Both European and US stocks surged overnight as the USD tumbled against the majors as signs that the US economy maybe slowing faster than expected came through in consumer confidence numbers. Both Euro and Pound Sterling lifted to near weekly highs as the Australian dollar finally found some momentum to almost rise above the 65 cent level.

US bond markets saw further drops across the yield curve with the 10 year Treasury pulling back to the 4.1% level while oil prices were more buoyant as inventory draws suggested increased demand with Brent crude stabilising at the $85USD per barrel level. Gold held on and then extended its recent gains to a new three week high above the $1930USD per ounce level.

Looking at share markets in Asia from yesterday’s session with mainland Chinese share markets seeing solid gains with the Shanghai Composite up 1.2% to close at 3135 points while in Hong Kong the Hang Seng Index did even better, closing almost 2% higher at 18485 points.

The daily chart is now showing a near complete selloff that has gone below the May/June lows with the 19000 point support level a distant memory as price action stays well below the dominant downtrend (sloping higher black line) following the previous month long consolidation. Daily momentum readings are now out of oversold mode with overhead ATR resistance the level to beat or this will turn into a dead cat bounce:

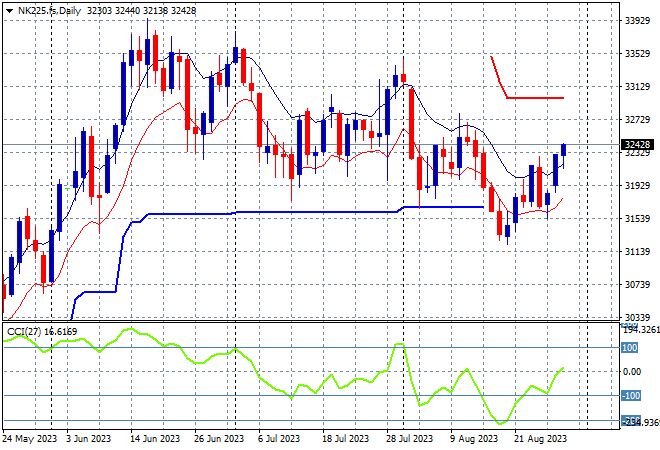

Japanese stock markets aren’t trying very hard to build on their recent rebound, as the Nikkei 225 closed just 0.1% higher at 32216 points.

Trailing ATR daily support had been paused for sometime now as the market went sideways after a big lift recently, with a welcome consolidation above that level but that has now turned into a proper dip. Daily momentum broke into the oversold levels but has now retraced as price action bounced back from the support zone with the potential for a swing building here, as futures are indicating a bigger lift in line with Wall Street:

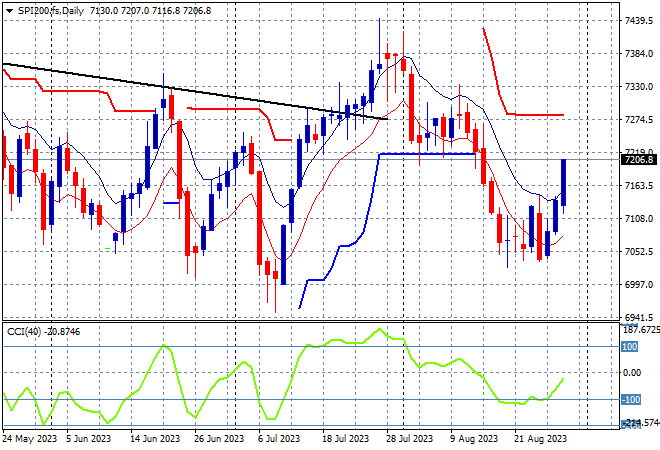

Australian stocks did well again with the ASX200 closing 0.7% higher to 7210 points.

SPI futures are up more than 0.6% this morning given the breakout on Wall Street overnight, with the 7300 point level remaining strong as short term resistance. Medium term price action is now moving sideways with the short term pattern looking like breaking out here as the July lows were tested and supported:

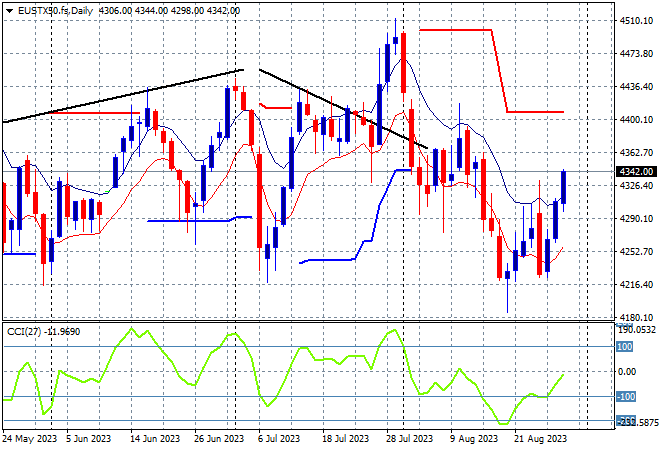

European markets also continued their great start to the trading week with the Eurostoxx 50 Index closing more than 0.7% higher at 4326 points, helped along mainly by German stocks.

While the daily chart shows weekly support at 4200 points barely defended, weekly resistance at the 4400 point resistance level has now pushed the point of control well below the 4300 point level. There are signs of stability returning here as daily momentum now gets out of oversold mode but I remain cautious:

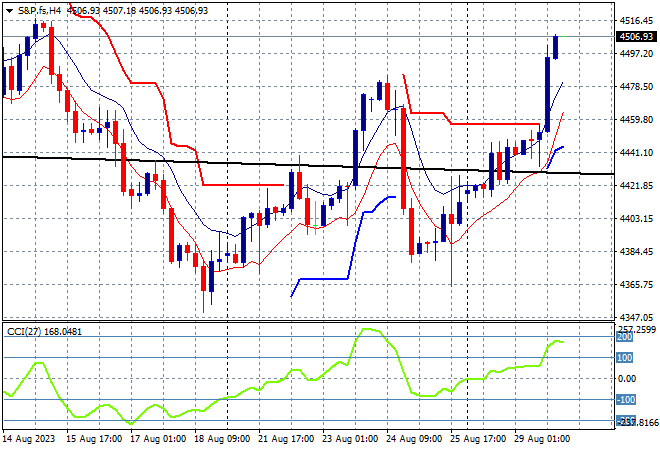

Wall Street lifted across the board and pushed even further than European markets on the lower USD with the NASDAQ again leading the way, up 1.7% while the S&P500 lifted nearly 1.5% higher to finish at 4497 points.

The four hourly chart is showing price action lifting above the previous lows and surpassing last week’s intrasession high. Short term ATR resistance just below the 4500 point level is the key area to beat ahead as short term momentum gets into overbought mode:

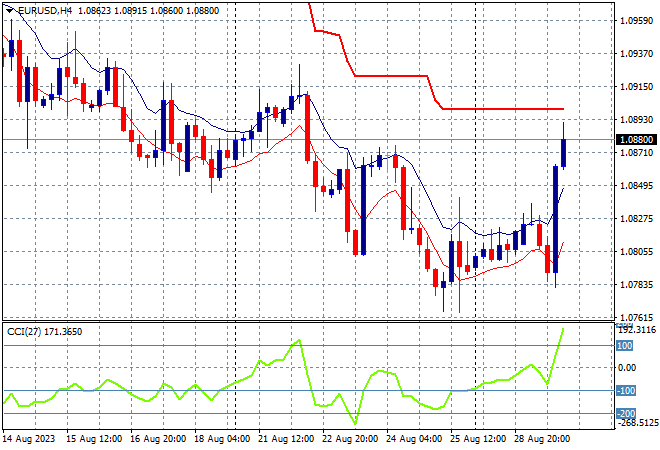

Currency markets are now getting comeback against USD with the release of the latest US consumer confidence figures and the return of UK traders pushing King Dollar down as bond yields continue to tighten. Euro broke out significantly above the 1.08 level alongside Pound Sterling as a result.

I’ve been saying for a while that the union currency really needed to have a strong return above trailing ATR resistance just below the 1.10 handle in recent weeks but failed with a decline back to the previous weekly lows just above the mid 1.09 level. Short term momentum has now switched to being overbought and price action is looking to breakout above that trailing resistance level but this is early days so far as price action remains nearer the August lows:

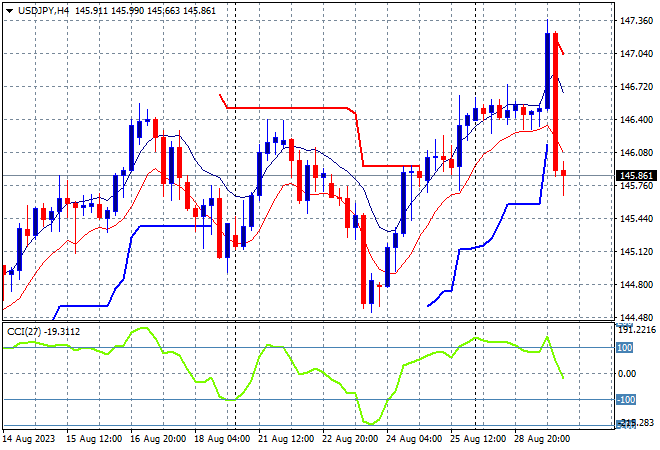

The USDJPY pair had a huge whipsaw overnight as it tried to convert its recent rebound with a false breakout above the recent highs before slammed back below the 146 level in a sharp reversal.

Four hourly momentum shows a break below previously overbought settings with this reversal taking the wind out of the recent breakout. Price action looks tenuous here in the medium term with a point of control forming at the 145 handle:

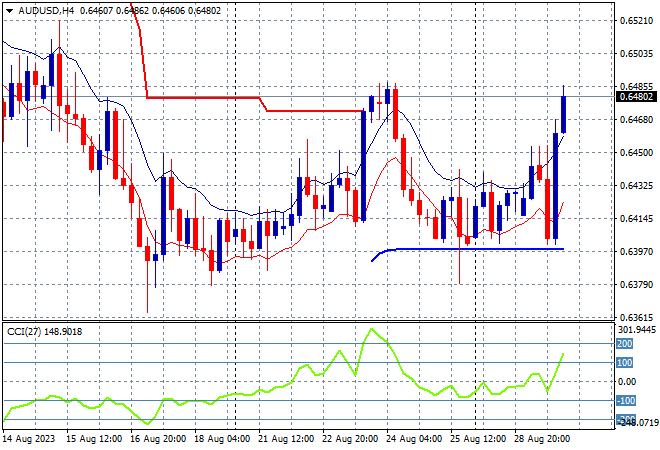

The Australian dollar had been under the pump against King Dollar for sometime with a possible bottom brewing at the 64 handle, as illustrated by the steady ATR support line and overnight we saw another attempt at breaking out, almost hitting the 65 handle in the process.

Four hourly momentum has switched to overbought but price action has not yet cleared last week’s failed breakout high so this is so far only a one off move with today’s monthly CPI print possibly upsetting the apple cart:

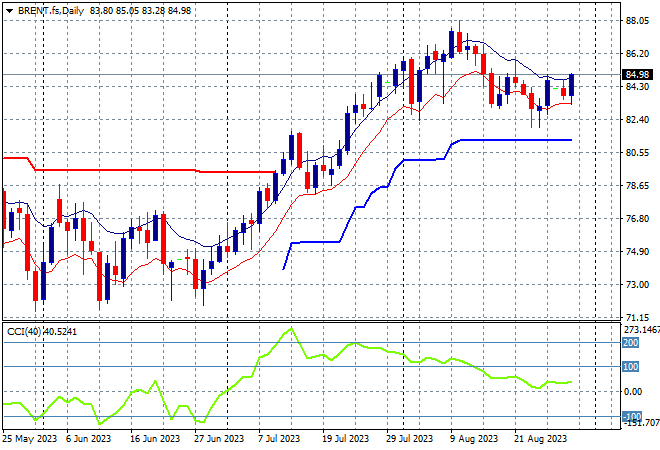

Oil markets continue to march sideways after their recent bullishness with news of more potential OPEC cuts keeping Brent crude off its recent lows as a weaker USD pushes the market to just below the $85USD per barrel level, holding on to its three month high and current uptrend.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now putting aside resistance at the $80 level. Daily momentum has retraced below previously overbought readings with price action rolling over – watch short term support at $80 to hold:

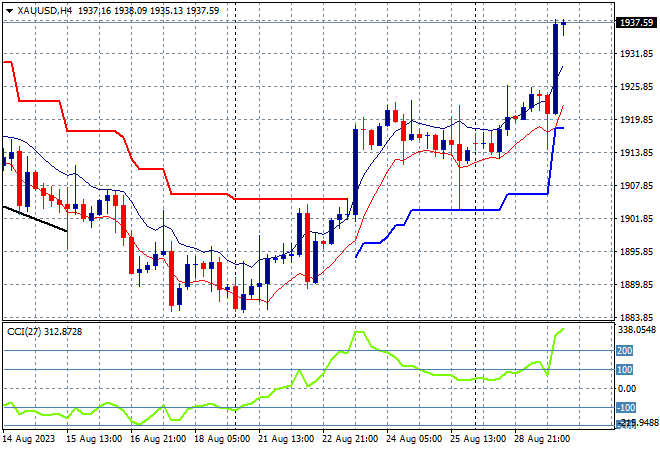

Gold was able to hold on to its recent positive sessions, and then substantially breakout and build upon that with a big move to almost clear the $1940USD per ounce level and again making a new daily high.

The four hourly chart shows a bottoming action at below the $1900USD per ounce level now filled in as the shiny metal continues its two week long uptrend but short term momentum is grossly overbought and we could see a minor pullback soon: