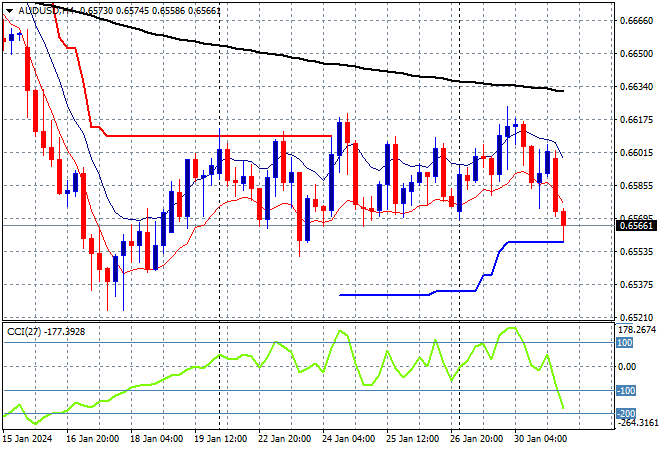

Asian share markets are still mixed with Chinese shares heading lower again while domestic equities are loving the softer than expected CPI print which is signalling a potential rate cut from the RBA once it gets back from its very long summer holiday. Wall Street looks to be lacking confidence due to better than expected domestic data which is keeping USD strong while the Australian dollar couldn’t hold on to its tiny advance above the 66 cent level due to the CPI print.

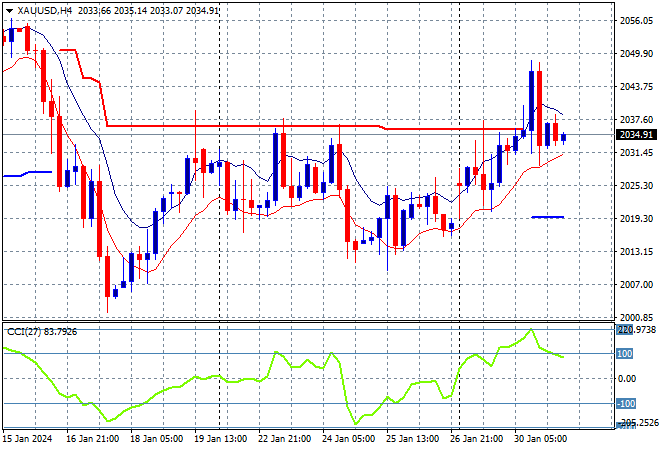

Oil prices remain volatile in the wake of Middle East tensions with Brent crude holding above the $82USD per barrel level while gold is a little stuck again after its false breakout overnight, holding just above the $2030USD per ounce level and without much confidence:

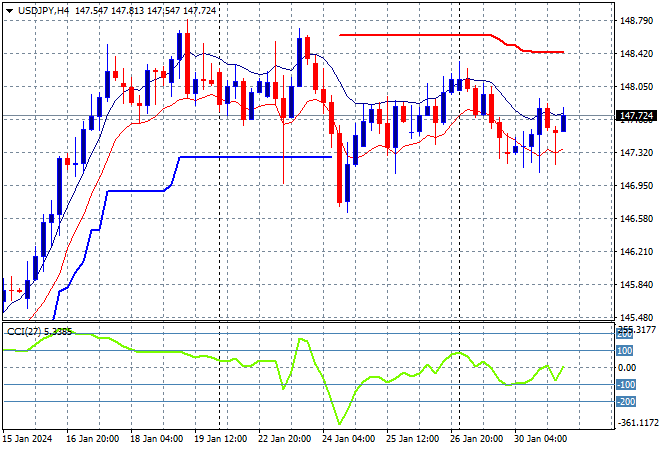

Mainland Chinese share markets are falling again in afternoon trade as the Shanghai Composite moves nearly 1% lower to 2804 points while in Hong Kong the Hang Seng Index is moving in a similar direction, down 1.3% to 15491 points. Japanese stock markets are lifting slightly with the Nikkei 225 closing 0.3% higher at 36175 points while the USDJPY pair has managed to hold on to most of its overnight gains to be just below the 148 level:

Australian stocks were able to advance strongly in the wake of the CPI print as the ASX200 closed more than 1% higher at 7680 points while the Australian dollar managed to dip back below the 66 cent level on RBA rate re-ratings as it fails again to break free of overhead resistance:

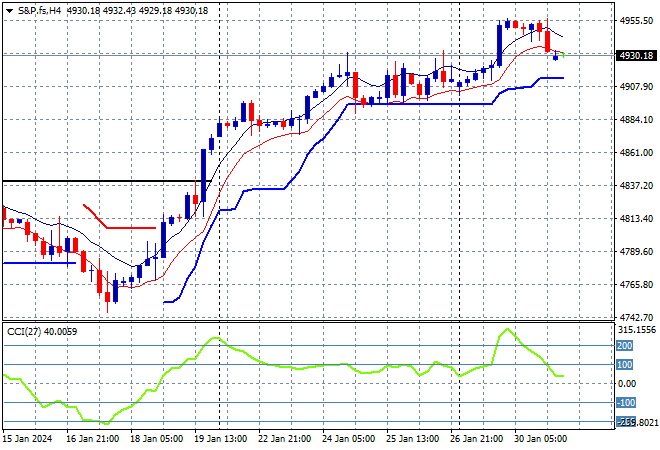

S&P and Eurostoxx futures are falling back going into the London session with the S&P500 four hourly chart showing price action dipping below the recent daily highs as the 4900 point level will come under pressure as support:

The economic calendar ramps up tonight with German unemployment and inflation, followed by the latest FOMC meeting.