand the weakest in 4 months. We believe there's a very good chance that she will disappoint dollar bulls this week. Under the grilling of Congress, Yellen may sound noncommittal and that tone could end up disappointing dollar bulls especially after the strong rise in the currency.

Euro: Waiting on Greek Parliament

The euro remained under pressure as the market awaits the Greek Parliament's decision to accept or reject the reform proposals. There's still a lot of resistance in Athens and investors fear that Parliament could still vote 'no'. Many of the reforms mandated by the Eurogroup are similar to the ones rejected at the referendum or stricter. They include a higher value added tax, spending cuts and pension reforms. Approving the reforms also does not guarantee aid. It is only a necessary step to "opening" new debt negotiations. If all goes well, Greece will receive 7 billion euros in immediate financing to meet their July 20 debt payment to the ECB and another 5 billion in August to pay the IMF. In total, they could receive as much as 86 billion euros in aid but would need to create a 50 billion euro privatization fund. The negotiations with creditors could still break down. A decision on reopening banks won't be made until after the Parliament's decision. Thereore Grexit remains on the table even though the risk is a small one. Unsurprisingly, Eurozone investor confidence took a steep tumble but the German data was less negative. Investors grew more confidence about current conditions in the region's largest economy but feared that the Greek crisis would hamper economic activity going forward. Expect Greece to be a main topic at this week's ECB meeting and one that will keep the central bank head dovish.

CAD: Will Bank of Canada Cut Rates?

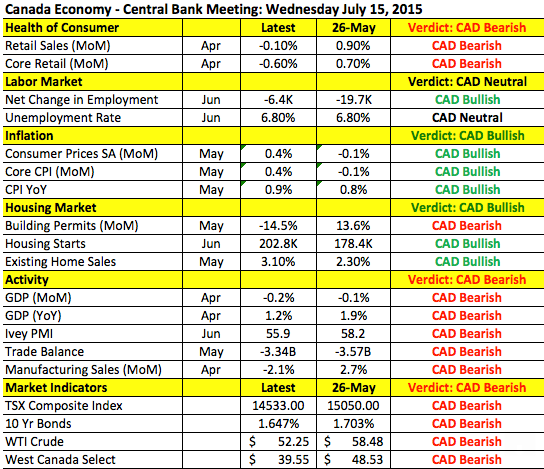

We are surprised by the resilience of the Canadian dollar ahead of the Bank of Canada's monetary policy decision and on the back of the historic nuclear deal with Iran. Tehran agreed to strict limits on its nuclear activities for the next decade. In exchange, the U.S., E.U. and U.N. would lift sanctions that could boost the economy by as much as 8% per year. Unsurprisingly the deal has been met with international criticism. Certain members of Congress as well as other countries in the Middle East have warned that lifting the sanctions could provide Iran with the monetary capability to expand its influence in countries such as Syria, Lebanon and Yemen. Nonetheless, it is an important deal that should be negative for oil and the CAD. However both the commodity and currency ended the day unchanged to slightly higher and we think this could be a delayed reaction. Meanwhile the main focus for the loonie in the near term is Wednesday's Bank of Canada rate decision. Taking a look at the table below, there has been more weakness than strength in Canada's economy since the last monetary policy decision in May and the good news isn't overwhelmingly positive. Job losses eased in June but the fact that jobs were lost at all is negative. Consumer prices ticked higher but year over year CPI growth is less than 1%. Meanwhile retail sales, GDP, trade and manufacturing activity all weakened. Along with the steep decline in oil prices, the BoC will remain dovish and even talk about the possibility of lower rates. We don't believe they are in a position to cut on Wednesday but either outcome should give us reason to sell CAD.

GBP Lifted by Hawkish BoE Carney Comments

Sterling traded higher versus the U.S. dollar despite weaker-than-expected economic data. Consumer price growth stagnated in June, leaving annualized CPI growth at 0% and core CPI growth at 0.8%. This disappointing data and lack of price pressures should encourage the Bank of England to leave monetary policy unchanged for the foreseeable future. BoE Governor Carney gave the pound a boost when he said the "point at which interest rates may begin to rise is moving closer." This hawkish sentiment is driven by wage gains as Carney indicated that changing wages will have some effect on productivity, which will affect the pace of tightening. Monetary Policy Committee member Miles also added that he does not see secular stagnation in the U.K. While no one expects the BoE to tighten in 2015, Tuesday's comments reaffirm the currency's yield advantage. There's no doubt that the BoE will raise rates before the ECB. However the Fed will still be the first to tighten, which means limited gains for GBP/USD. U.K. employment numbers are scheduled for release on Wednesday. Economists are looking for jobless claims to fall at a faster pace, which is good news for the economy but the main focus will be on average weekly earnings. The forecast calls for a sharp rise to 3.3% from 2.7%. If the data meets or beats expectations, it would drive sterling even higher.