Asian share markets are seeing mixed results at best as traders take a collective breath waiting for this week’s cavalcade of central bank meetings, starting with tomorrow’s effort from the BOJ. Tonight’s German inflation and GDP print could sway Euro which is fighting against further downside to the USD while the Australian dollar is waiting on tomorrow’s inflation print and has been unable to push itself off the floor stuck below the 66 cent level.

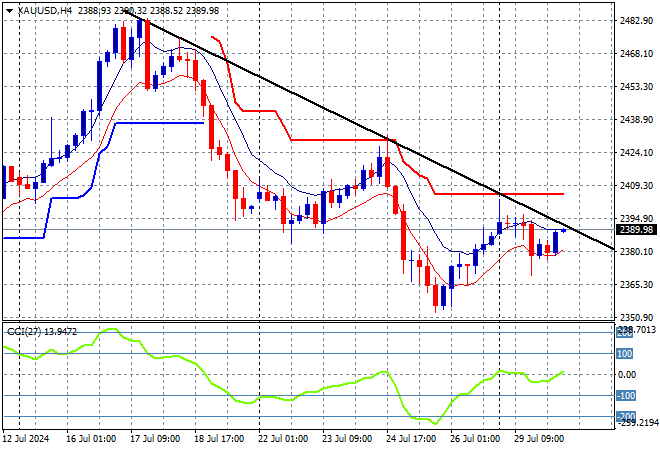

Oil prices flopped overnight and are still falling with Brent crude failing to get back above the $79USD per barrel level while gold has bounced back somewhat, currently just below the $2400USD per ounce level:

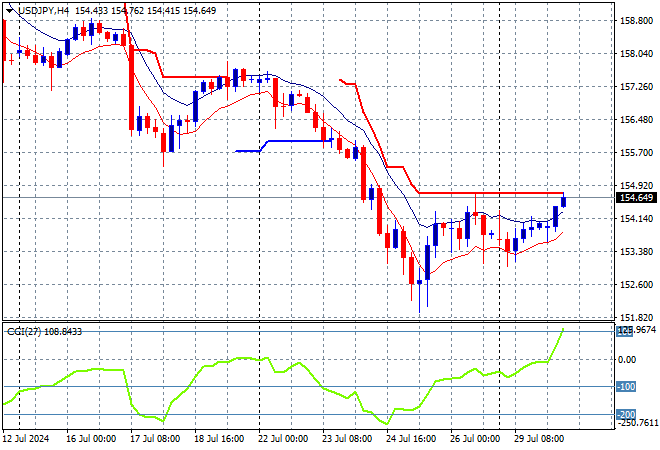

Mainland Chinese share markets are really struggling with the Shanghai Composite falling at the open and now down 0.7% going into the close while the Hang Seng Index is about to break the 17000 point barrier, falling more than 1.3% this afternoon. Meanwhile Japanese stock markets are trying to hold off the sour mood with the Nikkei 225 up slightly to close at 38506 points as the USDJPY pair finds some life mid afternoon in preparation for tomorrow’s BOJ meeting, breaking above the 154 level:

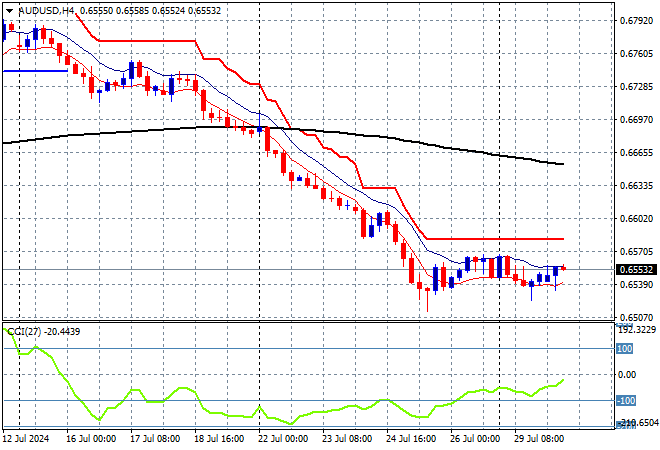

Australian stocks stumbled around given the poor lead from Wall Street overnight with the ASX200 closing 0.4% lower to 7952 points while the Australian dollar remains in pause mode awaiting this week’s cavalcade of interest rate decisions and inflation data as short term momentum tries to get out of extreme oversold mode:

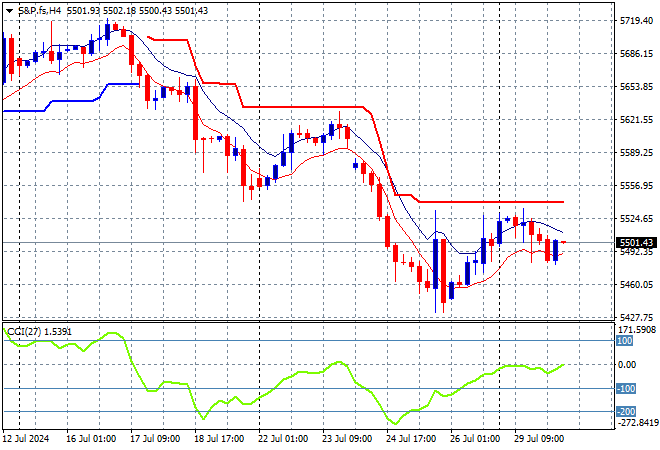

S&P and Eurostoxx futures are up slightly as we head into the London session with the S&P500 four hourly chart showing how a potential bottom at the 5400 point level is forming but if it doesn’t break through overhead short term resistance, the next target below is 5200 points:

The economic calendar ramps up tonight with the latest German GDP and inflation prints, then Euro wide estimates, followed by US consumer confidence.