Asian stock markets are having a very solid start to the new trading week after absorbing last week’s triple whammy of central bank meetings, with the all important US jobs print to look forward to on Friday. The Australian dollar has seen a little bounce but is licking its wounds after breaking down last week as the USD remains quite firm.

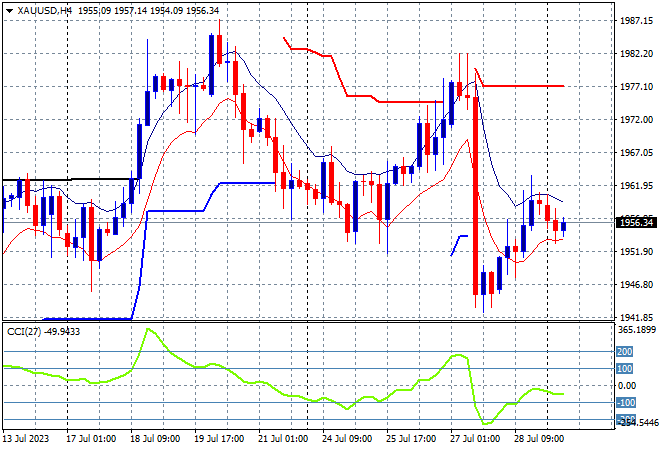

Oil prices are holding on to their recent gains as Brent crude remains above the $84USD per barrel level while gold is failing to clawback its recent losses, still floating around the $1950USD per ounce level but looking very weak here:

Mainland Chinese share markets are having modest sessions but still very positive with the Shanghai Composite closing nearly 0.5% higher at 3291 points while in Hong Kong the Hang Seng Index has pushed more than 1.5% higher to finally breakthrough the 20000 point barrier.

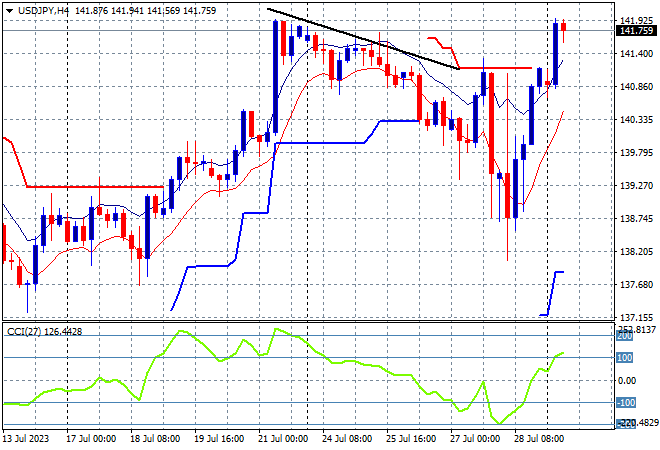

Japanese stock markets have re-engaged to the upside following the BOJ meeting with the Nikkei 225 closing 1.2% higher at 33172 points while the USDJPY pair has rebounded back to its recent weekly high just below the 142 handle in a big turnaround from last week’s low:

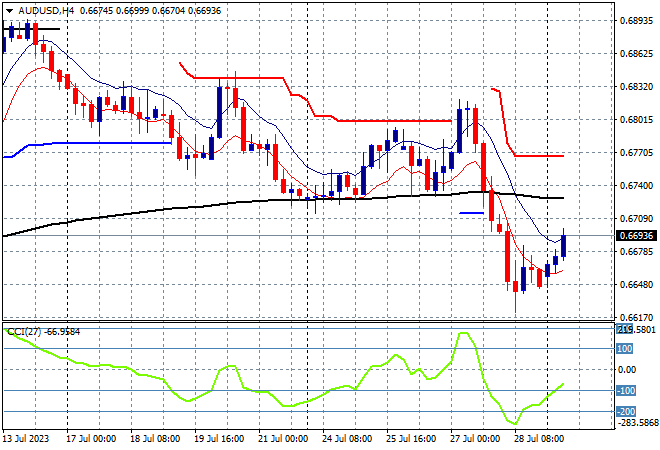

Australian stocks have been the sour note of the day with the ASX200 closing nearly dead flat with a scratch session at 7410 points. The Australian dollar has jumped a little on the weekend gap, currently dicing with the 67 cent level but the medium term trend has definitely turned down:

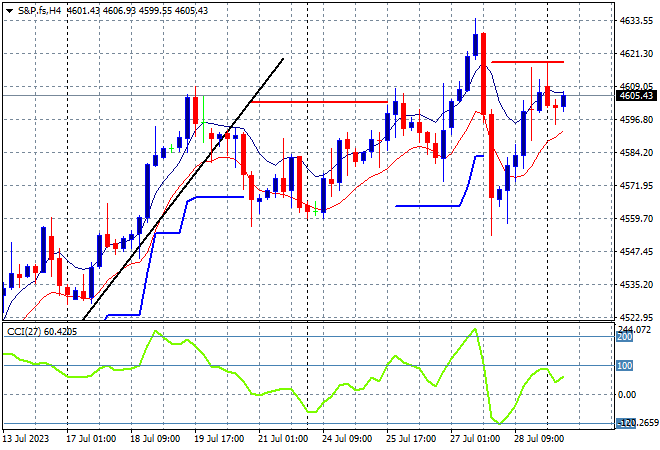

Eurostoxx and S&P futures are lifting as we head into what looks like a very positive overnight session with the S&P500 four hourly chart showing another attempt at getting through the 4600 point level as earnings season continues into this week’s NFP print on Friday:

The economic calendar starts the trading week with some flash GDP and core inflation prints for the Euro-zone.